Pre-salt discoveries continue in Brazil

Peter Howard Wertheim, Contributing Editor

Deep under the Atlantic Ocean, Brazil’s state-controlled Petrobras has made what could prove to be the largest oil discovery in 30 years, and one that would propel the already prospering country into the major league of oil exporters.

The head of Brazil’s upstream regulatory body National Petroleum and Biofuels Agency (ANP), Haroldo Lima, said in April that the find in the Carioca exploration area could contain 33 Bboe, which would make it the world’s fourth-largest field. Lima did not say whether his unofficial estimate was of recoverable reserves or in-place resources and Petrobras did not comment.

Brazil Energy Minister Edison Lobão was quoted as saying on São Paulo’s Estado newswire that he would neither confirm nor deny Lima’s statements. However, he cautioned that any announcement on the extension of oil fields should only be made once the government is certain about the data.

For context, current Brazilian crude oil proven reserves are at 14.4 Bbbl.

Outstanding sequence of discoveries

“This is one of the most impressive oil finds globally in terms of scale,” says David Riedel of New York-based Riedel Research Inc. The deepwater discovery, coming after a similar find announced last year by Petrobras, suggests that the world still has major pools of oil to be found.

For Brazilian analysts, it also casts new doubts on peak oil theory, which postulates that world oil demand will soon outpace supply.

Riedel says uncertainty remains regarding the size of the Carioca discovery on BM-S-9 block, which lays under 2 km (6,562 ft) of water, plus many more kilometers of sand, hard rock, and another 2 km of salt. The exploration area, also called Carioca-Sugar Loaf, is 275 km (171 mi) off the coast of São Paulo and Rio de Janeiro.

“Petrobras is very good at deepwater drilling but this is going to be very complicated stuff to get out of the ground,” he adds.

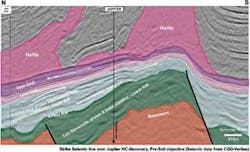

Besides affirming that there is no technical barrier to explore under the salt layer, Guilherme Estrella, Petrobras’ E&P director, argues that there must be change in the sector’s regulations because the pre-salt exploration can be seen as low risk exploration activity. According to Petrobras, the discovery of the blockbuster natural gas and condensate field in the Jupiter area in the Santos basin reinforces the notion that there is practically no exploratory risk in the pre-salt layer.

“Of the 15 wells we drilled during the last two years in the pre-salt, each one of them struck oil or gas. In fact, we have been drilling in the pre-salt area since we started drilling in Campos basin,” he says. “All of the pre-salt blocks achieved exploratory success, something that confirms the region’s high prospectivity.”

Estrella, a geologist, is former head of Cenpes, Petrobras’ R&D center.

Marcio Rocha Mello, president of the Brazilian Association of Petroleum Geologists, the national branch of AAPG (US), explained in an exclusive interview forOffshore that “at early exploration stages, the pre-salt reservoirs were targeted in the Campos basin, offshore Brazil. The results were satisfactory; with oil fields such as the Badejo, Linguado, and Trilha, allowing the basin to become even more productive. Later, with the discoveries of the super-giant post-salt Tertiary and Upper Cretaceous turbiditie systems at shallower burial depths, the pre-salt petroleum system was put aside as low priority.

“In recent years, due to lack of remaining giant prospects in the post-salt, Petrobras started to drill deeper, more than 6,000 m (19,685 ft), looking for giant oil and gas accumulations in the pre-salt province offshore, including Santos, Campos, and Espirito Santo basins. Among the major hurdles to success in this new exploration frontier was the challenge to properly image the pre-salt targets, to undertake drilling through thick salt layers, and to evaluate high pressure and temperatures,” adds Mello.

Carioca remained hidden from explorers until recently because energy companies lacked the technology to assess prospects obscured by undersea salt formations. Salt is difficult for geologists because it absorbs seismic energy and does not yield typical visualization results. Also, a decade ago the physical technology did not exist to drill to these depths in this much water.

With the discovery of Tupi two years ago in block BM-S-11 in pre-salt sequences, the significance of petroleum exploration in the Brazil offshore basins changed completely. The existence of a hydrocarbon province in the entire pre-salt sequences was confirmed.

Petrobras recently created a division to coordinate all production projects for the pre-salt clusters in Santos basin. José Formigli was named manager and has a staff that works with the support of Petrobras.

Cluster of pre-salt discoveries

Recently, Petrobras announced yet more discoveries in Santos basin pre-salt: the Bem-Te-Vi field (named after a Brazilian bird), on block BM-S-8, where Petrobras is the operator with a 66% stake, Royal Dutch Shell with 20%, and Galp with 14%; the Caramba field, in block BMS-21, where Petrobras is the operator with 80%, and Galp with 20%; plus the Parati field, in block BMS-10 where Petrobras holds a 50% stake, Chevron 25%, and BG 25%. So far these fields have no estimated reserves.

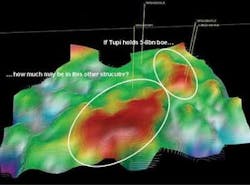

Petrobras’ new discoveries suggest the occurrence of a super-giant structure which covers almost 1,600 sq km (618 sq mi), encompassing a great part of blocks BM-S-8, BM-S-9, BM-S-21, and BM-S-22. Such super-structure is now called Carioca-Sugar Loaf.

The Carioca field is 45% controlled by Petrobras. DCC Plc’s British Gas LP Gas Ltd. holds a 30% stake and Repsol controls 25%.

Carioca’s possible 33 Bbbl of oil is enough to supply every refinery in the US for six years, making it the fourth-largest oil field ever discovered.

If Tupi-Jupiter and Carioca-Sugar Loaf discoveries are confirmed, the province foreseen in this cluster of blocks will become one of the biggest worldwide discoveries, affirms Mello.

“The lesson that we must learn about the petroleum exploration in southern Brazilian basins is: Let’s go deep! For there is an overcharged Deep Source Rock System in the area directly associated with good quality reservoir rocks, full of light oil and gas,” Mello says. He worked 26 years for Petrobras and is a partner of High Resolution Technology in Rio de Janeiro.

Only Saudi Arabia’s Ghawar (83 Bbbl), Kuwait’s Burgan (72 Bbbl), and Majnoon (50 Bbbl) discovered by Petrobras in Iraq in 1975 are bigger, Estrella says.

The Jupiter light oil/gas field was discovered by the 1-RJS-652 well 38 km (23.5 mi) to the east of Tupi oil field. Jupiter may be the biggest gas and condensate discovery ever made in the Brazilian basins. The well has 130 m (426.5 ft) of net pay and a TD of 5,686 m (18,655 ft).

Jupiter is of strategic importance because Brazil imports around 50% of its natural gas from politically unstable Bolivia which has been nationalizing its hydrocarbon sector.

Jupiter’s reservoirs lay at depths of 5,100 m (16,732 ft) and the rock that bears hydrocarbons is more than 120 m (394 ft) thick, above other gas-producing reservoir average.

The Jupiter discovery was made by a consortium made up of Petrobras (80% stake in the find), and Portugal’s Galp Energies (20%).

It will take decades for Brazil to develop Tupi and Carioca, but the country could eventually pump out as much as 3 MMb/d of crude. These discoveries, however, are in a difficult region and very deep below the seafloor. Oil experts reported that production from the pre-salt area could be “very challenging and expensive.”

Some experts estimate that Tupi field, containing up to 8 Bbbl, could cost $50 billion to develop to full production. John Parry of John S. Herold Inc. in Norwalk, Connecticut, estimates development costs could be $6/ to $7/boe to develop the Tupi field, adding it’s too soon to make similar estimates for Carioca. But at $7/boe, the development costs are “quite cheap in today’s market,” he says.

Carioca is 66 times larger than the Jack field discovered by Chevron Corp. in the Gulf of Mexico in 2004. California-based Chevron forecasts it will cost more than $3 billion and almost a decade to bring the field on stream.

Brazil’s offshore has become one of the hottest development regions in the global oil business, rivaling the offshore area of West Africa, with which it shares similar geology. As a result, the country is poised to challenge Venezuela and its socialist leader Hugo Chavez, as Latin America’s major oil exporter.

Mysterious Carioca-Sugar Loaf relationship

The relationship between Carioca and Sugar Loaf has not been defined geologically. The question of whether they are independent reservoirs or whether they are connected remains to be answered.

“We are bullish on the Brazilian pre-salt play, but we’re also trying to keep this story grounded in reality,” analyst Mark Flannery said in a conference call during a visit by a team from Credit Suisse Global Energy to Brazil.

“We believe Lima was saying that the whole Sugar Loaf structure might contain 33 Bbbl. That’s something we certainly think is possible,” he said, explaining that part of the confusion was in the name Carioca, sometimes applied just to the BM-S-9 block find, and at times to the whole Sugar Loaf area (BM-S-22 block).

Credit Suisse works with a “risked estimate” of 6.7 Bboe for the four-block part of Sugar Loaf under concessions and a more optimistic “blue sky” estimate of 15 Bbbl. That includes the BM-S-9 range of between 2 Bboe and 5 Bboe.

Only around half of Sugar Loaf is in licensed blocks, so doubling the blue-sky estimate would give a number similar to the 33 Bboe provided by Lima, Credit Suisse said.

Matthew Shaw, senior energy analyst for Latin America at Wood Mackenzie consultants in Scotland, urges caution. He says too many questions remain about Carioca, which he thinks is unlikely to contain that much crude. “There’s obviously a multibillion-barrel potential here, which is very significant for Brazil and the world oil market. There is a great deal of excitement and interest, but there are also a lot of questions that need to be answered,” he says.

Carioca is 273 km (170 mi) off the Brazilian coast in more than 2,000 m (6,562 ft) of water. The geological formation beneath a 2-mi (3.2-km) layer of salt is larger than Tupi and, if oil bearing, may contain “significantly more’” oil than Tupi, Gustavo Gattass, an analyst with UBS Pactual in Rio de Janeiro, said in a note to clients of Banking & Financial Services.

“The Sugar Loaf prospect (which is officially called Iguaçu) is a Late Aptian play in the Guaratiba formation. I would assume that Carioca is the same play, but can’t say for sure,” said Gatass. The Sugar Loaf prospect spans four different exploration blocks: BM-S-9, BM-S-8, BM-S-21, and BM-S-22. Petrobras is the operator in the first three with 45%, 66%, and 80% stakes. In BM-S-22, Exxon is the operator with 40%, Hess Brasil has 40% interest and Petrobras 20%, added the analyst.

“The main challenge that I see is understanding the reservoir. Petrobras has never developed a carbonate reservoir at this depth and no one knows for sure how that reservoir might behave under long-term production. There are some technical challenges due to the water depth (2,400 m), and we’ve heard that there were some concerns about paraffin build up in the test pipes, but frankly, here too there is not enough data. My view is that once we have a longer term test we might have a better view. But for now, the one thing that worries me is that the reservoir might not ‘behave well’ under a long-term test. Reservoir quality and heterogeneity are question marks,” Gatass toldOffshore magazine.

Petrobras, ExxonMobil Corp., Royal Dutch Shell Plc, Repsol YPF SA, BG Group Plc, Hess Corp., and Galp Energia SGPS all have concessions in the neighboring area, Gattass said, referring to the formation as “Sugar Loaf.”

Mauro Andrade, an oil analyst with Deloitte Touche Tohmatsu consultancy in Rio de Janeiro, said “there is no smoke without fire” and the Carioca find inspired a lot of optimism. “There is one well drilled, another being spudded and plenty of seismic data which are so much more precise than a few years ago. I think they do have a preliminary evaluation, which may not be the best in the world, but it’s there,” he said.

Analysts say the projection is most likely to be for possible or in-place reserves rather than recoverable, which may slash the number by two-thirds or so. That would still make Carioca what is called in the oil industry a “super giant,” with more than 5 Bbbl of crude.

Brazil in OPEC?

If confirmed, the Carioca-Sugar Loaf find would vault Brazil into the Top 10 countries for oil reserves, ahead of Organization of Petroleum Exporting Countries (OPEC) such as Nigeria and Libya. It also would surpass the US, point out oil analysts.

Director Estrella, who is known for conservative forecasts, toldOffshore that: “Considering the geologically provable dimensions of the whole pre-salt reservoirs, including Santos, Campos, and Espírito Santo basins, plus other prospects, such as geologically estimated recoverable oil and natural gas in the Tupi accumulation, we may be dealing with recoverable volumes very much larger than the current Brazilian proven reserves.”

Brazilian President Luiz Inacio Lula da Silva said on several occasions that when Brazil becomes a crude exporter it would like to join OPEC and work to lower oil prices.

Director Estrella pointed to the emergence of a new organization, the National Oil Companies (NOCs), as a forum of exporting and non-exporting countries that meets annually and has a different objective from OPEC: “In my opinion, NOC’s mission, through long-term strategic partnerships, is more interesting for Petrobras and raises the country’s political profile as an uncontestable leader of emerging countries. I am not in favor of Brazil joining OPEC. New oil producing countries started exporting but did not join OPEC, which in a way is weakening OPEC’s economic and political power. OPEC is going down the path of political obsolescence.”

While the potential Brazil find could add significant supplies to a global oil market many see as tight, it would likely take the better part of a decade before any of the oil finds its way to consumers. The site will need to be studied further, and many more facilities must be designed, built, and transported before it can start producing oil.

Future exploration

Although on the exploration front, Petrobras expects to make more discoveries in Brazil’s promising pre-salt oil province, as Chief Financial Officer Almir Barbassa hopes, exploration rigs for ultra deep oil areas are currently particularly scarce due to the heating up of the international oil industry, he says.

The company expects to receive more rigs in the next three years, Barbassa says. Petrobras started a veritable “war” operation to guarantee the means to explore in the pre-salt. The company is scouring the world to rent drilling rigs with capacity to drill at these huge depths and contracted another 10 drilling rigs expected to arrive in Brazilian waters between 2009/2011.

On June 3, Luiz Costamilan, president of BG Brazil, announced it rented three drilling rigs for ultra deepwater. The rigs were contracted from Seadrill and are expected to arrive in Brazilian waters by year-end. These rigs cost from $450,000 to $600,000 per day and will help to speed up pre-salt drilling in Santos basin.

International oil and gas companies are returning to Brazil for their first major effort since 1953, after being effectively excluded during four decades by the country’s old nationalist and protectionist policies, with Petrobras having upstream monopoly.

Since the opening of the sector ruled by the 1997 Petroleum Law, Brazil has discarded tariffs and protectionist quotas, enabling American companies to conquer about half the oil-service market, a survey by the US Consulate here indicates. Other opportunities await production and pipeline companies.

“There is going to be an explosion of this sector,” forecasts Etienne Kvassay, a Brazilian trade economist. “This market should grow at the rate of 30% in the next three years.”

In a study concerning the impact of pre-salt E&P upon the equipment and service industry, UBS bank estimates that during the next 30 years or more, some $600 billion worth of investments will be needed to produce 50 Bbbl in fields already discovered in Santos basin.

According to Bloomberg data, Petrobras is the fourth-most valuable company in the Western Hemisphere, behind Exxon Mobil Corp., General Electric Co., and Microsoft Corp.

“We think this is part of a major transformation of Petrobras, which could lead to it becoming a much larger company in terms of production and reserves over the next five to 10 years,” Merrill Lynch analysts wrote.