Finance options growing for Anchois gas project offshore Morocco

Offshore staff

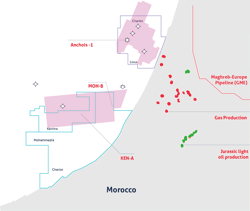

LONDON – Chariot Oil & Gas has received a non-binding expression of interest (EOI) letter concerning its proposed Anchois gas field development offshore Morocco.

The EOI from Africa Finance Corp. covers provision of development debt finance for Anchois, part of the Lixus Offshore license, and the development of future discoveries from Chariot’s wider prospect portfolio in the concession.

In addition, Chariot has received a non-binding EOI for the provision of Reserves Base Lending for the Anchois project from an unnamed multinational investment bank.

According to the company, both EOIs take into account the estimated capex of $300-500 million, while also highlighting Lixus as an important strategic asset that could help Morocco transition to a low-carbon economy.

The country expects domestic demand for energy to double over the next 20 years, Chariot added.

10/28/2020