Deepwater drilling analysis suggests significant increase in activity

Will Rowley

Infield Systems

The move to deeper waters has been ongoing for many years with extensive exploration activity, particularly in the "golden triangle" of Brazil, the US Gulf of Mexico, and West Africa. While there is a growing number of new deep-water areas, it is essentially this golden triangle that has been responsible for the majority of the current onstream deepwater fields.

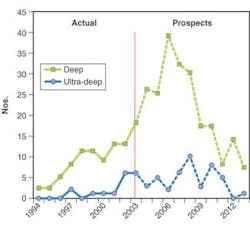

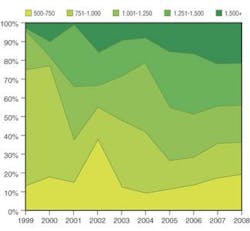

The longer-term picture of deepwater (≥500m) developments clearly shows, not only the relative youthfulness of the sector, but also the scale of the opportunity still to be realized.

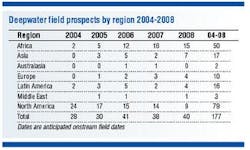

The prospects noted we evaluated are identified fields with a commercially viable development. As we move further to the future, the number of prospects drops off in what we refer to as a "data-droop." This does not indicate a lack of opportunities but simply that at this stage many of the fields that will become prospects and ultimately developments have yet to be classed as commercial and/or have not been discovered.

While the growth in deepwater is clear, the picture for ultra-deepwater (≥1500m) is less so. This is a reflection of the embryonic state of what is a technically and commercially challenging new frontier.

null

null

Over the past five years (1999-2003) the deepwater area maintained a steady growth profile and, to a degree, has been insulated from the slowdown in activity in 2000 and 2001 that followed the 1998/99 oil price falls. It is important to remember that while the number of developments over this period was small, already the industry were starting to see a greater resilience to price movements in this sector.

Of all identified deepwater prospects due onstream by 2008 in ≥500 m, only 15% are in ultra-deepwater. Looking beyond 2008, the ratio changes, with 26% of current deepwater prospects in ≥1,500 m.

The past five years have been characterized by dramatic crude oil price swings and consolidation among operators and contractors that has changed the global scene.

null

null

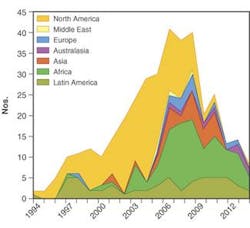

The long-term trend for deeper water developments has been evident for many years, and it is clear from the charts that until now deepwater has been associated with the US GoM, with this area alone accounting for nearly three-quarters of all deepwater fields brought onstream in the period 1999-2003.

The significance of the past five years is shown in the number of fields brought onstream, with 24 in 2003, but double that number came onstream in 1999. However, what has been clear for the past two to three years is that this situation is changing globally. The extensive exploration, engineering, and development activity undertaken through- out other deepwater regions of the world means that as we look forward, we see significant levels of increased activity.

As we have indicated earlier, deep and ultra-deepwater have both experienced substantive growth, and it is no surprise that as time has progressed, there has been a migration into deeper waters. The long-term trend shows this transition through the 500-749-m zone and the development of a large number of prospects in the 1,000-1,499-m zone.

Of the 177 fields under consideration for 2004-2008, over 90% (160 fields) involve an element of subsea (trees, manifolds, etc.) in their development plan, with the balance using dry tree solutions or extended-reach drilling.

The longer-term trend is for more deepwater developments and a continued increase in the use of subsea development solutions. The most interesting aspects of the deepwater subsea arena are not the predicted growth, but the changing nature of this important sector. This is shown in the deepwater drilling arena.

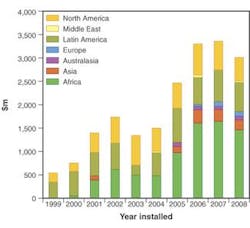

Of the $57 billion being spent over the next five years (2004-2008) to develop deepwater developments around the world, $13.7 billion will be spent on over 1,348 development wells. This is in addition to the $20.5 billion forecast to be spent on just over 750 deepwater exploration and appraisal wells.

Development wells are one of the backbones of the deepwater drilling industry. Multi-well and often multi-field contracts spread over many years help to regulate the income flow and allow for a reasonable period of constancy with utilization rates that rarely fall below 90% and often reach over 98% for suitable rigs. This high level of utilization of fifth-generation rigs and drillships also creates the stability required to commit to expensive technology that helps to push the envelope even deeper.

If we look at the geographical spread of expenditure on development wells over the next five years, we can see why Africa is so important to the drilling community. Accounting for 45% of forecast expenditure, the region is also the home of many of the world's most substantial projects, with an average of 26 wells per platform. To put this into context, the average deepwater development across the rest of the world has 17 wells. With Latin America at 23% (almost exclusively Brazil) and North America at 21% (mainly US GoM), the golden triangle accounts for almost 90% of global deepwater development drilling, with the balance split among Asia (6%), Australasia (2%), and Europe (2%).

While the overall volume and value of deepwater development wells is increasing, the nature of wells follows from the proliferation of deepwater exploration records set over the past few years with a continued move into deeper waters.

The money continues to flow into deeper waters with the ultra-deepwater drilling forecast to account for almost a quarter of all development drilling by 2008.

If we look at the deepest development completed and forecast to be completed by year, we see an almost linear progression through the 1980s, into the 1990s, and through into the current decade, with the expectation that today's record exploration wells will turn into development wells beyond the current deepest well forecast at just short of 3,000 m. The US GoM is the center of attention for ultra-deepwater activity, both for exploration and for development drilling. The next five years are forecast to see the US GoM continue with its progression toward the magical 3,000 m development.

The deepwater development drilling market is forecast to deliver the results that the drilling contractors expect, in terms of activity and revenue, over the next five years. The key question is whether the period beyond 2008 can deliver in the same way. Certainly, the continuance of water depth records is encouraging, but it also underlines the fact that the technical and commercial barriers to success are being pushed higher with average deepwater well costs increasing.

Is the industry ready yet, not just to drill exploration wells (as proven), but to produce from the frontier areas at and beyond 3,000 m? There is still much to be extracted from the "conventional" deepwater zone. With a considerable number of newbuild deepwater production vessels entering service, there will continue to be a need for additional tieback fields to maintain production levels beyond the peaks expected in 2009/10. Deepwater development wells are likely to continue to be the backbone of the drilling industry.

Author

Will Rowley, director of Analytical Services for Infield Systems, has formal training in business and law and spent many years in strategic and market analysis for the offshore industry. He is an author of global reports on key sectors of the offshore industry and has developed an array of medium and long-term market and financial models. [email protected]