Offshore platform rigs adapting to weight-space restrictions for floaters

Platform rigs have played an important role in the development of existing oil and gas fields since the 1970s. Although never held in the limelight like other offshore drilling units, such as drillships, semisubmersibles, or jackups, these workhorse machines make up 30% of the total workover and drilling business around the world's oceans.

An important distinction about these rigs is that more than half are owned by the lease operator or a country's oil and gas regulating body. Currently, there are about 300 conventional platform rigs, of which about 40% are owned and marketed by drilling and workover contractors.

The majority of the other rigs are operator or government owned, and have been installed permanently on their original platform location. These "permanently" located rigs are primarily in the North Sea, offshore Mexico, offshore Alaska, and US Pacific waters. This contractor/operator distinction is important from a commercial aspect - operator owned rigs are not in the competitive rig contracting market.

Platform rig types

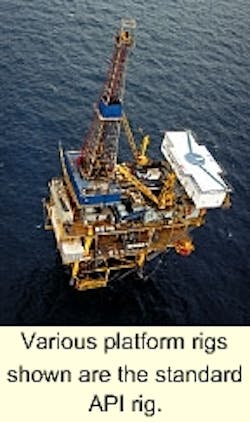

Not one definition can describe all platform workover and drilling rigs. There are basically four groups of conventional platform rigs: API, self-elevating modular rigs, and tender assisted rigs. The fourth group of platform rigs are typically specially built to target unique situations, such as hydraulic snubbing or coil tubing units.

For the purpose of this article and associated rig poster, conventional platform rigs are defined as a self-contained drilling or workover rig that rests within or on top of an existing offshore platform structure, typically confined to a limited amount of deck space where the platform bears all the loads of the rig.

- API rigs: These are platform rigs (generally over 2,000 hp) requiring crane barges to hoist the few large packages (100-1,000 ton lifts) up on the platform. The term "API" (American Petroleum Institute) comes from the API recommended practices API 2-E "Drilling Rig Packaging for Minimum Self-contained Platforms" of 1973 which recommended a uniform method for packaging of drilling rig components in logical, work-related modules. This API specification was abandoned in 1988, but the API name is still synonymous with this style rig.

- Self-elevating modular platform rigs: Roughly 75% of contractor owned platform rigs are self-elevating modular drilling or workover rigs. These units are packaged into relatively light modules that can be installed on platforms without using a crane barge. These rigs rest solely on the platform, and are self-contained and self-elevating.

- Tender assisted rigs: Instead of mounting the complete rig and all its associated components on a platform, there are situations where a barge can be placed alongside the platform and assist in supporting the rig. Once pioneered in the Gulf of Mexico, it's use is now limited to Lake Maracaibo, West Africa, and particular areas in Southeast Asia. The general mildness of the sea state allows the rig operator the luxury of using anchored barges or tenders. The hoisting components of the rig sit on the platform while the tender carries all other associated equipment such as pumps, generators, cement units, and quarters.

The offshore platform rig pull-out poster (unavailable on the internet) focuses primarily on the first two types of conventional platform rigs mentioned - API and self-elevating. The poster also focuses on contractor-owned rigs, rather than operator/government owned rigs. There are a number of operator owned platform rigs around the world, but they are not included because they seldom move off the platform and have little commercial value to other operators.

Trends, developments

Many technological developments of platform rig design have occurred since the 1980s. Some of the most important improvements include weight reduction, smaller footprints, mud system equipment, utilization of top drives, efficiency, safety of rig-up, and equipment packaging.

As oil and gas exploration moves to deeper water, operators are requiring smaller, more economical platforms. The size of the platform and rig are critical issues as to the viability of a play, particularly when marginal field development becomes more significant in the operator's portfolio.

Rig equipment is evolving toward lighter and smaller components. This is evident from a trend occurring over the past decade - the construction of a greater number of self-elevating modular platform rigs and fewer API type rigs.

- Size and weight: Early modular platform rig components were large, bulky and heavy. As the drilling contracting business strived to become more competitive, advantages have been made to reduce operator platform construction cost by reducing rig size and weight. There is a direct relationship between rig weight and platform weight required to support the rig modules. A general rule of thumb used in the industry is that for every pound of rig weight saved, there is a decrease of three to five pounds in platform weight.

- Masts: Self-elevating, telescoping masts have been greatly refined over the past decade. These developments include lighter individual mast components, quicker installation pro cesses and lower height requirements for installation. These improvements are directed at meeting existing average platform rig crane sizes and increase rig move efficiency.

- Top drives: Top drives are being installed not only in 300-ton and larger drilling rigs, but also for sidetracking in smaller 120-ton to 250-ton platform rigs. The top drive's primary functions are to increase speed of drilling, improve well control, allow for back-reaming, and improve the safety of work environment for the drillfloor workers. With the evolution of smaller and more powerful top drives, platform rigs have been able to incorporate the working efficiency of these units without major modification. In the past, the physical size required of masts to install top drives were too large to adapt to many of the slimmer, lighter masts of today.

- Cranes: Two observed trends have taken place with cranes in the offshore oil and gas industry: platform cranes tend to become smaller, and consequently rig cranes have to become larger. Operators prefer to keep the size of cranes on their platforms to a minimum to reduce costs associated with platform construction and maintenance. Contractors have adapted to smaller platform cranes by changing the design of cranes they own and use to operate the rig. Many of the new smaller capacity modular rigs do not require more than the typical 15-40 ton cranes seen on typical offshore platforms. The larger class modular platform rigs require 50-100 ton capacity cranes. These larger cranes have been designed to be erected by the smaller platform crane.

- Mud systems: Designing compact and effective mud system equipment such as mud pumps and processing tanks can be a daunting task. Design criteria for this equipment will vary depending on rig size. Pump manufacturers and fabricators are becoming more creative with the weights and sizes of their equipment to accommodate the general downsizing of rig components. It is interesting to note that over the past decade, operators are requiring more mud pumps. Whereas in the 1970s and 1980s, it was common to have two mud pumps on the larger 2,000 hp platform rigs, it is now standard that there be a minimum of three pumps. Although there seems to be requirements for more mud system equipment in general, contractors are finding ways to reduce component size and add efficiencies to the rig system such as cascading shakers and continuous well servicing mud pumps.

Rig utilization, day rates

Utilization and total fleet count of platform rigs has varied greatly in the Gulf of Mexico over the past two decades, according to statistics from Offshore Data Services. Since 1986, the total fleet of these rigs in the Gulf has dwindled by nearly half, from 159 rigs to just over 70 at present.

Many rigs have been decommissioned or sent overseas. Utilization rates bottomed in 1988, nearing 30%, and peaked above 80% during 1997 and 1998. Currently, utilization rates of platform rigs in the Gulf of Mexico is 50-60% and rising.

Average day rates for platform rigs in the Gulf have varied by nearly 30% during the past five years, according to statistical data. These average day rates are for all Gulf of Mexico platform rig sizes (see accompanying chart page ).

Getting a handle on true global platform rig utilization rates is somewhat difficult. Statistics show that the average utilization rates for all platform rigs have varied little between 75% and 85%. Again, the reason for this seemingly stable condition is that roughly 60% of worldwide offshore platform rigs are operator or government owned rigs work on the same platform and appear to work continuously.

Future challenges

As larger offshore discoveries become harder to find, more attention will be given to workovers and field development from existing platforms. Field development in the form of extended reach wells and recompletions will become vital in reserve preservation, particularly in the Gulf of Mexico. Platform rigs will play a major role is this work.

The frontier of the offshore oil and gas business is deepwater. There are many challenges for platform rigs in this new deepwater offshore expansion development. Obvious challenges will concern dynamic reactions from environmental conditions and increased loads due to the extended reach from greater water depths. Platform rigs will need to meet these new loading challenges with increased creative design engineering.

Another challenge for platform rig contractors will be to reduce further rig component weight. This is especially important to the economic viability of marginal plays off floating platforms such as SPARs and tension leg platforms. Top deck loads and vertical center of gravity reactions play a large part in the construction cost of these floating platforms. Platform rig work on these deepwater projects will depend on whether or not the wells are subsea or dry (surface) completions.

Some operators are finding that as a general rule, subsea completion work with a floater is economical in deepwater with less than three to four planned wells. Depending on the size of the reserves found, it may be more cost effective to use platform rigs for deepwater platforms completion work with more than two to three wells. In any case, workover and recompletion work by platform rigs on these deepwater projects is immanent.

An interesting trend is developing in offshore Gulf of Mexico project studies. According to data published by Offshore Data Services in February, 2000 (Gulf of Mexico Field Development Report), nearly 80% of all offshore Gulf of Mexico projects under study by operators pertain to projects in water depths over 1,200 ft. This significant movement seems to indicate that a considerable amount of work for platform rigs will be in the deeper waters over the next decade. What these workhorse rigs lack in glamour, they make up for in future significance for continued offshore oil and gas extraction.;

Author

Greg Carter is an Engineering Manager at Nabors Offshore Corporation. He is involved with engineering and operations of platform rigs. He holds a BS in Engineering from Texas A&M and an MBA from Houston Baptist University. He is a registered professional engineer and has been involved in the offshore oil and gas industry for 20 years.

Author's Note: Offshore Data Services provided the data for construction of the graphics material accompanying this article.