Brazil reserves soar on new find

Peter Howard Wertheim, Contributing Editor

The estimated 5-8 Bbbl of recoverable Tupi area 28° API oil discovered offshore Brazil in Santos basin moves the country into the elite category of world producers.

Brazil’s proved reserves of oil and natural gas is 14.4 Bbbl. Petrobras’ president Jose Sergio Gabrielli says this find alone may push Brazil’s oil reserves into the top 10 in the world, up from its present 24th place. The Tupi discovery in block BM-S-11 is just a “tiny’’ part of a new oil province that the company believes is beneath existing fields, Gabrielli says.

Petrobras is the operator with 65% interest. BG Group holds 25% and Petrogal - Galp Energia has 10%.

The analysis and interpretation of the production data from eight tested wells show high productivity and provide the company a basis to guarantee that Brazil found its largest oil province, comparable to the world’s most important oil-bearing areas, says Almir Guilherme Barbassa, Petrobras’ CFO and investor relations director.

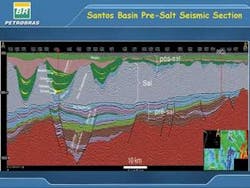

Barbassa explains that by integrating this data with a major mapping effort, the company determined, with a high degree of accuracy, that the pre-salt rock formations range from the coast of Espírito Santo state and extend southwards to offshore Santa Catarina state.

This formation, a system called Lagoa Feia, is more than 800 km (497 mi) long and up to 200 km (124 mi) wide, encompassing the Espirito Santo, Campos, and Santos basins. Waters depths vary between 1,500 m and 3,000 m (4,921 ft and 9,842 ft) and the pre-salt reservoir lies between 3,000 and 4,000 m (9,842 ft and 13,123 ft).

According to Márcio Rocha Mello, president of the Brazilian Association of Petroleum Geologists, in the whole area known as the Greater Campos basin, “there may be at least 50 Bbbl of recoverable reserves, in a conservative estimate.” For 26 years Mello worked for Petrobras and is now partner of High Resolution Technology Petroleum, Rio de Janeiro.

Tupi oil development

To investigate reservoir behavior, Petrobras plans an extended well test at Tupi in early 2010, with one well connected to a dynamic positioned FPSO already under conversion. This will be the second DP FPSO in the company’s fleet; the first is in Roncador field. The selected area for the pilot program is of 110 sq km (42 sq mi) and the appraisal plan area, 936 sq km (361 sq mi).

Two test wells were drilled in the Tupi area at the BM-S-11 block, a concession acquired during the second round of auctions in year 2000. The Tupi reservoir lies 286 km (178 mi) south of Rio de Janeiro, under 2,140 m (7,021 ft) of water, more than 3,000 m (9,842 ft) of sand and very hard rocks, plus 2,000-m (6,562-ft) thick layer of an evaporitic salt.

“The well tests indicate potential flow rates of 15,000 to 20,000 b/d per well and GOR between 140 and 220 m3/m3,” Petrobras Corporate Executive Manager Francisco Nepomuceno Filho says in an exclusiveOffshore interview.

Oil viscosity was around 1 cP, initial pressure was 580 kgf/cm², the total acid number was low, and CO2 in the associated gas ranged from 8% to 18%, he adds.

The results of the test wells were announced on Nov. 8, 2007, but the first time Brazil’s oil regulator, the National Oil, Natural Gas and Biofuels Agency (ANP), was notified about the discovery in BM-S-11 was on July 10, 2006.

Petrobras named the discovery well 1-RJS-628A (1-BRSA-369A-RJS was the name given by ANP) and said it flowed 4,900 b/d of oil and 4.2 MMcf/d of gas through a 5/8-in. (1.6-cm) choke.

Later, appraisal well 1-RJS-646 (3-BRSA-496-RJS as per ANP), 10 km (0.6 mi) southward, was drilled by Noble’s semisubmersible rigPaul Wolff, in 2,166 m (7,106 ft) water depth. Tests indicated flows of 2,000 b/d of oil and 2.3 MMcf/d of natural gas.

According to Nepomuceno, recoverable volume over the whole area for just the upper reservoir is 4.5 Bbbl. Two other carbonate reservoirs were found in RJS-646 to push the preliminary estimates for the recoverable volume for the whole Tupi area to 8 Bbbl.

Guilherme Estrella, Petrobras E&P director, says it is too early to make a definite statement about production figures for Tupi field. “That will depend on results of the pilot project,” he says. “Petrobras will start with an early production system in place and plans to produce 100,000 b/d from the field as early as 2010 or 2011. But that would only represent a very small amount of the field’s potential.”

Estrella adds that “there are no technological barriers to exploring Tupi, it’s all about costs. There’s no forecast of how much we will invest to explore Tupi since we haven’t held production tests in the region yet and the dynamics of the reservoir are not known.”

Since Tupi is 286 km (178 mi) from shore, Petrobras is considering whether to process either LNG or CNG from the field aboard ships for transport to the coast. Alternately, the gas could be used to generate electricity on floating units. “The costs for such gas projects are high, but the high price fetched by the oil make this investment viable,” Estrella concludes.

Technological challenges

Petrobras’ $112 billion investment plan for 2008 to 2012 does not include investments for pre-salt production. Petrobras does plan to mobilize resources by promoting a long-run standardization program for most well design/related equipment, as well as subsea hardware (wellheads, subsea trees, flexible lines, etc.).

Regarding subsea engineering, the main technological challenges include: qualification of risers for water depth of 2,200 m (7,218 ft), considering CO2 and high pressure; the riser towers including SCRs with lazy wave and others; the qualification of thermal insulated flowlines for water depths of 2,200 m (7,218); and flowlines for high pressure gas injection, Nepomuceno said.

Petrobras says that 15 wells were drilled to pre-salt layers over the past two years for a total cost of $1 billion. The first of these wells demanded a full year and cost $240 million. According to Nepomuceno, Petrobras now drills an equivalent well in 60 days for $60 million.

“The main cause of the reduction of the drilling cost was the reduction of the drilling time and this has been possible mainly due to the learning curve,” he explains.

Commenting on well engineering challenges in salt projects, Nepomuceno highlights the slow reservoir penetration; the deviation of the wells into the salt zone; the hydraulic fracture in horizontal wells; and research of wellbore materials resistant to high CO2 content.

The company has established a Pre-Salt Technological Program, PROSAL, at its R&D center (Cenpes) to develop and to disseminate technologies to incorporate reserves and to develop the production of the recent discoveries in the pre-salt section.

To decrease drilling costs and increase speed, Nepomuceno cites Cenpes studies on well construction for the pre-salt section: drilling fluids, cement resistance, stimulation techniques, geomechanical model, liner drilling, well control in the salt zone, and multilaterals.

“We have been using special casings with heavy wall and high collapse properties. To avoid stuck pipe and casing collapse problems, Petrobras has developed in-house software to evaluate the creep rate and casing collapse loads that allowed us to improve the mud and casing design. The casing design depends on the stratigraphy and thickness of each layer to be drilled. We have been using our own software developed in-house to specify the casing string. Also, to avoid corrosion problems in the production casing and tubing string, we have been using high alloy steel pipes,” says Nepomuceno.

Besides running negotiations with partners for project’s scope and budget approvals, the company plans to establish “batch orders” with key suppliers for long-lead items, and long-term contracts with service companies, and contractors for rigs, laying vessels, anchor handlers, etc.

Wells in Whales Park

North of Campos basin, offshore Espírito Santo state, another three wells were tested by Petrobras. The region is an environmentally sensitive spot known as Whales Park (Parque das Baleias). In a field named Caxaréu, 30º API oil was found in well 4-ESS-172-ES and the Pirambú field produced 29º API oil in the 4-ESS-175-ES well.

In Jubarte field, 77 km (48 mi) off Espírito Santo, the test well was named 1-ESS-103A-ES. “Current plans consider the 103A-ES start up in April 2008, connected to theP-34 FPSO. Ongoing studies indicate that other pre-salt wells could be connected to the Cachalote field FPU from 2009 on,” says Nepomuceno. Jubarte and Cachalote are fields named after whales’ species that frequent the area.

These fields were declared commercial on December 2006 and are being developed in the BC-60 block, acquired by Petrobras in Round Zero in 1998. From June 2006 to September 2007, ANP received 11 notifications of hydrocarbon finds in the BC-60 block at water depths around 1,250 m (4,101 ft).

Gabrielli affirms that more tests are scheduled in Caxaréu and Pirambú fields before operations start in the Tupi area.

“In Santos basin, the salt layer is thicker and deeper than in Campos basin. That is the reason why in Santos basin the salt shows more creep rate than in Campos basin. Therefore, it is more difficult to drill in the Santos basin. But, the characteristics of the oil in the pre-salt reservoirs in the northern region of the Campos basin are similar to Tupi,” says Nepomuceno.

The bulk of Brazil’s current 1.8 MMb/d output is heavy crude (14 – to 17° API) but the oil at Tupi is lighter. “With this discovery, Brazil will sharply reduce its light oil and diesel imports,” said Paulo Roberto Costa, Petrobras’ downstream director. Currently, Brazil imports 300,000 b/d of light oil to produce diesel.

Some estimates see Brazil as an oil products exporter by 2015. With Tupi onstream, the estimate is that Brazil will produce 4.5 MMb/d by 2015 and refining capacity should leap to 3.5 MMb/d from current 1.5 MMb/d.

Pre-salt blocks re-evaluated

As a result of the Tupi discovery, the government removed 41 Santos, Campos, and Espirito Santo basin oil exploration blocks out of the 312 blocks nominated for sale in the Nov. 27, 2007, auction. The government wants to reevaluate the potential because the blocks in Santos basin are close to the Tupi field and the other basins present geology similar to Tupi.

Dilma Rousseff, the government’s civilian chief of staff, former mines and energy minister, and head of Petrobras administrative council, says the measure allows reevaluation of those resources without breaking any existing contracts. “When we are better aware of the potential, we will consider offering them at auction again,” she affirms.

ANP already has granted about 25% of the pre-salt areas to several oil companies in the form of exploratory blocks and production concessions. The government said companies already owning stakes in pre-salt areas will keep them.

Ten years after the deregulation of the sector, private companies are responsible for a little more than 1% of the country’s production. In the next 15 years, 15% of the investments earmarked for exploration and production will come from private companies, the Brazilian Petroleum, Gas, and Biofuels Institute estimates.

Another pre-salt test well, the 1-SPS-060, was drilled in the BM-S-9 concession in Santos basin, where BG Group holds a 30% interest along with operator Petrobras (45%) and Repsol YPF Brasil S.A. (25%).

Within the BM-S-9 block the discovery of a new oil field known as Carioca was announced on Aug. 7, 2007, in 2,140 m (7,021 ft) of water, approximately 273 km (170 mi) off Rio de Janeiro. The consortium ran some 5,000 km (3,107 mi) of seismic in the area, drilled two wells, and expects to drill three more wells in 2008.

Also close to Tupi is the BM-S-10 block, closer to the coast of Rio de Janeiro, where another pre-salt well, the 1-RJS-617, was tested. In BM-S-10, Petrobras holds 65% interest, BG Group 25%, and a Portuguese oil firm called Partex, 10%. This consortium also ran 5,000 km (3,107 mi) of seismic and is expected to drill three wells this year.

Other pre-salt blocks sold in Santos basin near Tupi are the BM-S-22 block, operated by Exxon 40% in partnership with Amerada Hess 40% and Petrobras 20%, and block BM-S-24, where Petrobras has 80% and Petrogal, a Portuguese oil firm, 20%. Both consortia ran 2,500 km (1,553 mi) of seismic and are expected to drill four wells by September 2009.

Other blocks already sold within the Santos basin pre-salt area include BM-S-17 and BM-S-42, both 100% owned by Petrobras; BM-S-21, Petrobras 80% and Petrogal 20%; BM-S-50, Petrobras (60%), BG Group (20%), and Repsol YPF Brasil S.A. (20%); and BM-S-52, Petrobras (60%) and BG Group (40%).

Contract changes

Haroldo Lima, ANP’s general director, says that regulatory authorities are drafting proposals to introduce production sharing contracts for the fields now emerging in the pre-salt horizon.

The concession contracts signed by oil companies with the ANP are seen as modern, being used for half the world’s production. In this system, IOCs are responsible for exploration and production under their own responsibility and risk. If successful, the companies own the crude produced.

The government is compensated by royalties, and in Brazil the royalty is 10%. A special participation is charged every quarter, up to 40% over production of large oil fields. There is also the signature bonus, or value paid during the licensing rounds and a rental fee for using or retaining areas.

According to Lima, “Brazil has a wide range of sedimentary basins and we think the regulatory system should address that diversity.”

He said the ANP will propose two or three types of contracts: the present concession contract, for majority of known areas; a production-sharing agreement for new areas or frontier areas such as the pre-salt discovered in Tupi; more flexible contracts for mature fields; and contracts for rendering services. Production-sharing agreements are generally used in countries with large oil reserves such as Venezuela, Angola, and in the Middle East.

Latest news

Petrobras announced on Dec. 20 that the consortium formed by Petrobras (80% as operator) and Galp Energia (20%) to explore block BM-S-21 in deep Santos basin waters via well 1-BRSA-526-SPS (1-SPS-51), has confirmed light oil in the pre-salt layer in the Santos basin. The pioneer well is 280 km (174 mi) off the coast of the state of São Paulo, 2,234 m (7,329 ft) below sea surface. The well’s depth is 5,350 m (17,552 ft).

The discovery was confirmed by signs of oil and by profile interpretation in reservoirs at a depth of nearly 5,000 m (16,404 ft). The well had not been tested at press time because of operating and logistics issues.

The consortium says it will work to check the field’s dimensions and to verify the oil reservoir’s characteristics. Furthermore, it is elaborating the Discovery Evaluation Plan it will send to the National Oil, Natural Gas and Biofuels Agency (ANP), as provided for in the Concession Agreement.

Talk of OPEC membership

In the wake of the Tupi discovery and the optimism surrounding the reserves estimates, Brazil is reported to be talking about possible membership in OPEC, according to its ambassador to Saudi Arabia.

Isnard Pehna said at the November OPEC meeting that he was attending to talk with OPEC officials and that a membership decision would be made once Brazil had established its export capacity.

At that time, Petrobras CEO Sergio Gabrielli said Tupi production likely would exceed 200,000 b/d of oil and that a pilot production plan may start at 100,000 b/d in 2010-2011.

Other estimates see Brazil’s crude production rising from 1.8 MMb/d now to 2.75 MMb/d by 2011, and 1 MMb/d higher than that by 2015.