Higher floater dayrates hinge on new round of discoveries

Gavin Strachan

Bassoe Offshore Consultants

The floater drilling market in 2002 has some areas of strength and notable areas of weakness. Utilization of deepwater rigs in 2002 is continuing to be affected by the number of sublets available from those operators with rigs contracted on a long-term basis. Fuller utilization and higher dayrates for deepwater rigs will not come about until a further round of discoveries has been made, increasing the amount of development work.

According to a Lehman Brothers survey of oil company expenditure for 2002, however, a significant majority of companies view the economics of drilling for reserves superior to purchasing them. This is especially true outside the US, and longer term, the outlook for floating drilling rigs is bright.

Energy policy

Economic recession in the US, Japan, and Europe has precluded any substantial growth in oil demand. But of greater potential significance are the Sept. 11 attacks, which are likely to result in significant changes within the oil industry as the US restructures its energy policy. Although worldwide oil demand is currently reduced, it is likely to increase by 1% year on year going forward.

Although only a small proportion of America's oil supply comes from the Middle East, western countries rely on oil from the region. While the immediate need for the western world after the Sept. 11 attacks is to maintain the flow of oil from the Middle East, longer-term exploration nearer the US will take place. Reducing demand for Middle Eastern oil will mean that increased drilling will take place in areas such as West Africa, the Gulf of Mexico, and South America.

Deepwater

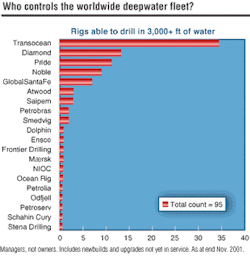

There are 92 rigs capable of drilling in over 3,000-ft water depth, and a further three under construction. All but one have contracts. The rig without is the dynamically positioned drillship Peregrine III, recently involved in a rig swap with Petrobras. The Peregrine II, which is to become the Frontier Deepwater, is also idle, but it is not currently capable of 3,000 ft. It is due for upgrade. Excluding newbuilds, deepwater rig utilization currently stands at 99%.

The likelihood of an order for a newbuild rig in 2002 is small. Most of the newbuilding in the last five years was for the deepwater market. The existing supply of units is sufficient for this year's needs, but not in the future. It takes just a few wells to discover and appraise a field, but many to develop it. The rate of orders for newbuildings slowed in 2001. Oil companies are unlikely to underwrite the building of a new rig at the moment, so it will probably not be until 2003 that the next order for a floater takes place.

Seven rigs that are currently idle and convertible could bring the supply of deepwater floaters to 102. These are two bare-deck hulls owned by Ocean Rig and three Noble rigs, one of which is a submersible-to-semi conversion. None is likely to become a deepwater rig without a firm contract, and the rigs would take around two years apiece to be readied for work. Amethyst Financial has two unfinished units in the GoM originally intended for Petrobras.

Dual drilling

Rigs equipped with dual drilling capability are likely to obtain higher dayrates. Dual derrick systems (not dual handling, which uses a single derrick) and two moonpools allow operators to make considerable time savings. One such rig is Smedvig's West Navion. Fixtures of the West Navion have set the upper benchmark for deepwater rates for 2002. Amerada Hess has taken the drillship for two wells at a rate of about $220,000, and Esso Norge is paying $210,000 for a well in 4,430-ft water depth in the Norwegian Sea.

Two different operations can be carried out simultaneously with dual drilling, reducing the idle time encountered with a single derrick. Any increase in deepwater rig efficiency is a plus, as the dayrates are high and supporting the floaters is costly because they drill far from land. Dual drilling particularly comes into its own when the rig is handling subsea production equipment. However, dual drilling is not being used as it could be.

Operating two BOPs on two wells at the same time is theoretically possible, but authorities perceive there is a safety problem if the rig hits difficulties in one well while at a crucial stage in the other. This will limit dual drilling activity to one BOP-controlled well while drilling just the top hole of the second.

Africa

Longer term, work offshore Africa should rise. Licensing rounds, mostly deepwater, are due this year from Ghana, Guinea, Guinea Bissau, Liberia, Nigeria, São Tomé, the São Tomé/Nigerian joint development zone, Sierra Leone, and on the east coast, Tanzania. Current concessions could lead to further deepwater activity over the next few years, subject to drilling success, especially in deepwater Angola, Cameroon, Congo (Brazzaville), Equatorial Guinea, Gabon, and Nigeria. The national oil company of Angola, Sonangol, plans to drill its first deepwater well in 2002 on block 34.

North Sea

Northwest European rig activity is on course to remain flat in 2002. Semi demand could fall to less than 39 rig years, well below 3Q 2001 and 4Q 2001, when 44 to 46 semis were active. The medium term future of the high-cost UK oil and gas industry is more dependent on the price of oil than other areas. UK oil production has not yet fully recovered from the oil price collapse of 1998/99, but is expected to do so as the application of new technology increases recovery rates and brings onstream previously non-viable reserves.

Although the Norwegian Sea, Barents Sea, and Atlantic Margin are likely to offer potential for majors, the core North Sea area is generally of declining interest to them. The process of independents taking over the North Sea will continue as the majors leave the area in pursuit of big fields elsewhere. Since 1999, global E&P spending by majors has risen by 15%, but declined in the UK by 25%.

This change from majors to independents will take time. BP is the largest player in the UK, and the country accounts for 25% of its global production. Between 2001 and 2004, BP Amoco will spend about 25% of its $4 billion planned budget for the North Sea on exploration and appraisal, 5% on new fields, 15% on satellites and tiebacks, and 55% on enhancing its existing production. It is possible that activity on the small discoveries and 200 vacant blocks will arrest the decline in UK drilling activity provided that the oil price remains at a reasonably high level. Of the 300 undeveloped finds in the UK sector, BP Amoco had 85, averaging 25 MMboe in early 2001. It has since sold or relinquished 27, and a further 10 are under review.

The UK government is now pushing to make operators relinquish unused acreage. There is scope for independents to produce such fields using the latest techniques. Technological advances in drilling and the use of floating production are allowing the two-year-old independent Tuscan Energy to reactivate the Argyll, Duncan, and Innes fields, abandoned 10 years ago, for a planned additional four years. The North Sea used to be characterized by long-term drilling contracts, but the rise in the number of independents operating there has converted into a spot market, as happened in the shallow and intermediate markets of the GoM.

The third well drilled offshore the Faeroes by Amerada Hess using the Sovereign Explorer was the first discovery for the archipelago. It could lead to debate on the hydrocarbon prospectivity for the Foinaven and Schiehallion areas as the well was drilled into lower Palaeocene sands, deeper than originally intended. The find, a significant one, according to the Faeroese government, was in 3,100 ft water depth very close to the UK median line. But its commerciality is still not clear.

Author

Gavin Strachan is director of Bassoe Offshore Consultants, providers of market intelligence on the worldwide offshore drilling industry. The company has offices in Houston, Scotland, and Oslo. Initially with UK-based drilling contractor Atlantic Drilling, Strachan became founding editor of The Financial Times World Rig Forecast in 1993 before joining Bassoe in 1996. He has an MA (Hons) from Cambridge University.

null