ULTRA-DEEP ENGINEERING: Need step changes in ultra-deepwater development, similar to seismic and drilling

Jackie LaFontaine

HES Deepwater

Mark McCurley

Halliburton Deepwater

Richard D'Souza

KBR Deepwater

The Gulf of Mexico deepwater and ultra-deepwater areas may hold the potential for meeting the US economy's growing energy demand, and reduce reliance on imported hydrocarbons. The US Mineral Management Service (MMS) classifies water depths greater than 1,300 ft as deepwater, and greater than 5,000 ft as ultra-deepwater. Oper-ations in these water depths are expensive and require significant time between exploration and production.

The challenge is to reduce development and operating costs and cycle times. Ultra-deepwater will require breakthrough technologies to achieve economically sustainable production. This article examines some of the issues and challenges to increase and accelerate production from deepwater and ultra-deepwater in the Gulf of Mexico (GOM) and elsewhere.

To facilitate commercial development of hydrocarbons in deepwater, the industry must find and characterize reservoirs with greater certainty, then recover more hydrocarbons with fewer wells, while reducing development costs and cycle times.

Step changes in and integration of 3D seismic reservoir modeling with drilling and completion technologies have been the main drivers for "opening up" many deepwater prospects to commercial development. The cost in dollars and time needed to shoot and process a sq km of seismic data has fallen by about two orders of magnitude in the last 20 years.

Concurrently, the sophistication of hardware and software that processes and analyses these vast amounts of data is improving by an order of magnitude every five years. The greater clarity of viewing subsurface stratigraphy afforded by 3D seismic is being complemented by increased sophistication of geologic modeling and analogs. The upshot is a 70% reduction in finding costs and improved success rates in identifying new reservoirs. The ultimate goal is to drill no dry holes and reduce finding costs to below 50 cents per bbl oil equivalent (BOE).

Uncertainty reduction

The high cost of drilling appraisal wells and shortage of deepwater drilling rigs is challenging the industry to continually reduce uncertainties in reservoir models with fewer appraisal wells. Increasing the robustness of reservoir models enables better reservoir management and reduces uncertainty in predicting ultimate hydrocarbon recovery.

The oil and gas industry is getting better at combining geologic models, reservoir rock, and fluid property data with seismic information to create higher quality 3D, 3-phase numerical simulators.

Major advances in directional drilling and measurement and logging-while-drilling technologies have enabled drillers to reach target zones that extend up to 10 km horizontally from a drill center. These stepouts are drilled with greater speed and accuracy at progressively reduced cost. Concurrently, continuing improvements in completions technologies have significantly enhanced individual well productivity and availability.

Today, cross-functional teams of geoscientists, petroleum and drilling engineers gather in "visualization centers" where high-end computers transform terabytes of seismic information into vivid 3D images of the reservoir. These teams pool their cumulative knowledge to rapidly develop reservoir depletion plans that will deliver high rate, high ultimate recovery wells from simple or complex reservoirs, with greater certainty.

At visualization centers, oil company manager's work in collaboration with service technology experts to solve drilling and completion challenges in real time operations (RTO). By using RTO, companies involved in critical operational activities improve the application and collaboration of their collective expertise and talent. This means better decisions and thus better results.

The subsurface challenge is not just to resolve reservoir uncertainties as quickly as possible with limited information, but to apply this understanding in evaluating and planning the subsea and surface development. This is currently where the greatest disconnects occur in field development planning.

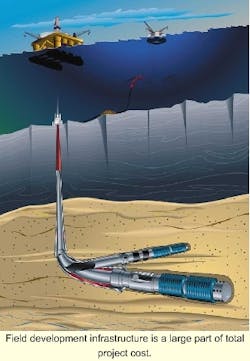

Capital cost reduction

The capital cost of field development infrastructure is a large part of the total project cost, and its sizing is usually fixed when uncertainties about reservoir performance are relatively high. This is where the best opportunities for cycle time compression and development costs reductions reside. Getting the size and design right on this infrastructure is not only a capital cost and cycle time issue, but it can negatively impact asset net present value (NPV) if it does not match the reservoir.

The solution may lie in expanding integrated, cross-functional subsurface teams to include subsea and surface facilities cross-functional teams. This must also include mechanisms to gather and disseminate learning's gained in leading areas. The true challenge lies in creating new models, where sharing and integrating knowledge is the main source of value creation.

Major operators that have embarked on this process of integrating teams across the development chain have benefited greatly and are still learning and improving.

- Shell Oil company used cross-functional integrated teams for years to develop deepwater GOM fields and has improved their processes by systematically applying lessons learned. Shell designed, built, and operated a series of five tension leg platform hubs in 3,000-4,900 ft water depths. The producer achieved reduction in cycle time and cost from project to project. This was accomplished by adopting a strategy of standardization and continuous improvement of platform technology, project execution, and effective supply chain management through strategic relationships with contractors. These relationships aligned goals and provided productive risk-reward relationships.

- ExxonMobil developed the Diana/Hoover area with a large spar hub platform in a record 4,800 ft water depth. They did this by selecting, collocating, and integrating a "best-in-class" multi-function team of subsurface, subsea, and surface personnel. Using contracting models, they were able to compress cycle time from the discovery of Hoover to first oil into 40 months, while staying within sanctioned costs.

Cycle time reduction

The following are some fundamental elements of a proposed strategy that has the potential to significantly reduce full field development cycle time for developments requiring a local host platform, while managing reservoir uncertainty. These points assume that a contracting environment will be in place that enables and encourages the sharing of information and expertise within the project team that would consist of both users and suppliers.

- The development plan should maximize use of remote wet tree tiebacks to a production hub.

- Use a production-only hub, which would be considerably less costly and complex than a conventional hub that incorporates drilling facilities.

- Pre-engineer the platform hull and engineer flexibility to adapt topsides modifications during design or construction.

- Pre-engineer facilities module packages that are easily modifiable to match reservoir requirements as well data becomes available.

- Have in place a project execution plan with suitable frame agreements with suppliers and fabricators to ensure building slots are available when needed.

Properly executed, this strategy can potentially reduce development cycle times by 25% relative to current models, while being capital expenditure (capex) neutral. Of course, this strategy must be weighed against drilling and intervention costs of remote versus local (wet or dry) wells.

An efficient way to commercialize small reserves in deepwater is to combine new subsurface and subsea technologies with existing infrastructure. Leveraging existing infrastructure is achieved in two ways. One is to use improved seismic and directional drilling technologies to recover new oil from existing fields.

Reportedly, BP was able to identify and produce six million bbl of oil from the Pompano platform by re-analyzing raw seismic data and teasing out details of previously invisible subsalt formations at a cost US$13 million, or about $2/bbl. With improving technology to extend the length of subsea tiebacks, commercial production of small isolated reservoirs can be tied to existing infrastructure. This enables recovery from sub-marginal prospects while enhancing the value of the infrastructure itself.

Ultra-deep reserves

In ultra-deepwater, technology innovations will play a significant role in keeping pace with the ever-increasing demands for reliable supplies. The need is for revolutionary, rather than evolutionary, technologies. However, operators are hesitant to be the first users of new technology.

Costs related to the design and implementation of an ultra-deepwater test program to qualify a new technology can run as high as $100 million. These large investments require new collaborative approaches that include all stakeholders. This investment must represent a sustained, long-term commitment.

An additional challenge is identifying technologies that will enabling production in ultra-deepwater and increase NPV. This requires a total-systems-engineering approach rather than focusing on discrete development components. This approach was recently used by Deepstar, a consortium of operators, service companies, and government agencies, to identify and prioritize high impact enabling and enhancing technologies for ultra-deepwater floating platforms and subsea systems.

Technologies identified include tubing risers for spars and tension leg platforms (TLP), SCRs for semisubmersibles, drilling and production semisubmersibles, carbon fiber tendons for TLPs, and subsea pig launching.

The Offshore Technology Roadmap is a recently launched initiative designed to unite all stakeholders in an effort to quantify order of magnitude funding in technologies that will accelerate ultra-deepwater energy development in the GOM. A series of workshops were held last year involving investors, producers, and environmentalist to identify significant issues and challenges.

These include high drilling costs, high well workover and intervention costs that limit recovery percentages and well availability, unconsolidated geology and associated wellbore stability, environmental impact of hydrocarbon releases from loss of well control, designing very high flow rate and ultimate recovery wells, and the operators' risk appetite and willingness to enhance change.

Over the last 20 years, information technology has been the driver for achieving remarkable productivity gains in the petroleum industry, creating a "new old economy." As software and hardware has grown in power, companies have begun learning to apply them to improve existing technologies. Each innovation has energized other innovations, none of them revolutionary, but all of them continuing in an accelerating cascade.

Knowledge, not petroleum, is becoming the critical resource in the oil business. Likewise, it is the integration of individual components of technology into a coherent and well-executed development plan that will be the key to accelerating deepwater development. Further it will require a major collaborative and sustained investment by all stakeholders in high impact enabling and enhancing technologies on multiple fronts in exploration, production, drilling, and flow assurance to unlock the vast hydrocarbon reserves in ultra-deepwater.

Authors

Jackie LaFontaine is the Division Vice President for HES Deepwater. She holds a Bachelor's degree in chemical engineering from Mississippi State University and has more than 15 years of petroleum industry experience, including five with Halliburton Energy Services. She holds two patents on development technology.

Mark McCurley is Vice President of Halliburton Deepwater. He holds a BA in Management and Marketing from Abilene Christian University. He began with Halliburton in 1978 and has split time between the US and international in managerial positions, marketing, product development, business development, and operations.

Richard D'Souza is Division Vice President of KBR Deepwater. He holds a BS in Naval Architecture from the Indian Institute of Technology; a MS in Naval Architecture from the University of Michigan, and an MS in Civil Engineering from Tulane University. He has 26 years of industry experience related to design of floating production and drilling platforms including semisubmersibles, TLPs, spars, and FPSOs.