Gulf of Mexico

Jaime Kammerzell • Houston

GoM celebrates new finds

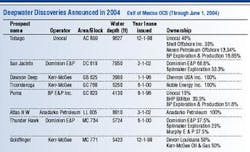

The deepwater area of the Gulf of Mexico continues to rapidly unfold as the major domestic energy source for the US, said Chris Oynes, the US Minerals Management Service Gulf of Mexico Regional Director, in revealing the details of eight new discoveries from the first half of 2004.

"While several new deepwater projects came on production in the Gulf in 2003, these eight new discoveries indicate that the province is still developing at a brisk pace," Oynes said.

In 2004, several other deepwater projects began production. Pioneer Natural Resources Co. announced start-up from its deepwater Tomahawk and Raptor fields in the Gulf of Mexico in June. Pioneer developed the two discovery wells as subsea tiebacks to the company's Falcon field facilities.

Tomahawk in East Breaks block 623 and Raptor in East Breaks block 668 are 1.4 mi and 5.5 mi, respectively, from the Falcon subsea manifold in 3,600 to 3,700 ft of water. The wells produce into a dual flowline system connecting the Falcon manifold to GulfTerra Energy Partners' Falcon Nest processing platform 32 mi to the north on the GoM shelf. Pioneer discovered the Tomahawk and Raptor fields in 2003.

ExxonMobil Corp. started production from the Llano field in the Garden Banks area in 2,600 ft of water, and Dominion E&P started production from the Devils Tower field in the Mississippi Canyon area in 5,610 ft of water.

According to Oynes, the steady drilling program and the growing deepwater infrastructure all indicate the deepwater Gulf of Mexico will continue to be an integral part of the US energy supply and will remain one of the world's premier oil and gas basins.

Mars resumes production

Shell Exploration & Production Co. has resumed production from its Mars TLP following completion of repairs to the flexjoints on both its oil and natural gas export lines.

The flexjoint on the natural gas line was replaced, and a temporary repair was made to the oil line to allow production to resume until the flexjoints could be refurbished. Shell expects a seven-day shut-in later in the summer to install the refurbished flexjoints.

Shell shut in the Mars TLP in Mississippi Canyon block 807 for repairs on May 22. The company found damage to the oil pipeline flexjoint after a small leak was discovered.

Temporary repairs were originally expected to take two to three weeks. However, when Shell inspected the natural gas line, the company found signs of deterioration on the flexjoint on the gas export pipeline.

Prior to shutdown, Mars was producing 150,000 b/d of oil and 170 MMcf/d of gas. It was expected to reach pre-shut-in rates within two to three days.

GoM success from a different angle

PFC Energy looks at operator success in the deepwater GoM from a different point of view – one that gauges an operator's success by comparing the number of development plans ultimately submitted by that operator for specific deepwater leases to the number of exploration plans originally filed by the same operator for the corresponding leases. Trad-itionally, when assessing an operator's comparative performance in the deepwater GoM, the focus is on exploratory drilling results, which compares the number of announced field discoveries to the number of exploration wells the operator drilled to make those discoveries. PFC acknowledges that this can be a useful tool to measure and compare an operator's exploration performance, but sees its accuracy in determining the operator's overall success compromised when that operator does not develop the discovered volumes.

PFC Energy explained that an operator must submit an initial Exploration Plan (EP) for approval by the MMS prior to beginning exploratory drilling. An operator must then submit an initial Development Operations Coordination Document (DOCD) if the operator intends to develop and produce reserves discovered on that lease.

PFC Energy's analysis considered initial submissions only, not those revised, supplemented, or amended. The company also excluded any DOCD submitted by an operator that did not also submit the initial exploration plan for the corresponding lease. Mergers and acquisitions were treated on a pro forma basis, meaning that PFC included a DOCD submitted by ExxonMobil, for example, if either Exxon or Mobil submitted the initial EP. Finally, the company examined the average number of years between an operator's submission of EPs and DOCDs on corresponding leases. While this is not necessarily an indication of success, it provides another way to diffferentiate operator performance, PFC Energy said. The company included only those operators that have made at least 20 EP submissions from 1990 through mid-May 2004.

For the record . . .

The Deepwater Nautilus team has set another world water-depth record for an offshore drilling rig operating in moored configuration in 8,951 ft of water in Lloyd block 399 in the US GoM for Shell. The achievement surpasses the prior world record for a moored rig of 8,717 ft of water set by Transocean's Deepwater Nautilus team last year for Shell in Alaminos Canyon block 857.

In addition to the world water-depth records for a moored rig, the Deepwater Nautilus team also holds the world record for the deepest subsea completion, set recently in 7,570 ft of water on the Shell-operated Coulomb project C-2 well in the GoM.

Heerema Marine Contractors has also set two new records in the GoM. The company set a new heavy lift record with its DCV Thialf vessel during the major lifts for the Holstein spar. The dry weight of the North module was 7,564 million tons, making it the heaviest lift in the GoM. At the same time, the company set another record, using the DCV Balder to install the first 24-in. diameter, 1 1/8–in. wall thickness steel catenary riser to the Mad Dog spar.