The global well intervention market is expected to reach $17.76 billion by 2025, according to a new report by San Francisco-based Grand View Research, Inc.

The report notes that well intervention services are increasingly in demand for various uses in drilling operations, including monitoring pressure and temperature at the reservoir; for transporting fluids and gases to and from the reservoir; stimulating the well and making it ready for production by increasing the flow of hydrocarbons; and isolating desired sections by means of annular seals.

While onshore E&P will continue to dominate spending on well intervention, it also notes that offshore is expected to be the fastest growing segment in the application category over the forecast period, with an estimated CAGR of 5.1% from 2016 to 2025.

Additional findings from the report suggest:

- The global well intervention demand was $12.45 billion in 2016 and is expected to grow at a CAGR of 4.2% from 2017 to 2025

- Logging and bottom hole survey emerged as the largest service segment in 2016 and is estimated to generate revenue more than $3.95 billion by 2025

- Stimulation is anticipated to be the fastest growing service segment over the next eight years and is estimated to grow at a CAGR of 6.1%

- The well intervention demand in onshore application was $8.15 billion in 2016 and is anticipated to witness steady growth over the next eight years

- The US offshore well intervention market applications category was worth $2.28 billion and is estimated to reach $3.5 billion by 2025

- The Middle East and Africa regions are anticipated to witness high growth at a CAGR of 5.7% by 2025. Recent developments in offshore activities such as increasing oil production in various countries including Qatar and Iran is expected to drive E&P market over the next eight years.

Frontier drilling could halt exploration decline, report claims

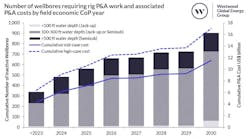

Commercial oil and gas volumes discovered globally fell to a nine-year low in 2016, according to Westwood Global Energy Group’s (WGEG) eighth annual State of Exploration Report.

This covers five years of global exploration results, the performance of 40 international E&P companies, and 991 completed conventional wildcat wells, drilled at a total cost of $43.5 billion.

WGEG attributed the dip in discoveries to the “lower for longer” oil price scenario that has led companies to keep cutting back on exploration, reducing their exposure to frontier deepwater and emerging play drilling.

However, the overall commercial success rate in 2016 was the highest in nine years at 35% of wells drilled, the report claims, 8% better than in 2015.

Average drilling finding costs increased to $2/boe in 2016 from $1.6/boe in 2015 due to the lack of large frontier and emerging play discoveries and the much smaller average discovery sizes.

Ocean BlackLion has been deployed for the project (above). (Photos courtesy Hess Corp.)">

Oil prospect finding costs averaged $3.1/bbl in 2016, down from $3.4/bbl the preceding year.

Among the report’s other conclusions are that around 88% of the 17.4 Bboe discovered by the REP40 peer group companies since the start of 2013 is still at the appraisal stage, reflecting the slowdown in progressing resources to production as a result of the oil price.

Well counts could be around 10% higher this year based on forward exploration drilling plans, although the number of wells drilled in 1Q 2017 was 35% down on corresponding period in 2016.

This year the report identifies plans for 62 high impact wells globally, targeting 19.5 Bboe of which 37% is oil. Twenty-four of the wells are on frontier plays, 11 being across the Atlantic Margin and the Norwegian Barents Sea.

Ocean BlackLion has been deployed for the project (above). (Photos courtesy Hess Corp.)">

Dr. Keith Myers, president, Westwood Research, said: “If the industry is out of the emergency room in 2017, it is not yet out of hospital. Even if oil prices recover further, explorers will need to focus on finding low cost oil and gas profitable to develop at $40/bbl or less.

Myers continued: “Companies will need to believe they have the acreage portfolio, technology, people and processes to deliver exceptional performance. This means an efficient exploration process with larger prospect portfolios and fewer, better wells targeting bigger prospects at higher commercial success rates.”

“The industry is emerging leaner and fitter from this latest downcycle, but it must be able to remain disciplined during the bull oil market to come, whenever that might be,” Myers concluded. “Decreased competition means lower access costs for exploration acreage and more opportunity to create value from exploration for the accomplished explorer.”