ASIA/PACIFIC

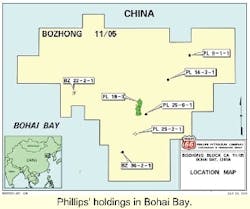

Phillips China developing Bohai Bay

Phillips China Inc., a unit of Phillips Petroleum Company completed appraisal of the Peng Lai (PL) 25-6 oil discovery. Appraisal well PL 25-6-2, was located in 75 ft water depth about one mile south of the field's discovery well, the PL 25-6-1. The appraisal well reached a total depth of 5,853 ft, encountering a gross hydrocarbon column of 1,634 ft, with 354 ft of net pay in the Guantao formation. Formation pressure data, oil samples, and a drill-stem test confirmed the presence of a thick oil column.

Dodd DeCamp, Senior Vice President of Worldwide Exploration, said "with this successful appraisal, we can move forward to evaluate developing this satellite field in conjunction with Phase II of the planned PL 19-3 development."

Phillips China plans for production from the first phase of the PL 19-3 development program to begin in the first half of 2002 at an estimated gross rate of 35,000-40,000 bbl/d of oil, with 17,000-20,000 bbl/d net to Phillips. If plans for producing an expected 50,000-65,000 net bbl/d from Phase II in 2005 are realized, production from the PL 25-6 field could be added.

China reducing foreign rig dependence

As a result of CNOOC's push for local equipment production, the first offshore batch of workover rigs was produced by the Nanyang Oil Machinery Works for use in the Wenchange 13-1/2 oil field offshore China. The first rig was inspected and accepted at the end of February.

Construction began in August of last year on two rigs, two model 800 pumps, and two model 35-35 blowout preventers. Technological guidance and support were provided by experts from the CNOOC's Zhanjiang Branch. A state organization strictly examined and verified rig design, and China Classification Society provided third-party classification. The construction of the rigs frees China of absolute dependence on foreign deepwater workover rigs.

Devon signs contract to pipe gas to Singapore

Devon Energy Corporation has signed a 20-year gas sales agreement to export Indonesian natural gas to Singapore. The agreement is between Pertamina, Indonesia's state-owned oil and gas company, and PowerGas Ltd. of Singapore subsidiary Gas Supply Private Ltd. Through a related agreement with Pertamina, Devon will supply natural gas pursuant to the Gas Sales Agreement.

The agreement calls for sales of 150 MMcf/d to begin in 2003. Devon will realize gains from two of the three blocks onshore Sumatra that are subject to the gas sales agreement, but is looking beyond the immediate impact of gas production. Significant quantities of natural gas liquids and condensate are contained in the natural gas in the Jabung block, which could substantially increase Devon's liquids production in Sumatra.

The gas will be delivered through approximately 300 miles of new pipeline facilities to be constructed from south Sumatra to the islands of Batam and Singapore. About half of the length will be offshore. PT Perusahaan Gas Negra, the Indonesian state gas distribution/transmission company, will own and operate the Indonesian section of the pipeline, while PowerGas will own and operate the Singapore section.

Premier evaluates Ujung Pangkah

Premier Oil Natuna Sea Ltd. completed appraisal drilling on its Ujung Pangkah field in East Java, Indonesia, confirming reserves on the Pangkah Block structure in excess of 450 Bcf of rich gas, equal to 90 million bbl of oil. Premier said there is a possibility of developing oil from an accumulation underlying the gas.

Premier is pursuing a market for the gas while considering development options for Ujung Pangkah in collaboration with Pangkah production sharing contract partners. The block's proximity to power markets in East Java will be an impetus for development.

A seismic survey planned for later this year will yield data for evaluating a possible western extension to Ujung Pangkah. Partners are operator Premier (40%), Amerada Hess (Indonesia-Pangkah) Ltd. (36%), Gulf Resources (Pangkah) Ltd. (12%), and Dana Petroleum PLC (12%).

India cultivating national joint ventures

India's state-owned ONGC Videsh Ltd. (ONGC-VL), the overseas arm of the Oil and Natural Gas Corporation, is working with national oil companies in Indonesia, Algeria, and Vietnam to form a consortium for pursuing exploration and production activities.

Brunei issuing early 2002 deepwater licenses

Interest in Brunei is heating up, with 28 companies now expressing interest in production-sharing contracts in its deepwater regions. The country expects to award production-sharing contracts early next year, with bids closing in November of 2001.

Petroleum Geo-Services ASA has been contracted to conduct a 3D seismic survey. Potential investors will be able to evaluate the processed seismic data to identify prospects before the bidding closes at the end of this year. The blocks are in 1,000-2,750 meters water depth and seem to be related to Malaysian geology where gas discoveries have been made. The first well in the new acreage could be drilled as early as Q4 2003.

ONGC invests in Russia offshore

In an investment deal valued at $1.5 billion over the next five years, ONGC is to acquire a 20% stake in the Sakhalin-1 oil and gas field in the Russian far east. The company signed an agreement to purchase half of the 40% stake in Sakhalin-1 owned by the Russian state-owned company Rosneft. ONGC agreed to find financing for future investment commitments for both it and for Rosneft's remaining share.

Sakhalin-1 is led by the US petroleum group Exxon Mobil with 30%, with a further 30% stake held by Sodeco, a Japanese consortium. The transaction provides an important boost to foreign direct investment into Russia, and it also clears the way for the development of one of the country's more significant oil and gas fields with an estimated full production level of 200,000 b/d of oil.