Global offshore prospects remain strong

John Westwood, Steven Kopits - Douglas-Westwood

We have just lived through the most volatile year in the history of the oil industry, with spectacular highs and crashing lows. After such a tumultuous year, what can we expect in 2009?

In the near-term, the oil business will suffer the effects of the global recession, primarily as a result of falling demand in the US and other developed countries. How deep and how long the recession will be remains to be seen, but the high oil prices witnessed in the first half of 2008 are unlikely to recur in the coming year. Analysts differ in their views, but most of them place oil prices in the $40-$65 range for this year. Consequently, short term oil industry dynamics likely will be subdued.

At the same time, Douglas-Westwood’s longer term view of fundamentals remains essentially unchanged. The global economy will recover and China will resume its irrepressible drive towards modernization. This growth, and the growth it engenders in other developing economies, will drive energy consumption forward at a solid pace for many years to come. And the world will remain dependent on hydrocarbons well into the future. In 2007, 35% of primary energy demand came from oil—nearly 60% from hydrocarbons as a whole—and we do not see that changing materially over time.

There are alternative energy sources, of course, but all of these have their own issues. Wind is limited by its intermittency. Sometimes the wind fails to blow. For example, the extreme cold of recent weeks led to a “wind drought” lasting many days in the UK. Although wind is an important new source of power, it cannot be called upon with the flexibility or certainty of gas-fired plants, and power storage solutions will be required to see wind reach its full potential. Solar remains expensive, and is limited similarly by available sunshine. As for wave and tidal power, the technical challenges presented by the relentless pounding of the ocean continue to bedevil industry. Nuclear is likely to be a critical component of our future energy picture, but the lead times are staggering, with the lag from project concept to realization reaching up to a decade. At the same time, the incumbent US fleet of reactors will be half a century old or older by the time the next generation nuclear capacity connects to the grid. New nuclear plants may be only enough—if we are lucky—to replace the existing fleet as it retires. Consequently, there are no alternatives on the horizon today which can act as a “game changer” to displace the wide-scale use of oil. Nothing, absolutely nothing, can match oil as a low cost, energy-dense, safe, and portable fuel. Pending some unexpected technological breakthrough, oil and gas will remain center-stage for many years to come.

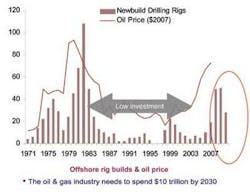

In the short term, however, global E&P spending is likely to decline. For 2009, Barclay’s Capital has forecast a 12% drop from 2008 levels. However, the 2009 forecast, at $400 billion, is not really much different from the spend in 2007. Investments remain near historically high levels because the industry has suffered from many years of low capital expenditure levels. Throughout the ’80s and ’90s, investments which are needed today were deferred. Putting additional assets into play has proven both expensive and time-consuming.

This is particularly true of offshore E&P activity. The rig market, for example, remains notably tight. With the exception of a minor easing for jackups, offshore rig utilization rates all are higher than they were a year ago when oil was over $100/barrel. Deepwater day rates also continue near all-time highs.

Of course, there have been limited cancelations of rig orders and leases, primarily due to credit limitations. We see vulnerabilities, not so much at ongoing operations in big companies, but rather at smaller E&P companies more exposed to credit markets and other types of financing. Such concerns may spread if low oil prices persist, but for now, the offshore business has held up remarkably well.

In a way, this is unsurprising. IOCs are experiencing increasing difficulty in replacing reserves. Onshore reserves in non-OPEC countries are largely carved up, and OPEC reserves are almost entirely controlled by NOCs. For the oil majors, finding the giant fields they need to make their economics work will tend to drive them offshore, and in particular into deepwater. That is where the major new discoveries are likely to be. As a case in point, ExxonMobil recently announced a potentially major subsalt find off the coast of Brazil.

Of course, offshore finds are increasingly important to NOC’s as well. Pemex, Petrobras, and CNOOC all recently announced hefty increases in their offshore budgets, despite low oil prices. They realize that a short period of high investment activity probably will not be enough to meet the world’s growing demand for energy. If we allow global decline rates at around 4%, approximately 3-4 MMb/d of oil production must be replaced every year. Incremental oil finds will be needed, even if demand stays level.

Second, comparatively low oil prices do not necessarily mean that oil industry economics have been undermined. We estimate that many operators are able to go forward with offshore projects at or near current prices. For example, Petrobras has indicated that its deepwater projects are economically feasible in the range of only $37-$42 per barrel of crude.

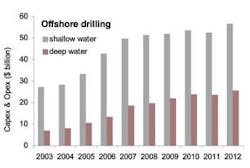

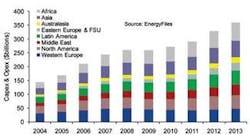

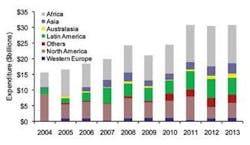

Of course, offshore activity is not immune to the recession. Overall, we expect growth to flatten before it re-accelerates around 2011. We expect capex to ease, off perhaps 3% this year. Looking ahead longer term, we anticipate growth in expenditure in most regions with specific exception of Western Europe, due to the maturity of the North Sea area. But in aggregate, deepwater drilling and deepwater gas production are projected to be vibrant industry sectors.

Another strong growth story is opex. Opex continues to ramp up, whereas capex tends to cycle. So, we find the whole operations area as an attractive business sector.

Overall in the next few years, deepwater capital expenditures should reach new heights. We see large amounts of spending, nearly $140 billion over the next five years. We note that those figures exclude the Brazilian subsalt fields, as much of Brazilian spending and development will be beyond this time frame.

Deepwater will need new equipment like FPSOs, which will continue to dominate expenditures, reaching $4 billion in 2009 and more than doubling by 2013. Subsea production will also expand. Subsea spending will more than double in the next five years compared to the previous five years. Growth is being driven by not only by the general migration to deepwater, but also by the increasing number of marginal fields and single-well tie-ins. We also see a very strong growth in ROVs, with the fleet growing from approximately 500 today to around 700 by 2020. Annual spends should exceed $400 million, and the related operations market will grow from about $1.6 billion to about $2.4 billion.

And finally, after many years, subsea processing is becoming a reality. We expect to see 186 subsea boosting applications over the next 10 years, as well as many separation systems and multi-phase meters.