Assessing floating platform concepts for deepwater production

Jinzhu Xia

Richard D'Souza

Granherne, a KBR Co.

Producing hydrocarbons, particularly gas, in deepwater offshore North West Australia usually requires a wet or dry tree floating host platform. Whereas semisubmersible, TLP, and spar designs all have the attributes to be a production host facility, only oil FPSOs have been installed in this region to date. FPSOs are used because of the remoteness and the lack of pipeline and process infrastructure. Storing oil on the facility for offloading and shipping is an obvious solution. Semisubmersible, TLP, or spar platforms show little advantage in these circumstances.

Deepwater gas has to be processed, compressed, and piped to shore for liquefaction or domestic use. As host processing facilities, semisubmersibles, TLPs, and spars have advantages over FPSOs because of their superior motion performance in the harsh Australian metocean environment. There are other benefits such as facilitating drilling, dry tree completion, and well services. FPSOs or FSOs may be applied for storage of associated oil and condensates. As an innovative concept for marginal and remote gas field developments, an LNG FPSO (FLNG) may be an attractive option since it eliminates long pipelines and land-based liquefaction plants.

Platform applicability should be accessed in the context of field development planning and concept selection for any specific offshore project. The process of field development planning involves a complex iterative interaction of its key elements (subsurface, drilling and completions, surface facilities) subject to regional and site constraints. The objective is to select a development plan that satisfies an operator's commercial, risk and strategic requirements. Uncertainty adds considerable risk to the selection of a commercially viable field development plan. The high cost of drilling and completing wells and the capital costs of the surface facilities and export pipelines exacerbate commercial risk. One of the greatest challenges is to select a development plan that manages downside reservoir risk (considering the very large capital expense involved) while having the flexibility to capture its upside potential.

Accessing the applicability of different floating platform designs for a deepwater development is important in field development planning.

Floating platform designs applicable to NWA

Four main categories of floating platform concepts are in the selection toolkit for NWA: shipshape, semisubmersible, TLP, and spar. Shipshape platforms have been extensively used offshore NWA, while the semisubmersible concept is scheduled to debut in 2016.

NWA region design drivers

Water depth has a major impact on drilling cost, design, and installation of moorings, pipelines, and risers. Currently, the maximum water depth for production off NWA is about 1,000 m (3,280 ft). Development planning, concept select and front-end engineering and design (FEED) studies are being conducted for gas fields in 1,000 m to 2,000 m (6,560 ft) water depths. In ultra-deepwater, the large hydrostatic head could impact applicability of the flexible riser technologies commonly used in this region. Low seabed temperatures impact flow assurance strategies and may add to overall development cost.

Extreme and operational wind, wave, and current conditions impact the design and cost of floating platform hull, moorings, and risers. Characterized by frequent tropical cyclones and persistent swells, the harsh metocean environment offshore NWA provides unique challenges for floating system design and selection. Swells impact installation windows (schedule) and operations (resupply, offloading, etc.). They also induce fatigue in the platform structure, riser, and mooring systems.

On average five tropical cyclones occur during each season over the warm ocean waters off the Australian northwest coast between 105°E and 125°E latitudes. The cyclone season officially runs from November to April. At the start of cyclone season, the most likely area to be affected is off the Kimberley and Pilbara coastline. Later in the season, the area threatened extends further south to include the western coast. The chance of experiencing a Category 4 or 5 cyclone is highest in March and April.

The swell conditions result predominantly from storms in the Southern Ocean or southern portion of the Indian Ocean. It is a perennial feature of exposed North West Shelf waters. Typically, the swell arrives at the outer edge of the continental shelf from the south and southwest, before refracting during propagation across the shelf, to become more westerly and even north-westerly near-shore. Swell peak periods are typically of the order of 12 to 18 seconds, although swells of 23 seconds period have been measured.

The calcareous sediments that form the seabed off Australia's coast are rarely found in other regions of offshore oil and gas development. Calcareous sediments have uniquely challenging engineering properties - such as extremely low shaft friction for driven piles and a tendency to weaken and liquefy when disturbed or under cyclic loading. This prevents many conventional foundation and pipeline engineering design practices from directly being applied offshore Australia. The calcareous sediments surrounding Australia's northwest coastline also exhibit extreme variability over short distances, ranging from soup-like muds to rock outcrops. This impacts field layout and architecture such as well placement, flowline routing, and host platform location.

Anchoring and foundation design for this region generally applies, the following observations:

- Suction caissons are widely used in deepwater as is the case for a variety of floating facilities all over the world

- Drilled and grouted piles generally are the preferred solution over driven piles in cemented sediments

- Large, self-installable skirted gravity foundations are considered for both shallow and deepwater applications.

The NWA offshore sites are usually remote from shore and/or existing pipeline infrastructure. This drives selection of certain elements of a field development plan. An example is LNG production using gas supplied from a remote offshore field where an economic trade-off between land-based liquefaction process and a FLNG will influence the choice of floating host platform. The remoteness and cost and risk of offshore installation and commissioning favor field development choices and platform designs that minimize offshore marine operations. For example, a topsides integration method that does not involve long-distance mobilization of heavy-lift vessels typically will be favored.

Remoteness also drives field development decisions toward having multiple reservoirs serviced by a single hub platform and common export system. It requires high reliability and availability in order to maintain gas supply to the liquefaction plant. Storm damages to the structures or facilities usually take a substantial amount of time to repair due to remoteness. It also puts a premium on rigorous integrity management programs. The requirement of high reliability, combined with the risks of evacuating personnel from remote fields, tend to drive the platform design to survive 10,000-year return cyclonic storms. This is a significant difference from Gulf of Mexico practice and has implications on platform selection. Platform fabrication is generally carried out overseas, in Korea for example. Therefore, long-distance transportation usually is involved.

Investment strategies

It is important to differentiate a gas development from an oil development. Gas is low priced and less fungible, requiring large capital investments and long-term sales contracts. As a consequence, the reservoir development plan (how to access the reserves and manage plateau production) is different from oil production with early peak rates.

If an operator is constrained by cash flow for a field development (which is often the case with small independents) that may drive a leased production facility or subsea tieback to an existing host. It also could drive a phased or staged development with smaller initial outlay to generate positive cash flow and have a flexible field architecture that could be progressively expanded to provide gas supply for LNG production. The phased investment strategy may be referred to as "Capex Deferral."

Functional requirements

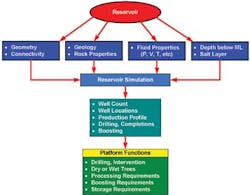

Major functional requirement categories for the platform are processing, export, well access, drilling, and enhanced recovery. The reservoir characteristics (geometry, connectivity, size, rock and fluid properties) and complexity determine well count and placement, drilling and completions, flow rates, production profiles, and ultimate recovery. These reservoir depletion drivers have the greatest impact on field development planning and surface facility applicability.

The ultimate objective of the subsurface development plan is the highest recovery rate with the fewest wells while factoring in the cost and complexity of well construction and completion. The number and seabed locations of the wells are the most significant drivers of floating platform functionality (dry or wet trees, drilling or no drilling). Successful development planning requires a high degree of interaction between the subsurface, drilling and completion, and surface facility teams.

Higher rock permeability and porosity yield better well performance, and fewer development wells. Gas fields generally have greater recovery factors than oil fields. NWA gas fields are generally much larger than the hydrocarbon fields in other offshore provinces such as the GoM and North Sea.

GoM experience shows that drilling and completing deep wells in deepwater can consume over 50% of a development budget. Well performance is strongly linked to type and effectiveness of the completions, which in some instances could equal or exceed the costs of drilling the well.

Future interventions to stimulate well flow can be a significant portion of opex, and intervention frequency could drive the need for direct vertical well access. The decision on whether to provide a drilling, workover, or production only capability on the platform impacts platform selection and is driven principally by the size, geometry, and complexity of the reservoir(s).

An early decision has to be made on inclusion or exclusion of drilling and well access functions as these have major impact on platform applicability and development economics and risk. When reservoir depletion requires a large number of wells accessible from a single drill center, the provision of a drill rig on the platform that permits direct access to the wells for drilling and intervention could substantially reduce drilling, completion, and intervention costs compared to a MODU.

Conversely, incorporating a drilling rig substantially increases facility cost, schedule and execution complexity, and limits flexibility for well placement. A decision subset is the choice of drilling with a surface or subsea BOP. The surface BOP and high-pressure drilling riser have substantially smaller topsides weight and footprint and quicker wellhead access, but is limited to low heave platforms (spar, TLP).

Another important early decision is choosing between dry tree/wet tree development. Dry tree developments enables direct vertical access through the wellbore to the sand face for light or heavy intervention (running and retrieval of downhole equipment, reservoir surveillance, recompletions) by bringing trees to the surface. Attendant benefits are greater recovery and lower opex compared to remote subsea wells that require mobilizing a MODU to execute these functions. Larger compact or stacked reservoirs with high well counts that can be efficiently depleted from a single drill center favor a dry tree platform.

Wet tree developments provide greater flexibility for well placement and field architecture, and are better suited for developments where reservoir uncertainty is high. Reservoirs distributed extensively in a large area, as is normally the case for NWA gas permits, require multiple, dispersed drill centers for optimum depletion and are more suitable for a wet tree development. A wet tree development results when multiple sub-economic reservoirs must be combined to ensure a commercial development. Wet tree developments also can be considered for small, marginal fields with low well counts. A compromise can be achieved by using subsea completions with direct vertical access from the production platform.

TLP and spar platforms enable dry trees and direct vertical access to the wells; semisubs and shipshape platforms normally do not. While the wet tree semisub platform has become an operator favorite, its dry tree counterpart has also received significant research and development in recent years.

Drilling and completing wells from a production platform costs significantly less than a platform with workover capabilities only, where the wells have to be predrilled and completed by a MODU. However, a drilling rig adds significant capital cost as well as execution and operational complexity. The decision on whether to have a full drilling or a workover rig is determined by the size of reserves and well count. Almost all dry tree platforms in the GoM with full drilling have reserves greater than 150 MMboe and production well counts greater than 12. All other dry tree platforms have workover capability only.

Tender-assisted drilling may reduce platform capex but complicates actual operations. It has been successfully implemented on TLPs and a spar in moderate metocean conditions.

Process requirements

Reservoir fluid properties determine how wells flow and help define measures required to assure flow (chemicals, boosting, insulation, etc.). These have a major impact on cost and complexity of subsea and platform topsides components. Flow assurance engineers use fluid property information obtained from well logs to develop transient and steady state hydraulic models to define operating conditions over the field life. This understanding is used to recommend measures to prevent hydrate formation which could constrain or shut down flow. They also determine the benefit of various forms of boosting downhole or above the mudline on well rate and recovery.

Flow assurance and boosting measures drive topsides weight, space, and hull storage requirements, whether it is the type and amount of chemical (e.g. MEG), regeneration and injection of the chemical, or equipment and power needed for boosting.

The presence of CO2 and H2S in a reservoir fluid can cause severe corrosion, especially under HP/HT conditions and will require corrosion resistant alloys in the subsea and topsides process equipment which impacts field development capex. Additionally, high concentrations of H2S are extremely hazardous and require safety measures that further add cost. In NWA, the cost of long gas export pipelines designed for life of fields where corrosive elements are present is a major capex driver which can determine the commerciality of a field development.

For land-based LNG liquefaction, offshore gas processing requirements may impact platform topsides weight which can include production cooling and separation, gas dehydration, and produced water processing. The produced water is re-injected or treated and disposed overboard, either of which has an impact on topsides equipment and payload. In case of long-distance NWA gas export to shore, compression is normally required as reservoir deliverability is not sustainable enough to free flow to shore. Additionally, large diameter gas risers are often required. The feasibility of these risers plays a key role in platform concept selection.

For an offshore LNG development, the process will further include acid gas removal and treatment, mercury removal, liquefaction, fractionation, and associated condensate stabilization, all performed on the platform. The deck space requirement may become a primary design driver for the platform.

Another requirement that drives platform applicability is the export strategy for associated hydrocarbon liquids. Where the hydrocarbon liquids are to be exported by shuttle tankers, platforms with large integrated buffer storage capabilities (FPSO) generally provide best commercial value, although an FSO can be used with a spar, semisubmersible, or TLP that has limited capacity for storing stabilized condensate.

MEG storage for large-scale gas developments has a significant impact on field development planning and platform applicability. A semisubmersible, TLP, or spar has limited capacity for storing, regenerating, and distributing MEG.

For an offshore LNG development, storage of LNG and the associated LPG and condensate products is a primary design driver for the platform.

Technical differentiators

The four categories of mature floating platforms all have track records in developing deepwater fields. They are all applicable to NWA. Each category has differing functional and technical capabilities, and flexibility for managing reservoir uncertainty as well configuration variants adapted for regional and topsides size requirements.

Each platform type has technical constraints related to its station-keeping and riser systems as a function of some combination of water depth, metocean conditions, and reservoir pressure and temperature. TLP tendons that provide station-keeping and heave restraint have a technical limit at present of about 1,500 m (4,920 ft). Above this water depth, a spar is the only proven platform that will support dry trees and surface BOP drilling. However, for large payload systems, especially those requiring large drilling payloads, the size of a spar introduces substantial challenges for construction, transportation, and installation, in addition to its requirement of offshore integration of the topsides with hull.

Top-tensioned risers for dry tree spars in ultra-deepwater (>1,500 m) and high well shut-in pressures (>10,000 psi or 68.95 MPa) push the envelope of top tension capability with either buoyancy cans or heave compensating tensioners. Semisubs in high-pressure, sour-service applications have a limited operating envelope for SCRs, and require motion optimized (deep-draft) configurations. Turret moored FPSOs are technically constrained by fluid and electric swivel pressure and power capabilities and capacity, and by the number of risers they can accommodate.

In deepwater NWA, technical feasibility of large diameter gas risers is critical. Flexible riser diameters are limited by hydrostatic pressure and hence water depth. SCRs generally are considered because of their long-term reliability and relative ease of installation versus free-standing hybrid risers. SCRs generally perform better on TLPs and spars than on semisubs and FPSOs.

Technical feasibility of foundations in the calcareous soils typically off NWA impacts concept selection. Establishing the technical feasibility of tendon foundations for TLPs to resist large static and dynamic tendon loads is a key challenge. Designing foundations for spread-moored semisubs and spars in these soils is not as onerous.

The 10,000-year return survival requirement influences the TLP design disproportionally because its lack of vertical compliance in extreme seas leads to greater air gap requirement and higher tendon loads for foundation design. It also impacts technical feasibility of SCR strength at the touchdown point in a semisub application.

Remoteness plays a big role in installing the platform, mooring, risers, pipelines, and subsea equipment kits. The requirement to mobilize a heavy-lift vessel to install topsides onto the hull of spar at the site is a disadvantage. Although a float-over deck installation may be considered instead, it involves risk associated with the persistent swell conditions. Conventional TLPs and semisubs can be mobilized to site with topsides integrated and pre-commissioned.

Some deep reservoirs have well shut-in pressures exceeding 15,000 psi (103.4 MPa). These will require technology qualification, mainly of subsea umbilical, riser, and flowline (SURF) components, to enable development. Additionally, qualification of deepwater HIPPS may be essential to ensure a commercial project.

In some instances when objective commercial and performance indications for two competing systems are indistinguishable, an operator's strategic position will break any ties. These may include:

HSE. Concepts with larger deck areas and fewer decks for the same topside equipment allow greater separation of hazardous and non-hazardous areas. High-pressure wells and simultaneous drilling and production activities expose crew to numerous hazards and should be considered during the selection process.

Flexibility. The platform with lower sensitivity over a range of payloads about the base case will be preferred as it will be more robust in adapting to variations in design production throughput (which frequently happens in design phase) or if the platform is to be used as a hub for future subsea tieback expansions. Contracting flexibility is a major consideration especially in a market constrained environment.

Mobility. FPSOs and semisubs can be decommissioned or relocated easier and at lower cost than spars or TLPs. Relocatability provides the flexibility to reuse the platform elsewhere if the reservoir underperforms.

Decommissioning. Often not addressed in concept selection because it is an end-of-life activity, is significant and must be considered in a tie-breaker.

Risked-based field development selection

Applicability of floating platform designs is systematically assessed in the context of field development planning which ultimately is concerned with comparing probabilistic, risk-based life cycle NPVs or return on investment of competing scenarios.

Depending on the size, geometry, complexity and uncertainty of reservoir and well performance, the subsurface and drilling and completion teams will generate multiple development scenarios (well count, location, production profiles). The surface facility teams will generate corresponding surface facility development scenarios including early decisions regarding wet or dry tree development, drilling or workover requirements, or the need for boosting to maintain high rate/high recovery wells, which may be essential for commercial viability. This can range from two to three scenarios for small, simple reservoirs with a high degree of reservoir certainty to dozens for large, complex reservoirs with a high degree of reservoir uncertainty. For each surface scenario the facilities team will select a field architecture and floating host platform with functionality that matches the corresponding subsurface scenario with its associated uncertainty ranges. Risked life cycle economic models are developed for each scenario. The one that provides the greatest financial value to the operator, while meeting ALARP (as low as reasonably practical) requirements, is generally selected.

Several levels of screening may be required before a final selection. The number of development scenarios narrows as more reservoir information becomes available from additional appraisal, and geological/geophysical information, and as reservoir models are updated. The granularity of the surface facilities models is refined progressively as the scenarios narrow. The greater the interaction and integration between the surface and subsurface teams, the greater the likelihood of arriving at a field development plan that minimizes the risk of an underperforming reservoir while capturing its upside.

More specifically, scenarios with the greatest median (P50) NPV and lowest spread between P10 and P90 NPV are selected. Uncertainty in major spending and revenue variables (production profile, schedule, capex, drilling expenditures, etc.) are captured by assigning probability distributions to quantify uncertainty and risk. The floating platform capex and schedule are major variables and are differentiated by execution risk, particularly in the topsides integration, installation, and commissioning. For example, the spar has greater execution risk than a semisub or TLP because it requires more offshore marine operations to install and commission. On the other hand, operators factor in platform standardization (execution familiarity) to offset execution risk.

The screening process typically requires generating capex, opex, and schedule estimates of competing field development scenarios at a -20% to +30% accuracy. Quality costing and estimating tools and databases, and experienced multi-discipline personnel are needed to do so. These estimates must be validated by rigorous benchmarking and normalization to ensure consistent and equitable differentiation among competing scenarios.

Each category of mature platform design has its own advantages and disadvantages for a specific development. To certain extent, they are not exchangeable in terms of optimum risk over the life cycle financial value of a project. In addition to mature, field proven platform designs, new platform concepts and variants are introduced constantly and have been designed and installed in progressively deeper water. Most of the new concepts are also applicable to the northwestern Australian deepwater fields. Assessing the applicability of a floating platform concept for a specific field development requires thorough understanding and effective management of the following critical elements:

- Operator's business and strategic drivers

- Regional drivers and site characteristics

- Reservoir characteristics and uncertainty

- Strategies to maximize well rates and recovery

- Technical differentiators of various platform concepts

- Multiple disciplinary collaborations.

Platform applicability and compatibility constantly evolve with the development of enabling construction and transportation technologies. Much bigger platforms will be transportable by the new transport vesselVanguard which was commissioned at the end of 2012. The new lifting vessel Pieter Shelte, expected to be commissioned in 2014, will be able to perform a single lift of up to 48,000 metric tons (52,911 tons). These infrastructure capabilities will make the spar concept, for example, more attractive than before for ultra-deepwater developments.

Acknowledgements

The authors gratefully acknowledge the support and input provided by Granherne colleagues during the preparation of this publication. Based on a paper presented at the Deep Offshore Technology International Conference & Exhibition, held Nov. 27-29, 2012, in Perth, Australia.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com