WEST AFRICA: Surge in offshore West Africa investment forecast for 2002-2005

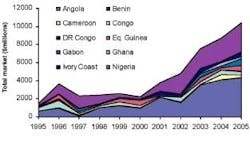

West Africa has experienced a large number of deepwater oil and gas discoveries off Angola, and lately Nigeria, and shelf drilling continues to hit small commercial pockets all along the coastline. As a result, a report generated by UK analysts Douglas-Westwood Ltd and offshore data specialists Infield Systems predicts a large surge in offshore oil and gas investment off West Africa. The report estimates that current annual expenditure of around $2 billion could grow to $10 billion by 2005.

"A significant increase in activity is expected off West Africa over the next decade, which could make it the world's most important offshore oil province. Within the foreseeable future, capital investment could eclipse that in more established regions, such as the North Sea and Gulf of Mexico," explained the report's author, Dominic Harbinson, Senior Analyst at Douglas-Westwood.

Prospects to 2005

The report, which examines offshore prospects from Ivory Coast to Angola, identifies 230 fields currently onstream, and a further 176 fields earmarked for development over the period to 2005. These additional fields could boost regional liquids production by almost 3 million b/d. The leading players are Nigeria and Angola, both with some 1.2 million b/d of potential additions.

"Although offshore production has been underway in the shallow waters off West Africa for many years, the period to 2005 seems set to establish the region as a world leader in terms of offshore E&P activities following a remarkable series of deepwater exploration successes," explained Dr. Roger Knight of Infield Systems, joint author of the report.

The 176 West African fields identified for development through 2005 hold combined reserves of almost 16 billion boe.

"West Africa's success coincides with the prospect of declining output in the major producing areas, such as the shallow waters of the Gulf of Mexico and the North Sea. We estimate that over the next five years West Africa could account for 21% of all offshore oil reserves brought on-stream," Harbinson and Knight stated.

The vast majority of new fields (86%) will be in shallow water (<200 meters) but the bulk of the reserves (9 billion boe) are located in deep waters (> 500 meters). At present, 17 deepwater fields in four West African nations - Nigeria, Angola, Equatorial Guinea and the Congo - have been identified for production over the period to 2005. These deepwater fields could contribute some 1.6 million b/d to regional prod-uction by 2005.The scenario that emerges is of large numbers of relatively small fields in shallow water being produced through the conventional fixed platform approach, while a few high-profile and technically challenging projects are launched to tap prolific prospects in the deep.

Offshore facilities

Currently, there are 633 fixed platforms of all types in operation in the region, plus 13 floaters and 20 storage and offloading vessels. In the next 5 years, the authors expect a further 159 fixed platforms to be installed and the drilling of more than 700 platform-completed wells.

Floating production systems are forecast to total 33 units over the next 5 years. These include some very large high-cost systems. For example, expenditure on the Girasol unit alone is expected to exceed $900 million. Although the proposed floating production systems are mainly floating production, storage, and offloading (FPSO) systems, an increasing interest in Spars (tethered spar-type production systems) is evident.

The large deepwater fields will require considerable numbers of subsea well completions, and an additional 297 are likely to be installed or on order by 2005. The drilling of these wells and the delivery and installation of the associated subsea production hardware could require a capital expenditure of almost $7 billion. In addition, some 1,200 km control lines and 5,000 km infield and export pipelines are forecast for the region - representing investment of around $4 billion through 2005.

Nigeria, Angola lead

Most of the offshore activity through to 2005 will be concentrated in Angolan and Nigerian waters, and these will account for almost 80% of total offshore development expenditure forecast for the region, according to the report.

Investment off Angola could amount to more than $15 billion for the period, with a further $11 billion being spent off Nigeria. Off the Ivory Coast, Gabon, the Congo and Equatorial Guinea, total expenditures of $1.5-1.8 billion are forecast for the period to 2005. Investments of $0.5-1.0 billion are foreseen off Cameroon and Ghana, with DR Congo and Benin seeing much more modest levels of activity.

Regional operators

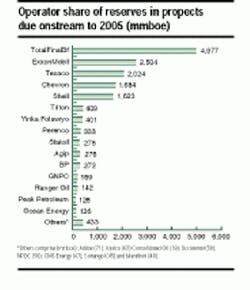

Among operators, TotalFinaElf dominates the West African region. The French operator holds almost a third of the reserve base slated for development over the period to 2005. Four other oil majors - ExxonMobil, Shell and the recently merged Chevron and Texaco - also have strong positions with reserves at least four times greater than other less well-endowed players.

The region has a diversity of operators present. In addition to the ubiquitous majors, national companies, such as the Ghana National Petroleum Corporation (GNPC), foreign independents, such as Triton and Ranger, and indigenous independents, such as the Nigerian companies Yinka Folawiyo and Peak Petroleum, are all vying for a piece of the action.

It is interesting to note that a small number of independents - most notably Vanco and Dana, but also Santa Fe and Ocean Energy - have adopted a highly speculative early entry strategy in the West African deepwater arena. Although no development is currently foreseen on their deepwater acreage in the period to 2005, it will be interesting to see what paths these enterprising independents take to capitalize on their current positions.

Attractions

The attractions of West Africa include an offshore environment that is relatively benign, with wave heights rarely exceeding five meters and few troublesome currents. The crudes are good quality, and the region's relative proximity to the refineries of western Europe and the US east coast is an added advantage.

Disincentives, however, are evident in political and commercial corruption and instability, unfamiliar and often inefficient commercial practices, a dearth of adequate local service and supply facilities, and occasionally hostile local communities. However, the major new deepwater discoveries are at a distance offshore and less susceptible to local problems than onshore and/or shallow water inshore fields.

Oil company interest in the West African region - and particularly in its deepwater acreage - has already begun to generate globally significant contracts for offshore technology and service companies. Although the high hopes of some operators have met with expensive disappointment, all the evidence suggests that there are elephants out there waiting to be found.

Given the ongoing exploration efforts, it seems highly likely that new and substantial discoveries will be made over the next five years.

Reference

"The Offshore West Africa Report," published by Douglas-Westwood Ltd., Canterbury, UK. email: [email protected].