Top 5 offshore development projects to watch in 2025

By Bruce Beaubouef, Managing Editor

Buoyed by high prices and rising energy demand, offshore operators and international oil companies are advancing plans for several field development projects, and 2025 looks to be a busy year for offshore construction activities.

With that in mind, the editors of Offshore have compiled the following Top 5 field development projects to keep an eye on this year.

The projects were selected primarily on the basis of an expected or upcoming FID, but other parameters included notable aspects such as size of reserves; infrastructure scale and scope; unique milestones such as first deepwater production; or inclusion of emissions reductions technologies.

Tiber

The biggest prize in the US Gulf of Mexico this year is bp’s Tiber project. First discovered by bp in 2009, the Tiber oil field was described as a “giant” find, estimated to contain 4 to 6 billion barrels of oil in place. The deepwater field is located in the Keathley Canyon block 102 of the US Gulf of Mexico, some 300 miles southwest of New Orleans.

But there were challenges in developing this field, notably that the reserves in this Paleogene-age Wilcox section were below the salt layer, at multiple levels, and required 20k psi technologies to develop – technologies that only became commercially available in more recent years. To get a better “look” at the reserves, bp had an ocean bottom-node seismic survey carried out and reprocessed that data over both its Kaskida and Tiber fields. The new look at the subsurface gave the operator even further confidence to develop these fields.

It is expected that the Tiber FPU will be very similar to the Kaskida semisubmersible, a “design one and build many philosophy,” as explained by bp Senior Vice President Andy Krieger at last year’s OTC in Houston. These FPUs will be smaller facilities, 80,000 to 100,000 b/d capacity, with simplicity as their key virtue – “simpler to construct, simpler to commission, simpler to operate, and requiring fewer people to be offshore during operation.”

Last month, Seatrium reported that it had signed a memorandum of understanding with bp Exploration & Production for work on the Tiber FPU. This would involve performing the engineering, procurement, construction and commissioning work related to the platform, which would feature technologies designed for improved operational efficiency and safety.

bp and Seatrium say they will jointly devise initial works and the EPCC scope ahead of FID, which is expected later this year. Last year, bp appointed Seatrium to construct the FPU for its Kaskida field development, also in the Keathley Canyon area. The companies aim to draw on lessons learned and technological advances from Kaskida in designing the Tiber FPU. As with Kaskida, the Tiber FPU would employ Seatrium’s topsides single-lift integration method.

Seatrium’s Tiber FPU contract award is subject to the final investment decision by bp, anticipated later in 2025, possibly in mid-year.

Coral Norte

Another major project approaching FID is Eni’s proposed $7-billion Coral Norte FLNG development offshore Mozambique. Discovered by Eni in 2012, Coral is a deepwater gas field in Area 4 of the Rovuma basin, 70 km offshore Mozambique. The Coral field is estimated to hold over 11 tcf of recoverable gas.

The first FLNG vessel, Coral Sul, was placed in service in late 2022, and the second upcoming vessel, Coral Norte, will be sited approximately 15 km north of Coral Sul pending approvals.

The Coral Sul FLNG vessel was constructed by a consortium of Technip Energies, JGC and Samsung Heavy Industries. This same trio are reportedly in discussions with Eni regarding the construction of the Coral Norte FLNG vessel.

The Coral Norte FLNG vessel is expected to be a duplicate of the Coral South unit, with an estimated cost of $7 billion and a capacity of 3.37 million tons per year (mtpa). Current plans envision operations starting sometime in the second half of 2027.

The project is part of Eni’s ongoing efforts to expand its LNG production capabilities and capitalize on the significant potential of Mozambique’s natural gas reserves. The successful approval and execution of Coral Norte is expected to further bolster Mozambique’s role in the global energy and LNG markets.

Eni has said that it is ready to take the FID on the project this year, but it is waiting to receive authorization from the government of Mozambique. In January, that governmental approval was reported to be “imminent,” but no such approval had been announced as of early March.

Baleine Phase 3

Phase 3 of the Baleine project is expected to get the FID this year, as Eni seeks to continue its phased, fast-cycle approach to its Baleine deepwater development project. The deepwater oil and gas field lies in approximately 1,200 meters of water off Cote d’Ivoire (Ivory Coast).

The Baleine deepwater field is the largest hydrocarbon discovery and the first commercial discovery made in the West African country since 2001. It is also reported to be the first net-zero upstream project, in terms of Scope 1 and 2 emissions, on the African continent.

Baleine phase one came onstream in August 2023 via a small, refurbished FPSO vessel – the former Firenze FPSO – which was producing 22,000-23,000 barrels per day as of late 2023, exceeding initial expectations.

A second phase, able to produce about 40,000 b/d, was developed via a cylindrical FPSO that previously worked in the North Sea. Altera Infrastructure deployed its Voyageur Spirit FPSO for the project and also converted its shuttle tanker Nordic Brasilia into a floating storage and offloading vessel for this second phase, which began operations in January.

The third and final phase will involve a new FPSO able to handle 150,000 barrels per day of oil and 200 million cubic feet of gas. The bid process for this third phase has reportedly been delayed, but could be wrapped up by about mid-2025, according to an Eni official.

Zama

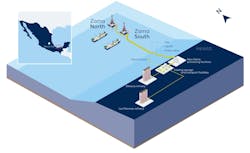

The highly anticipated Zama field development project offshore Mexico is expected to receive the FID this year as the front-end engineering and design studies are expected to wrap up soon. The field, located in shallow water off the coast of Tabasco state, is being developed by Wintershall Dea, Pemex (operator), Talos Mexico, and Harbour Energy.

Last year, the consortium awarded the FEED contract to the French engineering company DORIS, with work to be based on the scope of the Unit Development Plan approved by the Mexican Hydrocarbon Commission (CNH). It covers the planning of two offshore fixed platforms, 46 dry tree wells, 68 km of pipelines and cables as well as a new onshore facility, fully dedicated to the Zama project, located in the Dos Bocas Maritime Terminal, in Paraiso, Tabasco.

DORIS has been carrying out these studies in collaboration with two Mexican engineering companies, NOMARNA and SUMMUM.

Once these studies have been finalized, the Zama Unit partnership will proceed with the tendering process of the engineering, procurement and construction (EPC) contracts, followed by the final investment decision.

Zama is one of the world’s largest shallow-water discoveries in the last 20 years and was the first discovery made by an international consortium in Mexico in 2017. With estimated gross resources of 600 to 800 MMboe, Zama is expected to make a significant contribution to Mexico’s energy supply over the next 25 years. The field is expected to produce up to 180,000 b/d of oil at its peak, which corresponds to around 10% of Mexico’s current total oil production.

But despite being described as “one of Mexico’s most-promising new oil fields,” its development has faced several setbacks, and its startup timeline has been pushed back on multiple occasions. Initially discovered in July 2017, FID was initially expected in early 2020. Reported between the consortium partners continued to delay the FID. In February 2024, FID still had not been reached and production startup was pushed back from 2024 to 2025.

While reports indicate that FID could be reached this year after completion of FEED studies, the business history of the Zama field suggests that nothing is certain regarding this field development project. Meanwhile, it has recently been reported that first production from Zama has been pushed back to at least 2028. Early estimates suggest that the Zama field will cost $4.5 billion to develop.

Absheron Phase 2

Phase 2 of the Absheron field development project in the Caspian Sea is also expected to receive the FID this year.

The Absheron field is located on the Caspian Sea shelf, 100 kilometers southeast of Baku and 25 kilometers northeast of the Shah Deniz project. The field is owned by Abu Dhabi National Oil, State Oil Company of the Azerbaijan Republic (SOCAR), and TotalEnergies. The field is operated by Joint Operating Company of Absheron Petroleum, which is owned equally by TotalEnergies and SOCAR.

Phase 1 of the Absheron development included a single subsea production well that was tied back to a new gas processing platform linked to SOCAR’s facilities in the offshore Oil Rocks field. This first phase came online in July 2023 with production up to 4 MMcf/d of gas and 12,000 bbl/d of condensate.

Phase 2 is expected to produce 12.7 million cubic meters per day (4.5 billion cubic meters per year) and 37,000 barrels per day of condensate in addition to Phase 1 production, according to TotalEnergies. It is expected to come online in 2028.

Front end engineering design work for Absheron Phase 2 has begun, according to the Trend news agency of Azerbaijan. But there have been conflicting reports as to the components of this second phase. Initial reports indicated that the second phase would call for the construction of a new large fixed platform, but more recent reports indicate this portion of the project will be entirely subsea.

In late February, the Trend news agency quoted a TotalEnergies official to say that the Phase 2 concept will be a “subsea-to-shore scheme.” According to that report, the wells will be drilled at 500 meters water depth with the drilling section reaching more than 7,000 meters, “ranking among the longest in the Caspian Sea.” The wells will be tied back directly to the shore near Sangachal through a 140-km multiphase (gas and condensate) pipeline. Gas and condensate will be separated and treated in central processing facilities near the Sangachal Terminal.

TotalEnergies is aiming to finalize the full-scale development plan and prepare for FID within 2025, an official with the Baku office of TotalEnergies reportedly told the news agency.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.