Shell leading the line-up for frontier exploration in 2024

Offshore staff

OSLO, Norway — The majors’ frontier drilling plans this year could deliver play-opening deepwater discoveries, according to Rystad Energy, notably in the Atlantic Margin, Eastern Mediterranean and Asia.

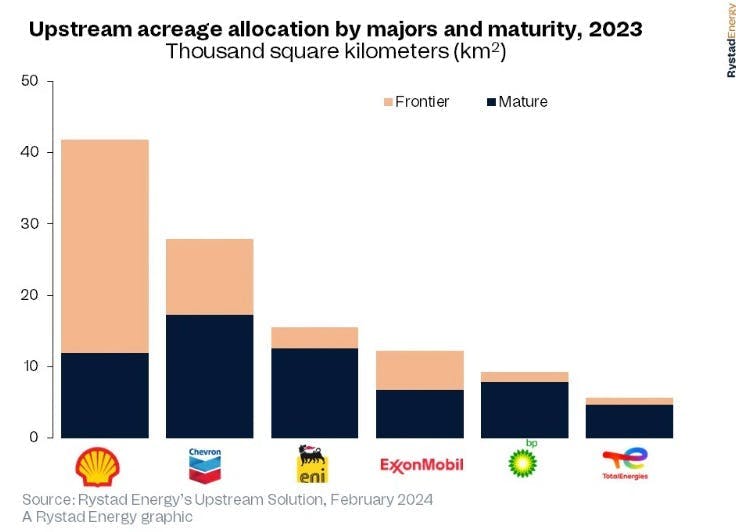

Last year the major players secured 112,000 sq km of new offshore acreage awards, 20% up on the previous year, with 39% in the shelf segment, 28% in deep water and 33% in ultradeep water.

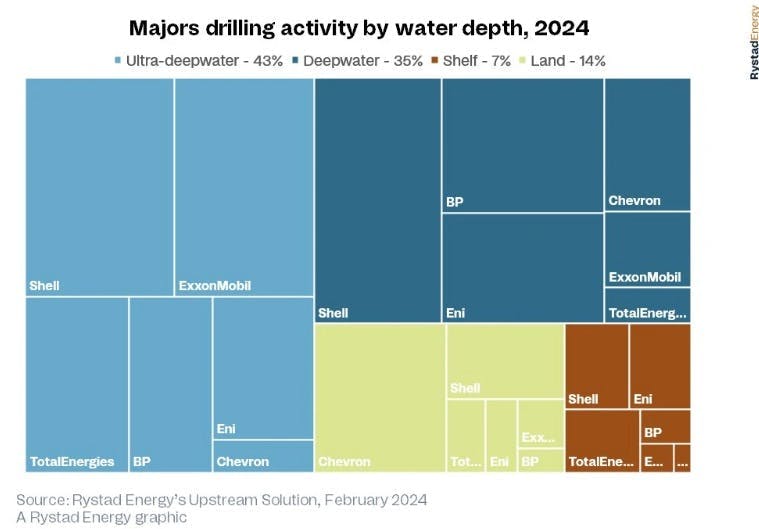

This year Rystad predicts that about 50 more deepwater and ultradeepwater exploratory wells could be drilled compared to 2023.

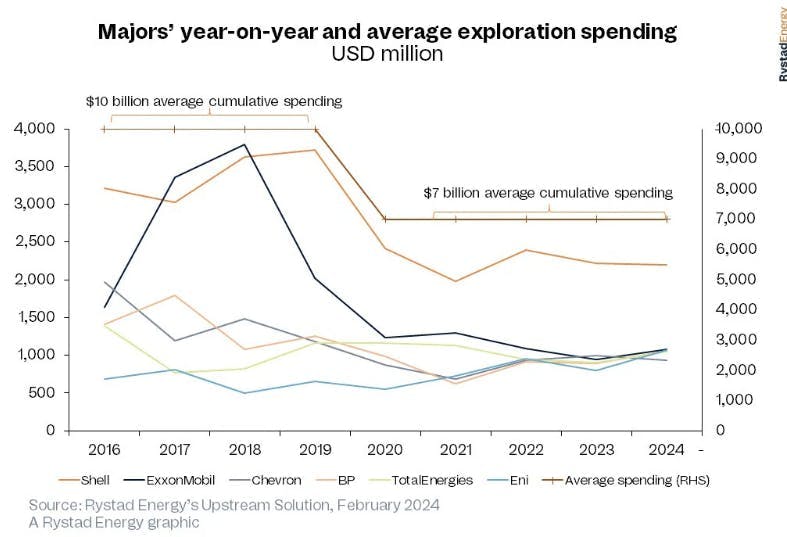

Senior analyst Santosh Kumar Budankayala said, "As majors tighten their financial belts, they're cautiously venturing into deeper waters and reevaluating their approaches for frontier exploration. While we anticipate them to appraise and mature their frontier acreages, we also expect them to continue to focus on familiar territory—regions with established expertise and existing infrastructure that offer quicker monetization with lower risks.”

Last year’s conventional discoveries delivered 1 Bboe of new resources, 68% down on the 3 Bboe achieved in 2022, with frontier basins accounting for only 20% of volumes proven.

However, frontier and underexplored basins remain attractive due to the potential for finding large, geographically concentrated prospects.

Highlights over the past five years include Turkish Petroleum’s giant Sakarya gas field discovery in the Turkish sector of the Black Sea sector, TotalEnergies’ Brulpadda and Luiperd offshore South Africa, and Venus and Graff offshore Namibia.

Much of the frontier acreage awarded last year was offshore Uruguay, where Shell led the way by securing 42,000 sq km, which also represented more than 50% of Shell's overall awarded acreage.

Currently, Shell is drilling the ultradeep gas-condensate prospect Pekaka on Block SB 2W offshore Sabah, said to be potentially analogous to the 2022 Tepat discovery in deepwater Block M.

After that, the company has more ultradeepwater exploration to come on the Bijak prospect on Block SB X (both permits were awarded under Malaysia’s 2021 bid round).

Rystad anticipates further exploration drilling in the shelf region of Sarawak. In the meantime, Shell continues appraisal activity in the Orange Basin offshore Namibian waters to further delineate the extent of its recent discoveries, including Graff.

bp is looking to drill multiple wells offshore Egypt, including appraisal of the Raven gas and condensate field and exploration drilling in the King Mariout offshore concession in the Western Mediterranean.

And Pau-Brazil will be the company’s first operated well in the Santos Basin offshore Brazil.

Chevron and Shell have plans to drill in Block 42 offshore Suriname, containing the Walker carbonate prospect.

Offshore Argentina, Argerich-1 will be the country’s first ultradeepwater well, in which Shell has a 30% non-operated interest. Success here could trigger further deepwater exploration in the region.