Market-driven and structural levers improving economics

Sandeep Khurana, Sr. Manager•Richard D’Souza, Consultant

Granherne-a KBR company

Florian Christ, Partner•Parker Meeks, Partner•Kassia Yanosek, Associate Partner

McKinsey & Company

In the midst of the low oil-price environment that began in 2014, the role of deepwater as a significant source of future supply growth has been called into question. This has been primarily driven by factors such as shaky project economics, large upfront capital investments, long-cycle times from discovery to first oil, and uncertainty in project delivery. A 2015 McKinsey & Company analysis of global greenfield deepwater project costs showed that the majority of deepwater projects would be uneconomical or would barely breakeven in a scenario in which sub $50/bbl prices persist.

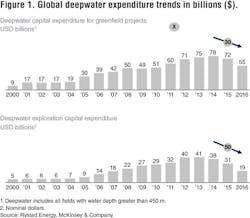

Operators, many of whom were struggling to balance cash obligations even at $70/bbl, made significant cuts in capex and reduced deepwater activity between 2014 and 2016. Deepwater project investment fell on average by 30% from 2014 to 2016 and deepwater exploration activity fell 50% per year over the same timeframe (Figure 1).

According to analyses by McKinsey Energy Insights and Rystad Energy, by early 2016 approximately 6 MMboe/d of deepwater production had been deferred compared with 2014 projections. In just a few short years, however, the tide has turned and prospects for deepwater could be looking up as companies take advantage of both market-driven and structural levers to reduce costs. McKinsey & Company projects up to 14 MMb/d of new offshore production by 2030, based on a long-term oil price of $60-65/bbl.

Deepwater breakeven costs

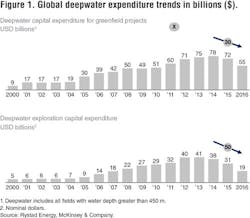

There have been 52 floating production systems (FPS) sanctioned in the Gulf of Mexico from 1993 to date, according to Granherne. These sanction activities can be broadly divided into five phases, namely: Evolution (1993-1999), Exuberance (2000-2003), Inflation (2005-2007), Hyper-Inflation (2010-2014), and Correction (2014-2016). This is based on the number of projects sanctioned and breakeven oil price analysis. During this period, the average water depth of these sanctions with an FPS increased steadily from 2,500 to 5,600 ft. Meanwhile, the industry established record maximum water depths for drilling and production while increasing project complexity. With the lessons learned and the significant two-year (2014-2016) correction in the escalating breakeven cost, the trend now bodes well for the future of deepwater (Figure 2).

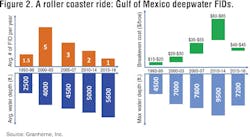

Breakeven costs have fallen by more than one-third since the oil price drop in 2014, and have the potential to drop further. Cost compression across the industry has brought average breakeven costs for projects down from $70/bbl in 2014 to approximately $40-50/bbl in 1Q 2017. This estimate is in line with projections by McKinsey & Company which was discussed during the 2016 OTC Panel, wherein breakeven analysis reflects full life-cycle economics that includes government take, development drilling, facilities, equipment, subsea, and operating expenditure with a 10% allowance for return on capital.

Breakeven cost improvements for many operators were initially driven by improved commercial rates, such as rig costs. Rig day rates had already begun to fall prior to the oil price drop due to an oversupply of deepwater rigs, and by 2016, the number of idle rigs represented 50% of the total fleet.

While commercial gains primarily drove 2015 breakeven estimates to $55/bbl, engineering re-designs and efficiency improvements are driving the additional $10-15/bbl impact on breakeven projections for 2017 estimates. Additional cost compression could also be obtained through new technology advancements, e.g., improved subsea boosting and predictive analytic tools to improve operational efficiencies). Operators are making substantial cost improvements through spec, technical re-design, demand management, and standardization levers. As a result, the industry today can realistically expect $40 to $45/bbl breakevens for many, but not all, deepwater projects (Figure 3).

In summary, up to $30/bbl - or approximately 40% - of reduction in deepwater breakeven costs from 2014 to 2017 has been driven by a combination of lower supply chain costs and cost-out designs. The challenges facing deepwater are two-fold: the extent to which producers and suppliers can structurally lower their costs even further; and the degree to which the pace of cost escalation can be successfully managed in an oil price recovery environment.

New levers improving economics

Innovations in project delivery, commercial arrangements, and financing structures are creating new levers by which operators can further alter project cost structures and upfront capital requirements. These examples range from potential benefits of supply chain consolidation, multi-operator partnerships, and third-party financing of hub and subsea infrastructure, e.g., through private equity investment. Private equity is becoming an important force in providing access to capital in the oil and gas market. In 2014 and 2015, over $100 billion in oil and gas focused private equity capital was raised.

In the coming years, private equity players could become a key source of funding for portfolio growth in the deepwater oil and gas industry.

This aside, and more importantly, there is still much curiosity on how operators can sanction projects with a $40/bbl deepwater breakeven cost. Two questions yet to be answered are whether operators can deliver projects at $40/bbl; and how much of the cost opportunity identified is structural or subject to escalation as oil prices rise.

Finally, in reality, the competitiveness of deepwater projects will be shaped not only by the efforts of operators, but also by the relative costs of other sources of supply.

Project delivery innovations

The recent waves of cost reductions and critical technological breakthroughs have enabled many companies to expand their portfolio of sanctionable deepwater developments. Cost reductions in engineering design and construction have enabled a step-change in capital outlays required for deepwater oil and gas projects. Three of the new approaches are discussed below.

Design one, build two. Repeatability of facilities can generate significant value through cost savings, limiting cost overruns, and reducing time to build. This approach allows operators to accelerate time to sanction, reduce engineering charges, expedite order placement, facilitate contracting, ensure certainty of design and scheduling, and enable the exchange of parts, personnel, and equipment.

There are a number of recent examples of operators effectively using this approach to develop large capital projects in deepwater, achieving dramatic productivity gains as a result. Anadarko Petroleum Corp. took a modularized approach at the Heidelberg field in deepwater GoM. The synergies and efficiencies created through modularization helped Anadarko produce first oil at Heidelberg - the first field development to replicate the Lucius spar design - ahead of schedule and under budget.

Anadarko applied a “design one, build two” approach at Heidelberg to leverage many of the efficiencies gained through the Lucius development. By compressing concept selection and FEED stage gate schedules, enhancing operational synergies and reducing engineering resources at each development stage, this approach shaved off more than 18 months from the typical schedule for a standalone project of Heidelberg’s scale and drove significant cost savings.

ExxonMobil adopted a similar approach for its Kizomba and Kizomba Satellites development in Angola, with a “design one, build many” philosophy for the multiple FPSO and dry-tree units which realized significant cost savings and cycle times to first oil. In addition, ExxonMobil is considering a phased approach for its recent Liza discovery development in Guyana with an FPSO, and can eventually leverage its experience depending on reservoir performance to build multiple FPSOs.

Design optimization. Shell’s deepwater Appomattox discovery was the first standalone development to receive a final investment decision in the US GoM (July 2015), since the oil price collapse nearly a year earlier. According to Shell’s September 2015 investor presentation, the total project cost for what will be Shell’s eighth and largest floating platform in the GoM was reduced by 20% during the design stage through design optimization and efficiency gains.

The bulk of that reduction stemmed from the optimized development solution based on the operator’s repeated use of a four-column hull design, most recently used on its Mars B/Olympus TLP facility. The redesign of the project included a reduced well count and a corresponding reduction in subsea kit.

Similarly, BP took a similar approach in designing the second phase of the Mad Dog field by using its past design experience with the Atlantis project. The operator worked with co-owners and contractors to simplify and standardize the platform’s design and leveraged cost reductions across the supply chain, thereby reducing the overall project cost by about 60% from the $20 billion estimated in 2012. The solution for Mad Dog Phase 2 is now a 140-Mb/d semisubmersible facility rather than the original giant production spar. BP reduced costs in part by using a new project phasing approach and a simpler, standardized design.

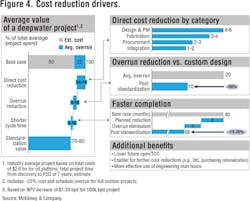

Standardization. The deepwater industry can make great strides in reducing development costs through a strategy of standardization. Standardization has been successfully demonstrated in subsea and topsides equipment, as well as full platform designs, and can be implemented more broadly across the industry. Similar techniques can be applied to many other areas of the supply chain. The vision for the industry is to standardize specifications for procurement of equipment and packages, facilitating improved standardization of major projects across the globe. Industry-wide standardization can enable faster execution, lower project costs, and increase safety by streamlining procurement. By reducing direct costs and overruns and by shortening cycle times, standardization can improve the total project value of a deepwater project by as much as 30% (Figure 4).

Industry-wide efforts are underway to standardize equipment at the industry level. The JIP33 Capital Project Complexity initiative, which begun in conjunction with industry participants and the World Economic Forum in 2015, was created to prove the concept of industry level standardization. This joint industry project, which is now hosted by the International Association of Oil & Gas Producers, seeks to drive a structural reduction in upstream project costs with a focus on industry-wide, non-competitive collaboration and standardization. Today, it hosts a consortium of international and national operators.

The first phase of JIP33 successfully proved the concept of industry collaboration by completing standardized equipment specifications for ball valves, subsea trees, LV switchgear, and piping material.

Preliminary estimates indicate improved safety, potential cost reductions of 10-20% of capex on equipment, up to 40% schedule compression for standardized asset classes, and improved equipment quality and reliability, thereby lowering lifecycle costs.

Commercial, collaborative innovations

At the field and basin levels, operators can further improve cost structures through commercial and collaborative innovations. This could take the form of expanding relationships along the supply chain, developing a multi-operator approach, and development phasing or increasing the reserve size with co-developments and partnerships.

New alliances and partnership models in the industry have the potential to improve cost savings and project performance even further, particularly through risk sharing and performance-driven commercial collaboration between suppliers and producers. Supply chain management is a continuous effort that begins during the concept selection phase. With EPC companies and equipment suppliers increasingly compelled to take on a greater share of the risks, the need to realize such savings has brought about a change in the operator-supplier relationship.

Since 2012, subsea-focused service companies formed a number of partnerships and JVs. These alliances were driven by the intense cost pressures of deepwater, with the aim of improving project economics and lowering cost structures through design simplification and standardization.

The acquisitions of Cameron by Schlumberger and FMC Technhologies by Technip and the pending merger of Baker Hughes and GE furthered this trend of consolidation that began several years earlier. However, it is too early to tell whether these deals will bring about fundamental changes in the cost structure of deepwater projects.

Innovations and deeper collaborations among operators can also significantly transform the deepwater project cost structure. One example is to build a cross-operator inventory of follow-on activities that provides opportunities for tiebacks to existing deepwater facilities. This multi-operator approach could accelerate development activities at a reduced cost, significantly improving rates of return and supporting continued investment in deepwater projects in the US GoM. An example of the multi-operator approach in the GoM is the Anadarko-operated Independence Hub, which was sanctioned in 2005. In recent months, Anadarko has further expanded the ability to tieback new discoveries to existing infrastructure with deepwater floating production facilities Lucius and Heidelberg. Lucius established infrastructure in a new area of the GoM with existing discoveries such as Anadarko’s Phobos field, as well as surrounding industry discoveries including Hadrian and Buckskin. Another recent example of the multi-operator approach is LLOG’s development of the Delta House project, which includes seven upstream asset owners who tieback to the facility.

Other opportunities for operator collaboration include sharing logistics costs, such as helicopter flights, within a basin. Collaboration initiatives are already under way in the North Sea, where offshore operators announced in 2016 that they were in talks to merge substantial parts of their operations, including procurement, logistics, and finance departments.

Reducing capital requirements

An emerging trend across deepwater operators is the use of third-party capital to reduce upfront capex requirements for development projects and in some cases, reduce overall ownership of deepwater assets.

When operating cash flows fall short in financing new developments, operators (particularly non-majors), often consider leveraging equity and debt financing. Depending on the life-cycle stage of the asset, traditional sources of external funding for development projects range from conventional bank loans to reserves-based lending and bond issuance. Increasingly, non-traditional financing sources in development projects are emerging, such as funding from private equity and infrastructure funds.

A diverse and innovative marketplace is providing options for financing specific assets such as pipelines and FPS units, exchanging equity in upstream assets for services and equipment, to deferred payments linked to first oil in exchange for services work completed.

In a cash-constrained market, third-party infrastructure investment may reduce risks associated with developing resources and free up capital. In these transactions, the infrastructure owner provides upfront capital and then collects monthly fixed fees, plus additional fees based on the volume of production processed by the infrastructure.

The structure includes repayment with front-loaded fees to recoup investment, tiered processing fees and toll fees for exporting production, and the infrastructure effectively serves as collateral. Two examples of operators using third-party investment to finance deepwater GoM infrastructure include LLOG’s Delta House project and Hess’ Tubular Bells project.

In the case of Delta House, privately held operator LLOG adopted a similar approach to finance its Delta House discovery in the deepwater GoM.

LLOG desired a source of financing for the infrastructure (FPS and export pipelines) to develop the discovery. Traditional infrastructure companies require an investment grade guaranteed stream of payments which LLOG could not provide since it is an unrated private company.

LLOG brought in private equity firm ArcLight Capital Partners to provide the capital for the infrastructure. Ultimately, ArcLight provided both equity and debt to meet the needs of the project. ArcLight agreed to provide the capital for and maintain ownership of the FPS and the oil and gas export lines. With ArcLight providing the capital for these assets, LLOG was able to focus its capital on core exploration, development, and production activities. The tiered processing fee helps assure ArcLight of a reasonable return on the low end of reserve range, and limits the exposure for producers in a high reserve range scenario.

The overall cost reported for Delta House FPS and oil and gas pipeline laterals is about $850 million.

Hess Corp. also decided to contract with a third party to build the production facilities for its Tubular Bells development, which helped accelerate the time to sanctioning of the project. Hess signed a facilities agreement with Williams Partners to construct and operate the Gulfstar One spar-based FPS and related export pipeline system.

Under the agreement, Williams Partners owns the host facility - including the topsides, hull and export lines - while Hess has exclusive-use rights to the topsides for the first five years of service.

Implications, opportunities

There are various levers to reduce cost and access external financial resources to enable projects to reach FID. Yet, several questions remain:

- Successful execution of $40/bbl or lower breakeven costs will require step changes in efficiency and performance. Are today’s cost projections driven by structural changes or will they escalate in a rising price environment? What is the guarantee that the new cost structure is sustainable and delivery and performance risk is minimized? What are the capabilities for new parties to project manage and control cost as new collaboration partners and financial sponsors take on new roles?

- Is it time to revisit the multi-operator approach, perhaps for the development of Lower Tertiary assets such as Anchor, Shenandoah, and North Platte? This approach could provide a unique opportunity of bringing equipment providers for new technology and midstream providers while working with multi-operator resources.

- Are the goals of private capital investors (e.g., quick entry and exit while generating material returns) aligned with oil market uncertainties and the long-term nature of deepwater economics? What are the potential impacts on project operations?

- Will financing structures emerge that combine exploration and drilling financing with midstream financing to entrench deeper in the value chain, thus creating more alignment between capital players and the oil industry investment cycle?

Acknowledgment

This article is based on a paper and panel discussion at the Offshore Technology Conference held on May 2, 2017. Our thanks to the panelists Sandeep Khurana, Sr. Manager, Granherne; Kassia Yanosek, Associate Partner, McKinsey & Company; Tim Duncan, CEO, Talos Energy LLC; Starlee Sykes, VP Global Projects, BP; Brian Cothran, N. America President, GE Oil & Gas; Edwin Verdonk, VP Deepwater, Shell; and Susan Cunningham, EVP (retired), Noble Energy Inc.