Rig retirements to continue in 2017

Cinnamon Odell

IHS Markit

Although Transocean remains the world’s largest offshore drilling rig contractor in terms of the number of rigs managed, the rest of the list has been shaken up a bit. Some rig companies have thinned their portfolios in light of current depressed market conditions, while others have added to their fleets (primarily through acceptance of newbuild rigs that were already in the works, as opposed to acquisitions of existing units from other owners). For 2016, the list has one new entrant - Venezuela’s state-owned oil company, Petroleos de Venezuela, more commonly known as PDVSA.

Naturally, this list entry comes at the expense of a former Top 10 company exiting the list. Hercules Offshore has already divested several of its rigs following its second bankruptcy since 2015. As part of the second bankruptcy filing, the company announced it would wind down operations, beginning with the sale of newbuild jackupHercules Highlander, now known as Maersk Highlander, to Maersk Drilling. The rig came with a five-year drilling contract with Maersk Oil for work in the North Sea.

Returning to PDVSA, its addition to the Top 10 makes it the second state-run company on the list, joining China’s COSL, which held its number four spot from last year despite its fleet being reduced by one to 46 after its lease from Sinopec Offshore Services Co. of jackupKan Tan II ended early in 2016. PDVSA manages a fleet of 29 units, the majority of which are drill barges located in Lake Maracaibo, Venezuela. None of the company’s rigs are located outside of the country.

While Seadrill’s fleet count was unchanged from 2015 at 56 units, it moved from the third spot to number two, switching places with Ensco, which downsized its fleet from 70 to 53, the vast majority of which were removed through attrition from the global fleet. UK-based Ensco elected to retire or recycle 14 units this year, which equates to nearly 33% of the 43 rigs that were removed from the worldwide fleet in 2016. Second behind Ensco in terms of retiring and recycling last year was Transocean with seven rigs, making Ensco the only contractor to remove double-digit units from the world’s rig count.

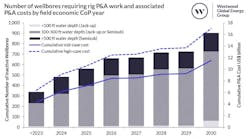

IHS Markit expects significant levels of rig retirements to continue in 2017, as the offshore fleet remains oversupplied in terms of expected demand. In light of oil’s recent seemingly sustained rise above $50/bbl for both Brent and WTI crude as of late December, there have been some signs of increased interest in offshore rig programs with 2017-2019 start dates. However, this is not enough to account for the oversupply that was already hurting the market prior to the drop in oil pricing and the subsequent decline in demand.

Hercules Highlander, re-christened the Maersk Highlander, prepares for to depart for the Maersk Oil-operated Culzean project in the UK central North Sea. (Courtesy Maersk Drilling)">

Shelf Drilling and Paragon Offshore shared the number five spot on the 2016 list. Shelf Drilling’s rig portfolio was down from 2015 by two to 37, while Paragon increased its fleet by one unit, also to 37. In the 2015 tally, Shelf was number five and Paragon was number six. US-based Paragon filed for bankruptcy protection in February 2016 and has yet to emerge from the proceedings.

Meanwhile, Rowan Companies decreased its fleet by two, but managed to gain one spot on the Top 10 list, rising to the number seven slot behind Shelf and Paragon. The jackupRowan Louisiana was sold at the end of 2015 and mobilized from the US Gulf of Mexico to India for a long-term charter. Then jackup Rowan Gorilla IIwas retired in the second half of 2016. Tied with Rowan for the number seven spot is Noble Drilling, which was also tied with Rowan on the 2015 list when the duo came in at number eight. Both contractors now have 30 units in their global portfolios. Drillship Noble Discoverer was retired at the end of 2015, and jackup Noble Charles Copelandwas sold in mid-2016 but remains in the Middle East, now going by the name Ocean Drilling 1, but it has not worked since 3Q 2015.

Finally, at the bottom of the Top 10 list is Diamond Offshore with 28 units, having decreased its fleet from 33 rigs the year before, when it finished in seventh place. Diamond made use of both rig sales and rig retirements to reduce its portfolio. At the time of writing, over 175 different managers controlled the world’s 1,075 offshore drilling rigs. Many of these are not true rig contractors in that they are financing companies or shipyards or various other ventures that do not intend to manage these rigs long term but are hoping to make a sale at some point.

Across the world, rig attrition accounted for about a 6% drop in the offshore rig supply from year-end 2015. While this was helpful in reducing the number of idle units, the much larger drop in the working count reminds us how stark the situation remains. The global supply fell by 70 units from the end of 2015 to the end of 2016, while the working count fell by 116 over the same period. It was the larger rig contractors that bore the brunt of the drop in contracting, having controlled about 45% of the working rigs at the end of 2015, versus just 41% by the end of 2016.

In terms of region, one area that used to be a major charterer of both jackups and floating rigs was the US Gulf, which has taken a big hit to both its rig supply and its working count during the current downturn. The overall supply fell by 20 units over the course of last year, and the working count dropped by 15 units from 45 in December 2015 to 30 in December 2016. Further, a total of 57 rigs are cold stacked (not marketed for work) in the region - that’s more than half the region’s total supply.

Conversely, the one region that has had an increase in supply is the Middle East, which grew from 171 units to 176. However, in line with most of the world (albeit at a smaller percentage decrease), the working count in the Middle East is lower than it was a year ago, having fallen by about 13 units. A total of eight units in the region are currently considered cold stacked.

One region that did not experience either a retraction or expansion in the year-end supply is northwest Europe. Despite the market conditions of the past year, the net supply count was unchanged from a year ago at 107 units. But the region did experience a decline in its working count, falling by roughly 20 rigs over the course of the year. Part of the reason for the static supply number is that many rigs working in the North Sea are adapted or specially built for the harsh environment and are unlikely to work in many other places. So even if they run out of work, they would likely be stacked in the same area in the hopes of being well positioned for obtaining future work.

Interestingly, the Top 10 contractors as a whole lost a bit of ground in all of the regions shown in the accompanying table except for Latin America and the final category labelled ‘Rest of the World.’ In Latin America, the largest contractors now account for 35% of the region’s fleet, versus 20% the year prior. This is mostly attributable to the addition of PDVSA to the list since all of the company’s rigs are located in Latin America, while Hercules did not have a presence in Latin America in 2015. Meanwhile, the smaller regions that are grouped together only experienced a modest increase from just below to just over 15%. As oil and gas companies spread their exploration campaigns around the world in search of the next big find, more rigs owned by the larger contractors will make their way into these new areas.

As for rigs under construction, many have been placed on standby or are facing a significant slowdown in work. This is unlikely to change until the market environment improves sufficiently that their owners are able to take delivery either with a contract in hand or the belief that employment will follow shortly. At the time of writing in December, 159 units remained classed as under construction, down from 184 units one year prior. The Top 10 rig contractors account for nearly 16% of these units. It remains to be seen when delivery will take place and more interestingly, whether the company that ordered the rig will be same one that that takes delivery when things turn around.

The author

Cinnamon Odell is Senior Rig Analyst at IHS Markit.