GULF OF MEXICO

David Paganie • Houston

Investment interest in GoM E&P increasing

The oil and gas industry witnessed a number of corporate-level strategy changes in the Gulf of Mexico in 2005. Four foreign-based companies announced strategic plans to expand their interests in the GoM, while two US players opted out of the Gulf to become pure onshore resource providers.

Given the cash flow generation from offshore properties, the GoM should see an increase in merger and acquisition interest by both domestic and international companies, a trend that appears to have already begun, according to Raymond James & Associates, Inc., equity research analysts.

The highly publicized Chevron and Unocal merger was completed on Aug. 10, 2005. The combined company will produce approximately 2.8 MMboe/d and increase Chevron’s proved reserves by more than 15%. Chevron says the addition of Unocal’s position on the shelf, its interests in Mad Dog, St. Malo, K2 and Puma, and its portfolio acreage will further strengthen the company’s GoM profile.

Woodside Energy (USA) Inc.’s strategy to build a presence in the GoM was clear when it formed an alliance with US-based Explore Enterprises. Under the agreement, both companies will jointly invest in the shelf and deep waters of the Gulf. The alliance is good for five years and includes an option to extend a further two years.

Later in the year, Woodside Energy (USA) Inc. expanded its interests in the GoM by acquiring Houston-based Gryphon Exploration Co. for $296.9 million. Through the acquisition, Woodside gains ownership in 118 leases, 95 of which were previously operated by Gryphon. A majority of the leases are located on the continental shelf.

At the time of the announcement, an independent petroleum consultant estimated Gryphon’s proved reserves to be 72.5 Bcfe, and Proved plus probable reserves at 114 Bcfe. These reserves are made up of at least 85% gas.

Norway-based Hydro is growing its presence in the GoM through acquisition of US-based Spinnaker Exploration Co. Completion of the $2.45 billion all-cash transaction was announced on Dec. 14, 2005. The combined company’s total current production is expected to reach about 50,000 boe/d by 2008, and total reserves are estimated to reach 129 MMbbl.

Tokyo-based Nippon Oil Exploration U.S.A. Ltd. (NOEX USA), subsidiary of Nippon Oil Corp., and Norway-based Statoil plan to expand their interests in the GoM through property acquisitions.

NOEX USA has purchased 27 oil and gas leases in the GoM OCS offshore Texas, Louisiana, and Mississippi, with intentions to establish the area as a core for its worldwide upstream business. NOEX USA plans to take over operatorship on 18 of the leases, pending MMS approval. Combined daily production from these leases in 2005 was expected to be around 12,300 boe/d.

Statoil is further establishing the GoM as a core area with the acquisition of EnCana’s entire GoM deepwater portfolio for $2.0 billion. Statoil said the acquired portfolio has potential to deliver 30,000 boe/d by 2009, increasing to more than 100,000 b/d after 2012. In addition, the newly purchased properties contain expected discovered resources of 334 MMboe, and expected reserves in excess of 500 MMbbl.

Forest Oil, in an effort to become a pure onshore resource company, spun-off its offshore GoM operation and merged it with Mariner Energy. Under the terms of the transaction, Forest Oil bundled all of its offshore GoM operations into a newly created separate entity called Spinco. The unit was then merged into Mariner Energy in a stock-for-stock transaction, adding 603 Bcfe of proved and developed reserves, 228 MMcfe/d of production, and 664 million net acres to Mariner’s portfolio. Mariner more than doubled its GoM asset-base.

Similar to Forest Oil, Houston Exploration has announced a restructuring plan to become a pure onshore US gas producer. The company intends to divest its entire GoM asset base and will open a data room to qualified bidders in January. The company expects to close the transaction during 1Q 2006.

ATP Oil and Gas Corp. has acquired nearly all of the oil and gas properties of an unnamed privately help company for $40 million. ATP will assume operatorship of most of the acquired blocks, which are located on the Gulf’s Shelf. At the time of the announcement, the net production from the acquired blocks was approximately 25 MMcfe/d.

Hurricane-damaged platforms

Some of the platforms destroyed by hurricanes Katrina and Rita are creating potential obstacles for operators and mariners in the Gulf of Mexico. So far, the US Mineral Management Service has collected locations for 115 of the platforms.

During 4Q 2005 there were three separate incidents of vessels striking submerged platforms, the MMS says. One of the vessels flipped over and one sunk, while all incidents resulted in potential pollution events.

The vessel that capsized was the double-hulled tank bargeDBL 152owned by K-Sea Transportation of New York. According to the US Coast Guard (USCG), the barge struck debris from a submerged platform in West Cameron block 229 while en route from Houston to Tampa.

The USCG says that when the barge collided with the platform, it gouged a 35-ft by 6-ft hole in its starboard bow, puncturing both hulls and damaging one of the cargo tanks, which was carrying 300,000 gal of oil.

As a result, the vessel capsized and oil leaked from the barge’s breached cargo tanks. The barge was positioned approximately 29 mi south of Calcasieu Pass, Louisiana and 100 mi east of Galveston, Texas.

A second vessel involved in a collision was theM/V L’Arpenteur, operated by Fugro GeoServices, Inc. According to the US Coast Guard, the vessel was searching for a sunken rig when it struck a submerged platform in 140 ft of water and sank. At last report, the vessel was resting on a 12-in. non-flow pipeline.

According to the MMS, a third vessel involved in a collision with a hurricane-destroyed platform was theAmerican Salvor owned by Crowley Marine Services, Inc. The agency says that the vessel collided with a platform in South Marsh Island block 166. The MMS added that the vessel safely returned to port.

Lease Sale 198

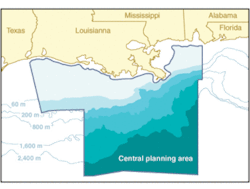

The MMS has announced a date for its yearly Central Gulf lease sale. The regulatory agency confirms that it is proposing to hold Central Gulf Lease Sale 198 on March 15, 2006. Bidders will be required to submit their bids to the MMS by 10 a.m. on the day before the lease sale, March 14.

The proposed lease sale includes about 4,000 unleased blocks covering approximately 21 million acres in the Central Gulf of Mexico OCS Planning Area offshore Louisiana, Mississippi, and Alabama. The blocks are located from 3 to about 210 mi offshore in water depths ranging from 4 m to more than 3,400 m.

The MMS estimates the proposed lease sale could result in the production of 276 to 654 MMbbl of oil and 1.6 to 3.3 Tcf of natural gas.

According to the MMS, the following recently revised provisions proposed are included in this lease sale:

• Deepwater royalty relief lease terms that were specified in the Energy Policy Act of 2005

• Shallow-water deep-gas royalty relief specified in the Energy Policy Act of 2005. In this sale, such relief is available to leases in water depths from 0-400 m. In addition, this sale will provide an increase in royalty suspension volume from 25 Bcf to 35 Bcf for successful wells drilled in 20,000 ft TVD or deeper

• Rental rates will increase to $6.25 per acre in water depths less than 200 m and $9.50 per acre in water depths greater than 200 m

• A new stipulation regarding limitations on use of the seabed and water column in Mississippi Canyon block 118 resulting from an ongoing federally funded University of Mississippi study of gas hydrates

• A new Information to Lessee (ITL) clause that relates to ongoing US Coast Guard reviews of the Gulf Landing LNG Project. The ITL notes that this ongoing LNG permit analysis may eventually lead to a lease stipulation that will be designed to minimize conflict with the LNG project

• An earlier deadline for electronic fund transfer (EFT) of one-fifth bonus, four-fifths bonus, and first year rental payments associated with this sale. That deadline will be 11 a.m. Eastern Time on the specified days within the EFT sale guidelines versus the prior time of 1 p.m. Eastern Time on those specified days.•