Commercial success rates down for high-impact wells

Offshore staff

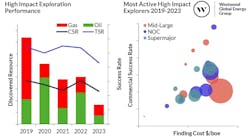

LONDON — High-impact exploration drilling globally declined by 21% last year, according to a new report from Westwood Global Energy Group.

This was due to a combination of factors including industry consolidation, higher well costs and reduced activity in former exploration hot spots.

In addition, the commercial success rate was the lowest since 2018, with the average "large" discovery yielding ~220 MMboe, the lowest since 2014.

Since 2019, Westwood added, overall drilling finding costs have increased by a factor of six to $1.2/boe.

However, the string of giant discoveries in Namibia’s offshore Orange Basin prove that there are still large volumes of hydrocarbons to be found. And the industry is bringing oil discoveries onstream faster, typically a year quicker than gas discoveries.

Graeme Bagley, Westwood’s head of global exploration and appraisal, said, "The relationship between exploration drilling and the previous year's oil price has broken. High oil prices previously led to high levels of exploration drilling.

“The appetite for exploration is still there, but energy transition strategies are having a significant impact on the way the companies choose to replenish their reserves base, with industry consolidation and new technologies also having apart to play.”

06.06.2024