Upstream spending continues steady recovery, report finds

Offshore staff

“Enough is Enough? Debunking the Myth of Upstream Investment” contradicts a widespread belief that the industry is underinvesting and that a supply crunch is inevitable, the consultants said.

“This was never Wood Mackenzie’s opinion,” said Fraser McKay, head of Upstream Analysis. “Our long-held view has been that spending and supply would rise to meet recovering demand and that the upstream industry would not and could not reprise the ignominious years of ‘peak inefficiency’ during the early 2010s.”

This year oil demand should exceed eclipse pre-pandemic highs, the consultants said. Although from 2024, oil demand growth will likely slow, peaking at 108 MMbbl/d in the early 2030s.

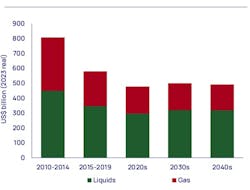

Spending levels do not need to rise significantly above current levels to achieve the supply needed to meet demand through to the peak and beyond, Wood Mackenzie added, for three main reasons: the development of giant low-cost oil resources, continued capital discipline and major improvements in investment efficiency.

The price shocks of 2015-2016 and 2020-2021 compelled the industry to become more disciplined with its capital.

“Conventional greenfield unit development costs have been slashed by 60% in 2023 terms,” McKay said. “New technology, capital efficiency and modularization have [also] been leveraged to powerful effect.”

Over the remainder of this decade, oil and gas investment will likely be directed mainly at the lowest cost, lowest emissions resources and those with the least risk. Thereafter, new supply sources will become costlier to develop.

To continue meeting demand, the industry will depend increasingly on late-life reserves growth from legacy supply sources, along with higher-cost greenfield developments and as yet undiscovered volumes, the consultants predict.

07.20.2023