Technology gains taking subsea processing deeper, farther out

Industry advances helping meet field development challenges

John Morgan, Rebecca Roth, Lee Thomas, Matai Wilson and Terry Wood, INTECSEA

Since therelease of the first Worldwide Survey of Subsea Processing Technology poster in Offshorein 2008, INTECSEA has monitored the status of the technologies and systems used on the seafloor to enhance reservoir recovery rates. The technologies continue to mature with each successful field development application. However, it is a long and costly process to bring the technology to market. And sometimes the process takes longer to find the right match of the technology for a field development application. The greatest challenge for operators is the risk of using a new technology or a combination of technologies for the first time on a project.

To justify these risks, operators require that: 1) the technology bring a minimum of a 30% to 40% cost savings incentive, or 2) the technology is the enabler for the project to proceed. Either way, these are key drivers for operators to use subsea processing technologies on their project.

Alliances, partnerships, and JIPs

Because of the costly nature of bringing the technology to market, various alliances and partnerships have emerged (captured on the poster in Chart 1 – Subsea Supplier Matrix). Partnerships or collaborations can bring technologies which, when combined, result in even greater benefits. Additionally, collaborative efforts greatly reduce the costs associated with maturing the technology through to each TRL (Technical Readiness Level).

An assessment of the history of subsea processing reveals, that with each field development, it is not one technology, but rather the combination and integration of multiple technologies from multiple vendors which enable subsea technologies to work together to achieve the desired results. Because of the huge importance of integration, the role of one supplier to integrate and package the systems becomes critically important to the project.

JIPs (joint industry projects) are another path for bringing subsea processing technology to the market. A JIP consists of a specific group of operators and contractors working together to mature the subsea processing technology from conceptual studies through testing and piloting, and eventually installation and operation.

The subsea gas compression technology on the Åsgard field is expected to increase the reservoir’s productive life by 15 years. (Photo by Elin A./Courtesy Equinor)

Subsea compression technology

Table 1 of the 2019 Subsea Processing poster shows two major compression projects (Åsgard and Gullfaks South Brent) which are currently operating. The success of these projects is providing the industry with confidence in subsea gas compression, and more operators are now conceptually evaluating subsea gas compression on other projects. These potential subsea gas compression projects are indicated in the “Current Status” column of Table 1 with a “C” for “Conceptual Project. Unfortunately, only publicly announced gas compression conceptual studies can be listed on the poster. However, according to the contractors and system integrators, many more such studies are under way but are confidential at this time.

Chevron has publicly indicated that subsea gas compression is being conceptually evaluated for the Jansz-Io fields which would negate the need for a multi-billion dollar offshore floating host platform. This is a prime example of the potential for technology to produce a significant cost saving that far outweighs the risk introduced by using the technology. In the case of Jansz-lo the cost savings would be significantly greater than the 30% to 40% threshold.

The risk of certain “unknowns” is reduced for operators considering subsea gas compression as Equinor gains experience and publicly shares information about their technical success and “lessons learned” from their Åasgard and Gullfaks South Brent projects.

The timeline for bringing subsea compression technology from concept to Åsgard’s first compression gas was 20 years. Conceptual development studies started in 1985, and operations started in September 2015. Future gas compression projects will be much faster due to the shared learnings from the Åsgard and Gullfaks projects.

In December 2018, MAN Energy Solutions’ first subsea compression trains at Equinor’s Åsgard field had achieved 50,000 operating hours with nearly 100% availability. This achievement helps operators to have greater confidence in the technology. And industry experience with gas compression helps other operators to reduce the level of risk for their field development conceptual studies. According to Equinor, the subsea gas compression technology on the Åsgard field will increase the reservoir’s productive life by 15 years and add 282 MMboe in reservoir recovery.

Long-distance tiebacks

Pseudo dry gas systems are an emerging technology in subsea gas production boosting that is a promising, economically viable alternative to compression systems for long tiebacks of an approximate 100 km (62 mi) or greater. This innovative technology adapted from surface applications helps overcome the pressure losses due to gravitational affects in long tiebacks and deepwater depths.

This year’s Subsea Processing poster highlights a combination of technologies that in the future will enable operators to recover stranded gas fields using long-distance subsea tiebacks. The combined technologies of INTECSEA’s Pseudo Dry Gas liquids removal unit plus Fuglesangs Subsea AS’s (FSubsea’s) Omnirise miniboosting system with Voith’s integrated variable speed torque converter and magnetic coupling will enable liquids to be separated within the flowline and therefore increase gas flow. The removed liquids are then pumped through tubes in the umbilical or a small diameter liquids line to the host facility. The gas in the flowline contains less liquids after going through this separation process inline of the flowline. With dryer gas in the flowline gravitational losses decrease and the production throughput greatly improves.

Eliminating variable frequency drives

Another technology is evolving due to the collaboration agreement between FSubsea and Voith. FSubsea has integrated Voith’s torque converter in its Omnirise Subsea pump. See the green box on the poster entitled: “Subsea Boosting Technology.”

The significance of combining these two technologies is to eliminate the need for a VFD (variable frequency drive) on the topsides or on the seafloor as a separate piece of equipment. This also eliminates the need for certain topsides equipment, hydraulic fluid connection, and signaling flying leads. FSubsea anticipates that its Omnirise Boosting System (1.5 MW pump shaft power) will be TRL-4 by 1Q 2020.

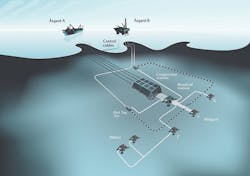

The Åsgard field contains what is believed to be world’s longest subsea gas production tieback. (Courtesy Equinor)

Subsea water injection

Another technology that is maturing through the technical readiness level process is NOV’s Seabox subsea water treatment unit and SWIT Technology. According to NOV “the water treatment is done directly at the seabed and the treated water is pumped straight into the injection well.” The SWIT Technology provides the quality of water needed for injecting water in the injection wells “where it is needed and when it is needed.”

This emerging technology will reduce space and equipment on the floating host topsides, eliminate water injection flowlines and risers, and simplify the subsea hardware for the water injection system.

ConocoPhillips is currently testing the system during the 2018/2019 winter season in the North Sea at an offshore platform. It has taken 16+ years of development funded by the Norwegian Research Council, operators, and NOV in order to develop and test the technology. It may become a 20-year effort to get the technology in the field for full time use.

Subsea tieback milestones

Graph 3 from the 2019 Subsea Processing poster illustrates (as of February 2019) how the industry has continued to increase the tieback distance for subsea boosting projects. In 2018, Murphy‘s Dalmatian field became the world’s longest subsea oil production tieback at 35 km (22 mi) using a subsea boosting system. This tieback record is 50% of the length of the longest natural flow subsea tieback distance – Shell’s Penguin A-E field tieback of 69.6 km (43.4 mi). In the next five to 10 years, it is anticipated that a combination of technologies applied to the right project will enable boosting tieback distances to exceed natural flow tieback records. Operators and contractors are working together to close this gap. Note that Åsgard is the longest subsea gas production tieback.

Graph 7 illustrates (as of February 2019) the continued advancement of subsea boosting projects for the past 24 years starting with Eni’s Prezioso field in 1994 at 50 m (164 ft) to Shell’s Stones field in 2018 at 2,927 m (9,600 ft).

The graph shows how operators slowly gained experience and confidence in subsea boosting from 1994 to 2006. During this time an average of one subsea processing project per year was installed. Starting in 2007 the number of these projects installed more than doubled. And in 2014 and 2015, four to five projects were installed. Increasingly, operators are technically and economically evaluating the subsea boosting or compression option as one of their field development options.

Conclusion

Evaluation and adoption of subsea processing technologies by operators is not moving as fast and wide spread as contractors had hoped, but subsea boosting and subsea compression projects are increasing in frequency. Some in industry feel that the industry downturn has slowed down the number of subsea processing projects. However, this downturn has forced contractors and operators to develop more cost-effective solutions which ultimately will help accelerate the use of subsea processing technology on projects around the world.

The emerging technology in the future will allow operators to reduce equipment on the host topsides and eliminate some equipment on the seafloor. Simplification and size reductions will make the technology less costly and ultimately help to economically justify a more widespread use of the technology.

No matter what technology is used, the ultimate goal for all subsea processing technology is to help operators improve the recovery percentage of the reserves by increasing the productive life of the field or accelerating the production during the field decline. •

Editor’s note

This issue ofOffshore contains the 2019 Worldwide Survey of Subsea Processing Technology poster, the twelfth installment of this industry resource. The primary aims of this poster are to chronicle the development and developers of these systems and to document the continued commitment of oil companies to the application of these technologies. For online access to view and download all posters, please visit http://www.offshore-mag.com/maps-posters.html.