Gulf of Mexico

Jaime Kammerzell • Houston

Wellhead cutting technology

When permanently plugging and abandoning Gulf of Mexico wells in water depths to 2,264 ft, the Minerals Management Service (MMS) requires that operators remove the wellhead and casing to at least 15 ft below the mud line.

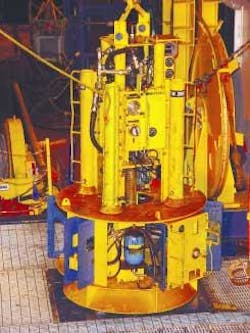

Oceaneering International Inc. has developed a subsea rotary drive system that allows the mechanical casing cutting to be performed from a dynamically positioned, multi-service vessel (DP MSV) in a standalone operation. Oceaneering developed the drive system to combine with a traditional mechanical casing cutter, such as Eaton Oil Tools' carbide-impregnated blade tool, that grinds through the casing string from the inside out, while recognizing the need for an alternative and more cost-effective method for cutting well stubs without using a drilling rig.

null

The cutting system has three separate packages – the subsea rotary drive unit, the gripper unit, and the subsea power unit. The rotary drive unit houses a hydraulic motor that produces 3,000 ft-lb of torque and turns at 120 RPM. Plumbing on the unit and a specially designed manifold allow water to be pumped down the drive shaft to provide the hydraulic pressure necessary for extending the cutting blades. The unit is deployed through the working moon pool on the MSV from a 60-ton A-frame.

The gripper unit, deployed by the vessel's ROV, clamps onto the wellhead and provides guideposts to position the rotary unit into place. The gripper also resists the counter torque generated by the rotary unit and keeps it from rotating on top of the wellhead.

The subsea power unit supplies the hydraulic power needed to drive the rotary unit and the volume of water pumped to provide the necessary flow for extending the cutting blades and washing the cutting surfaces. The subsea power unit is controlled from the surface through an electrical/fiber optic umbilical. The unit is a compact, self-contained package that is launched over the side of the MSV, similar to an ROV.

An average Gulf of Mexico well stub removal using the MSV-mechanical casing cutter system – including projections for DP stabilization, cutting a 3 to 5-string wellhead, and recovery of the well stub to the deck of the MSV – will take three days.

Truss spar projects

Contracts have been awarded for work on two truss spar projects underway in the Gulf of Mexico. Weatherford International Ltd. will install the special alloy production tubing and accessories and provide drill pipe, rental tools, and nitrogen services on the Devils Tower field development project for Dominion Exploration & Production Inc. The Devils Tower field is in the Gulf of Mexico's Mississippi Canyon block 773 in 5,610 ft of water.

The Devils Tower completion program started in February. The field will be developed with the world's deepest truss spar, and will initially support eight dry-tree surface completions.

Kerr-McGee Oil & Gas Corp. has awarded Technip Offshore Inc. a contract for the engineering and construction of the company's sixth spar floating production platform hull and the engineering and delivery of the associated moorings and production riser system for the Constitution field in the Gulf of Mexico. Technip will provide the global engineering, as well as the engineering and procurement of the riser system. Kerr-McGee has selected Mustang Engineering to provide engineering, procurement services, and project management assistance for the topsides production facility. Gulf Island Fabrication has reportedly issued a letter of intent with Kerr-McGee to fabricate the topside for the Constitution truss spar platform. Gulf Island will start fabrication in 2Q 2004 and deliver the topsides in 2005 for first production in 2006.

The hull for Constitution will be 554 ft long, with a diameter of 98 ft. It will have a displacement of 59,250 tons and a steel weight of 15,000 tons.

The Constitution field is in 5,000 ft of water on Green Canyon blocks 679 and 680 in the deepwater Gulf of Mexico.

Ultra-deep drilling record set

The Minerals Management Service reports a record number of drilling rigs are working in ultra-deepwater in the Gulf of Mexico. Twelve rigs are drilling for oil and gas in 5,000 ft of water or more.

Deepwater oil and gas development in the GoM continues to be the workhorse of US domestic oil and gas production. The US has been drilling in the deepwater GoM for nine years and shows no sign of stopping as discoveries continue to indicate more resources.

According to the MMS, deepwater oil production rose 535% between 1995 and 2002, and deepwater gas production rose 620% over those same years. Production of oil from the Gulf now accounts for more than 30% of all US production; for gas, the GoM accounts for 23%.

Five discoveries were announced in 5,000 ft of water or greater in 2001, three in 2002, and six in 2003.

Offshore LNG deepwater port buoy classed

ABS has contracted with Advanced Production and Loading AS of Norway (APL) to provide classification services for APL's submerged turret loading (STL) system, a single-point mooring system and a component of the industry's first offshore LNG terminal, destined for the Gulf of Mexico, 116 mi offshore Louisiana.

The project will create industry's first offshore LNG deepwater port terminal in the US and will be the first of its kind in the world, William J. Sember, ABS vice president of energy development, said.

The Energy Bridge Deepwater Port, the terminal system, planned for installation on West Cameron block 603 in 280 ft of water, incorporates APL's STL technology used to offload oil in regions including the North Sea, offshore China, and offshore Western Australia. First cargo for the Energy Bridge Deepwater Port is scheduled for January 2005.

The project provides an industry model for taking traditional, land-based LNG receiving terminals offshore to achieve environmental advantages and economies of scale to global gas trading, Sember said.

"Offshore gas ports, such as the Energy Bridge Deepwater Port, will avoid many of the challenges associated with building or expanding conventional terminals in environmentally sensitive or populated areas while facilitating the delivery of re-gasified LNG directly into pipeline grids," Sember said.