Report: Capex shifting to international markets

Bruce Beaubouef * Managing Editor

A major capex shift from North America to international markets has been ongoing since early 2023, according to Evercore ISI’s latest Offshore Rig Market Snapshot. This trend has been concurrent with low natural gas prices in the US, which has prompted a number of rigs to out into international markets.

Combined with attractive offshore returns from improving economics, the long-cycle nature of offshore plays continues to drive demand for offshore E&P spending, Evercore says.

According to Rystad Energy (as cited by Evercore), offshore deepwater economics have materially improved, boasting an average breakeven brent price of $40/bbl, which is more economical than other oil plays, including offshore shelf, tight oil, oil sands, and other non-OPEC onshore plays. The average internal rate of return for offshore deepwater plays at $70/bbl is 30%-plus, the firm says.

Offshore E&P capex is expected to exceed $200 billion in 2024 and reach $234 billion by the end of 2027, says Evercore. “We believe [that] highly attractive deepwater economics will be a major catalyst for the broader group of oilfield services companies levered to offshore,” the firm wrote in the report.

According to Spears & Associates (as cited by Evercore), offshore contract drilling will increase by 14% year-over-year, while petroleum aviation, offshore construction services, and subsea equipment are anticipated to grow annually by 12%, 10%, and 9%, respectively.

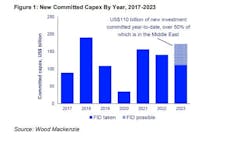

“The increasing pace of FID announcements gives us confidence in the long-duration of this upcycle,” Evercore wrote. Between January 2023 and November 2023, they noted that 14 projects with reserves greater than 50 MMboe have been announced, totaling $51 billion in capex. In that timeframe, five FIDs were announced in Africa, three FIDs in Europe, three FIDs in North America, two FIDs in Latin America, and one FID in Asia. These projects are expected to begin production between 2024 and 2028.

01.15.2024

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.