Offshore oilfield, wind investments to continue growth in 2023

Editor's note: This cover story first appeared in the January-February 2023 issue of Offshore magazine. Click here to view the full issue.

By Matt Hale, Rystad Energy

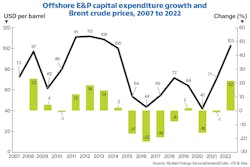

Offshore exploration and production capex shook off the COVID-19 pandemic-induced declines of the past two years to rebound by 21% in 2022, reaching a total $165 billion spent on exploration, wells and facilities. This is slightly less than half the all-time high for offshore E&P investment of $332 billion, set in 2014 at a time when the average Brent oil price had stayed above $100 per barrel for a fourth consecutive year. Following several years of lower crude prices and demand uncertainty, crude jumped again last year to average over $100 per barrel.

While Brent prices have cooled from a peak of $128 per barrel in 2022, demand will outstrip supply starting in December 2022 and lasting through the end of 2023, translating into an average price of $89 per barrel in 2023, peaking at $99 in August and falling to $89 in December. This is largely driven by the European Union embargo on Russian oil that took effect on Dec. 5, 2022, which constrained Russian exports by limiting the fleet of tankers available to deliver crude to countries considered “friendly” by the Kremlin, including India and mainland China. In addition, natural gas takeaway capacity and capital discipline in an environment of high service price inflation are expected to limit the growth of US oil production. With this outlook for crude prices, offshore E&P operators are expected to continue investing in production, lifting capex by another eight percent to $178 billion next year.

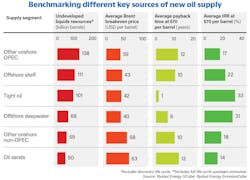

Since the offshore spending peak in 2014, operators have shifted their capital projects toward short-cycle investments, including shale and other tight resource plays in North America, which quickly boost short-term production, similar to infill drilling in proven geologic areas. In a sustained high commodity price environment, operators feel more confident deploying capital into long-cycle offshore developments, like we saw in the last offshore investment cycle in which capex increased every year from 2010 to 2014. These investments can take the form of seismic and front-end engineering and design activity as well as more concrete investments in new wells and offshore facilities. While Brent breakeven prices for offshore shelf and deepwater development average $40 and $43 per barrel, respectively, as of October 2022, long payback periods require operators to risk-adjust their investments, meaning they need to see higher prices to sanction new projects compared to tight oil assets with similar breakeven prices and significantly shorter payback periods. Looking back over the past 15 years, operators have looked for Brent prices in the $60 to $70-per-barrel range to maintain capital spending and even higher prices to significantly grow investments. As central banks around the world raise interest rates to contain inflation, offshore project hurdle rates will increase, meaning high commodity prices must be maintained at current levels to increase sanctioning.

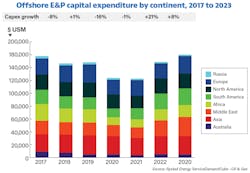

In the offshore drilling sector, state-owned producers including Saudi Aramco, ADNOC, QatarEnergy and Petrobras are taking a lead in well construction, aided by international majors and other operators. One particular region of increased activity is the Middle East, where Saudi-backed driller ADES International and UAE-supported ADNOC Drilling have spent recent years expanding their fleets, acquiring dozens of new and used jackup rigs to drill in the shallow waters of the Persian Gulf. Zooming in on Middle East rig demand, we see that the vast majority of year-on-year growth will come from Saudi Arabia, adding 24 rig years on top of 2022 levels. The entire region is expected to grow by 23% from a base of 118 rig years for 2022, already 10% higher than 2021. In terms of rig years, the Middle East is by far the biggest growth region in 2023.

Growth in South America will be concentrated in the deepwater areas of Brazil and Guyana, led by Petrobras and ExxonMobil, with shelf activity only accounting for a small minority of capital spending. Rather than fixed platforms, these developments will require massive FPSO vessels and complex subsea production systems. Based on standardized hull, topsides, and mooring designs by SBM Offshore and MODEC, the largest newbuild FPSOs feature up to 2.3 million barrels of storage and 50,000 tonnes of topsides. Globally, seven FPSO projects were awarded last year, with an additional 15 to be awarded in 2023 and another 12 in 2024.

Brazil has been the dominant FPSO market in recent years, with just over one-third of FPSO awards between 2017 and 2024. In addition to four projects in Brazil, this year will see three awards in the UK, two in Guyana and two in Angola. In South America, subsea capex is expected to exceed $10 billion as these operators build out the infrastructure needed to support massive offshore oilfields such as Buzios, Bacalhau and Jubarte in Brazil and Yellowtail, Payara, and Pacora in Guyana.

With crude oil and natural gas prices expected to stay elevated through 2023, offshore spending on oilfield services will increase above 2022 spending levels. State operators aiming to extract valuable resources amid the rapidly advancing energy transition will lead the way, along with international majors, many of which now feel confident investing in long-cycle offshore projects in core basins to grow production in a high energy price environment.

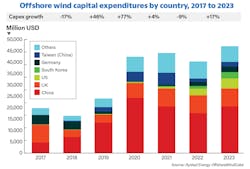

In parallel with the growth in oil and gas spending, we forecast 17% growth for offshore wind capex in 2023, reaching a new record of $47 billion. This follows a nine percent decline in offshore wind capex last year. Mainland China continues to lead the way with $21 billion in investments this year followed by the UK, which continues to spend heavily on offshore wind development. Also notable are the emergence of the US and South Korea in this market, which have ramped up development significantly in the last year or so from a low base. France and the Netherlands have experienced declines in spending in offshore wind, from peaks in 2021 and 2020, respectively.

In total, the offshore outlook for 2023 is positive with operators increasing spending in both oil and gas and wind energy development.

About the Author

Matthew Hale

Matthew Hale is senior vice president—Drilling & Wells at Rystad Energy. He has extensive experience in oilfield services, spending most of his career with Baker Hughes and NOV supporting product development, marketing, and corporate strategy teams. He holds a bachelor's degree in mechanical engineering and an MBA, both from Rice University.