Impetus continues for high-impact, frontier offshore drilling

Offshore staff

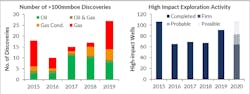

LONDON – Ninety-one high-impact wells were drilled globally last year, 36% up on the total for 2018, according to Westwood Energy.

The total discovered commercial volumes were the highest since 2015 at around 13 Bboe from the 27 high-impact discoveries announced so far, and the commercial success rate was at a 10-year high of 32%.

Westwood expects this level of activity to be sustained through 2020.

At the same time the associated drilling expenditure in 2019 was little changed year-on-year at $3.5 billion, with average well costs falling.

Gas accounted for 77% of total discovered volumes, with seven of the top 10 finds being in Russia (2), Iran, Mauritania, Senegal, Indonesia, and Cyprus.

Both the largest oil discoveries were in the ExxonMobil-operated Stabroek license off Guyana, currently though to hold 6 Bbbl.

According to the consultant, Northwest Europe led the way in terms of high-impact well numbers (27), but only two led to discoveries: CNOOC’s Glengorm in the UK central North Sea and Aker BP’s Liatårnet in the Norwegian North Sea, a success rate of just 7%.

Two of last year’s wells are still drilling and could yet deliver discoveries, but Westwood expects the high-impact well count in this region to fall in 2020.

The continued successes in Stabroek and the Tullow Oil-led partners’ heavy/sour oil finds in the Orinduik license, and what is already planned for development, may be far more than Guyana’s economy can handle, Westwood warned, and the pace may have to slow this year if the country is to cope.

But the industry will nevertheless likely continue to push the boundaries of the play into both shallower and deeper Guyanese waters, with Apache/Total’s recent Maka Central off neighboring Suriname shaping up as the first commercial find outside of Stabroek.

Offshore Mexico, the five high-impact exploration wells completed by IOCs in 2019 failed to deliver a commercial discovery (with one still drilling), the consultant claimed.

This year at least 10 wells are planned, operated by seven different IOCs and testing more than 2.5 Bbbl of prospective volumes in frontier and emerging plays. But the geology is complex so mixed results are likely.

Off Brazil one high-impact well is currently drilling and seven wells are planned for 2020 in newly awarded licences targeting 6 Bbbl in the presalt Santos and Campos basins, and the Ceara basin.

ExxonMobil will operate two of the wells and Premier its first well, in the Ceara basin. In the Santos basin several of the wells will be drilled outside the proven presalt play.

In Africa, the 14 high-impact wells drilled delivered more than 3 Bboe of which ~80% was gas.

Total’s Brulpadda off South Africa opened a frontier gas condensate play and there were high-impact discoveries elsewhere in Senegal, Mauritania, Nigeria, Angola and Ghana.

This year Westwood foresees a similar number of high-impact wells across 10 countries with six potential frontier play tests in Guinea Bissau, Kenya, Namibia, and Gabon.

Among these, Total will test a new play concept at a well in block 48 in the Congo basin off Angola, in a record water depth of more than 3,600 m (11,811 ft).

In the Eastern Mediterranean, the six wells drilled brought two commercial discoveries delivering 5 tcf of gas. Three were drilled by Turkish state oil company TPAO, two in the Cyprus area.

Five wells should be drilled in the region this year targeting a total of 16 tcf including Total’s Byblos-1 well off Lebanon.

Drilling should pick up offshore Australasia this year, with wells planned in Australia, New Zealand, PNG and Timor Leste testing over 10 tcf of gas, mostly in frontier plays.

The four most active companies globally in 2020 look set to be Equinor, Eni, Shell and Total, each participating in 14 or more high-impact wells.

01/10/2020