Analysts assess potential fallout of oil price ‘war’

Offshore staff

OSLO, Norway/LONDON – Sustained lower oil prices could force E&P companies to make heavy capex and opex reductions, according to Rystad Energy.

If the current $30/bbl environment continues, capex/opex commitments could be scaled back by $100 billion this year and by a further $150 billion in 2021, the consultant claims.

This development could force some service companies out of the market altogether, it adds.

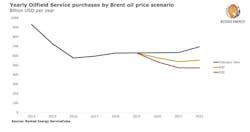

Rystad has forecasted flat oilfield service purchases this year, but now anticipates a reduction of 8% if oil averages $40/bbl, rising to 15% in a $30/bbl scenario.

And if the current dispute involving OPEC+ countries continues, with no further production cuts agreed until 2021, there could be further spending reductions next year of 7% at $40 oil and 11% at $30 oil.

However, Audun Martinsen, Rystad Energy’s head of Oilfield Service Research, predicted that service companies with low leverage and with healthy order books from past wins in 2018 and 2019 should be able to steer through the storm.

He added that a deep downturn could finally complete consolidation in the market, creating a healthier supply chain in the recovery period.

Of the $191 billion of greenfield projects expected to be sanctioned in 2020, less than $100 billion would likely go if oil prices average $40/bbl or below, Rystad concluded.

Wood Mackenzie’s senior vice president, corporate upstream, Tom Ellacott said the present macro-economic backdrop is completely uncharted waters for oil and gas companies. However, financially the industry is in much better shape due to actions taken following the previous price collapse of 2014.

“At current activity levels, we estimate that many companies need an average Brent price of $53/bbl to break even in 2020,” he said, “including dividends at expected current levels and announced buybacks.”

Fraser McKay, head of upstream analysis at Wood Mackenzie, said up to $380 billion of cash flow could be lopped off forecasts if Brent prices remain at $35/bbl for the rest of the year.

“Sustained prices below $40/bbl would trigger a new wave of brutal cost cutting, he predicted. “Discretionary spend would be slashed, including buybacks and exploration.

“But given the lack of excess in the system, the cuts to development activity will be necessarily fast and brutal.

“US tight oil development activity, though not as flexible as many believe, will react immediately. Unsanctioned conventional projects will also be delayed, and in-fill, maintenance and other spend categories scaled-back.”

Ellacott added: “There is much less obvious excess spend to cut this time around after five years of disciplined investment and austerity.

“Raising capital is also much harder now, especially for US independents, and upstream M&A market activity is at record lows. In addition, many companies have already made the most of the obvious asset sales.”

Gregory Brown of Maritime Strategies International said that oil prices remaining at current levels could impact near-term plans for offshore developments, with decisions on marginal projects likely to be deferred.

“We think that West African work, which already had questionable economics, looks particularly at risk, while investment plans in Brazil could be scaled back,” he said.

“Middle Eastern offshore activity looks to be more resilient. We’d expect Saudi Aramco to continue tendering its Zuluf Redevelopment work, while ADNOC is unlikely to stop the Hail and Ghasha projects.

“The immediate impact could be that in the absence of work elsewhere these tenders become even more competitive.”

Jack Allardyce, oil and gas research analyst at Cantor Fitzgerald Europe, said: “The ending of the uneasy, three-year OPEC+ alliance means there will be no restrictions on output from April 1, and this has revived memories of the 2014 price crash, when Saudi Arabia and Russia fought for market share with US operators which have never participated in output-limiting pacts…

“The danger now is an extended price war which would hurt all parties. While we would expect Saudi Arabia to be keen to convince Moscow to return to the table, particularly given the uncertainty around demand amidst the growing coronavirus outbreak, its actions over the weekend appear to suggest that it is prepared for a price war.

“Looking ahead, prices will eventually rebound as current levels are below the marginal cost of production for the majority of operators, including all the US shale basins. Sub-$40 isn’t sustainable for any longer than a short period, most likely just months.”

03/10/2020