Gulf of Mexico

Jaime Kammerzell • Houston

Deepwater production systems

Two deepwater floating production systems are either in place or soon to be on location in the deepwater Gulf of Mexico. Anadarko Petroleum Corp. has installed the deepest TLP in the world on its Marco Polo field on Green Canyon block 608 in 4,300 ft of water, 160 mi south of New Orleans, the company said.

The 196-ft hull traveled 13,000 mi from South Korea to the field, where the company mated it to its 6,725-ton topsides.

null

Anadarko will begin the tiebacks and completion of Marco Polo's six development wells and will connect oil and gas export pipelines to the TLP. Anadarko expects oil and gas production to begin in July 2004. Production capacity is 120,000 b/d and 300 MMcf/d of gas. GulfTerra Energy Partners and Cal Dive Inter-national own the platform structure. Anadarko is the operator.

BP's 20,000-ton Mad Dog development spar has arrived in Pascagoula, Mississippi, after a three-week journey from Pori, Finland, where its was constructed. BP will conduct routine testing and make final preparations at the port before towing the spar to the Mad Dog field at Green Canyon block 826 in 4,500 ft of water.

BP expects peak production rates to be 80,000 b/d and 40 MMcf/d of gas. First oil is scheduled by early 2005.

BP has 60.5% interest in the Mad Dog project, BHP Billiton 23.9%, and Unocal 15.6%.

Deepwater GoM drilling results

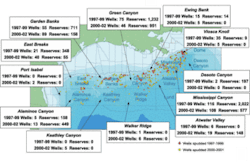

There have been 850 exploration and appraisal wells drilled between 1997 and 2002 in the deepwater Gulf of Mexico and 7 Bboe in recoverable oil and gas reserves added over the same time frame, according to a study by PFC Energy. The company examined regional drilling success in the context of mean recoverable reserves added relative to the number of wells drilled.

Three areas – Garden Banks, Green Canyon, and Mississippi Canyon – accounted for over 70% of the exploration and appraisal wells drilled. While there was virtually no change in the combined relative drilling share of these regions, there was a decline from 85% in 1997 to 1999 and 72% in 2000 through 2002 in their combined relative contribution to deepwater reserves added. The Garden Banks region contributed to this decline. The well count was up, but added reserves dropped considerably.

The Green Canyon area had improved drilling results. While the drilling activity level dropped, the area's share of reserves added climbed 5 MMboe from 1997-1999 to 2000-2002.

Among the GoM's other deepwater areas, Alaminos Canyon registered the greatest gains, as a 160% increase in drilling activity generated a 184% increase in reserves added. This combination moved the region to a much more prominent position in deepwater drilling intensity and contribution to overall deepwater volumes added in the Gulf of Mexico.

El Paso Energy gets LNG approval

El Paso Energy Bridge Gulf of Mexico LLC has received approval to build a deepwater LNG port, 116 mi south of New Orleans. The facility will process and transfer natural gas from LNG transport ships to a pipeline system, which will carry the natural gas ashore for distribution to US markets.

null

In addition, an ExxonMobil Corp. affiliate, Vista del Sol LNG Terminal LP, plans to develop a $600-million LNG receiving terminal along Texas' Gulf Coast.

The terminal will process imported LNG for distribution throughout Texas and the US and will take three years to build. It is scheduled for completion in 2008/09, with a processing capacity of 1 bcf/d of LNG.

"There is strong growth in natural gas demand projected in the future, and the import of LNG will be an important component of the supply mix," Philip Dingle, president of ExxonMobil Gas and Power Marketing Co., said.

In Offshore's January 2004 issue, the article "Turnkey drilling model bucks decline trend," Applied Drilling Technology Inc. President Blake Simmons was quoted as saying, "The drilling and completions management company drilled 676 wells . . .." The correct number should be 76 wells.