Offshore Mexico gaining significant interest

Bruce Beaubouef

Managing Editor

Entering the new year, E&P activity in the US Gulf of Mexico is still being adversely impacted by the market downturn. Although oil prices have surpassed the $50/bbl mark, operators and development companies are still being cautious with their capex budgets. While some field development activity will take place in 2017, seismic exploration and exploratory drilling are not expected to return to pre-2014 levels anytime soon.

“The new year is not expected to bring much joy to the US Gulf of Mexico drilling rig market,” says Cinnamon Odell, rig analyst with IHS Markit Petrodata. She notes that this time last year, Hercules Offshore was still a going concern and the biggest jackup contractor in the region with 18 jackups in its fleet, of which 13 were actively marketed. “Now, the region’s remaining marketed supply from all other rig contractors combined is not even that high,” Odell points out. As of late November, only eight jackups are still being marketed for work in the US GoM.

Meanwhile, the floater market is showing that it is not immune to the effects of the downturn either. The marketed supply has not suffered as much as the jackup supply has, starting out the year at 50 units and falling to 38 by the end of November. “For next year, new work is expected to remain hard to come by, and short-term programs will be used to fill some of the gaps,” Odell says.

Drilling permits

Other metrics of drilling in the US GoM seem foreboding as well. In its December US Drilling Permit Monthly report, Evercore ISI found that Gulf of Mexico permitting took a step back after a solid string of sequential gains.

After three months of increases, new permits issued in the GoM decreased 56% over November. The November total of seven new permits fell 56% from 16 in September, and was down 67% from permitting in November 2015.

No new ultra-deepwater or deepwater permits were filed in November, while midwater permitting showed some resilience, falling just 29% month-over-month to five permits. New well permits fell from six in October to one in November, with just one midwater permit filed. Side track permits held flat at four.

The analyst firm has found shallow-water permitting to be of consistent concern, although the December report showed some growth, increasing from one permit in October to two in November. Shallow-water permits have shown the sharpest decline year-over-year, down 73% from this time last year and 88% from 2014. The analyst firm believes that offshore drilling will continue to show depressed activity as long as shallow-water permits remain at historically low levels.

Upcoming work

There are, of course, some activities planned for the new year. BHP Billiton has reported that it had the apparent winning bids on 12 blocks in the Gulf of Mexico Lease Sale 248; and the company also announced that it had signed an agreement with Statoil to acquire an interest in blocks GC 436 and GC 480 in the Gulf of Mexico. And, BHP Billiton has reportedly filed 28 well permits for midwater work in 1H 2017.

Noble Corp. recently reported that Hess has extended the contract for its semisubmersible Noble Paul Romano in the Gulf of Mexico. The estimated contract duration is mid-December 2016 to late May 2017 at a day rate of $128,500.

In December, Anadarko Petroleum Corp. provided an update on its deepwater drilling activities in the Gulf of Mexico, highlighted by successes at Warrior and Phobos, which add to its inventory of future tieback opportunities, as well as a successful development well in the Heidelberg field.

The Warrior exploration well encountered more than 210 net ft (64 m) of oil pay in multiple high-quality Miocene-aged reservoirs. The Warrior discovery is about 3 mi (just under 5 km) from the Anadarko-operated K2 field and is expected to be tied back to its Marco Polo production facility. Anadarko is the operator at Warrior with a 65% working interest. Other partners include Ecopetrol and Mitsubishi Corp. Exploration Co. Ltd.

At the Phobos appraisal well, which is located approximately 12 mi (19 km) south of the Anadarko-operated Lucius facility, Anadarko has encountered more than 90 net ft (27 m) of high-quality oil pay in a Pliocene-aged reservoir similar to the nearby Lucius field. This secondary accumulation was present in the Phobos discovery well and will be evaluated for tieback to the Lucius facility. Meanwhile, drilling is ongoing toward the primary objective in the Wilcox formation. Anadarko has a 100% working interest at Phobos.

At the Heidelberg field, the fifth production well currently being drilled has encountered the reservoir sand with more than 150 net ft (46 m) of oil pay to date. The well will be completed immediately following drilling operations and is expected to be brought on production in 1Q 2017.

Field development

The brightest piece of news for field development in the Gulf of Mexico came in early December, when BP announced that it had sanctioned the $9-billion Mad Dog Phase 2 project in the deepwater Gulf.

Mad Dog Phase 2 will include a new floating production platform with the capacity to produce up to 140,000 b/d of crude oil from up to 14 production wells. Oil production is expected to begin in late 2021.

The second Mad Dog platform will be moored about 6 mi (10 km) southwest of the existing Mad Dog platform, which is located in 4,500 ft (1,372 m) of water about 190 mi (306 km) south of New Orleans. The current platform has the capacity to produce up to 80,000 b/d of oil and 60 MMcf/d of natural gas.

In 2013, BP (operator with 60.5% working interest) and co-owners, BHP Billiton (23.9%) and Union Oil Company of California, an affiliate of Chevron U.S.A. Inc. (15.6%), decided to re-evaluate the project after an initial design proved too complex and costly.

Since then, BP has worked with co-owners and contractors to simplify and standardize the platform’s design, reducing the overall project cost by about 60%. Today, the $9-billion project, which also includes capacity for water injection, is projected to be profitable at or below current oil prices.

Bob Dudley, BP Group CEO, said: “This announcement shows that big deepwater projects can still be economic in a low price environment in the US if they are designed in a smart and cost-effective way.”

While BP has reached a final investment decision on Mad Dog Phase 2, BHP Billiton and Chevron are expected to make a final investment decision in the future.

BP discovered the Mad Dog field in 1998 and began production there with its first platform in 2005. Continued appraisal drilling in the field during 2009 and 2011 doubled the resource estimate of the field to more than 4 Bboe, spurring the need for another platform at the field.

Richard Morrison, president of BP’s Gulf of Mexico business, said: “Mad Dog Phase 2 has been one of the most anticipated projects in the US deepwater and underscores our continued commitment to the Gulf of Mexico. The project team showed tremendous discipline and arrived at a far better and more resilient concept that we expect to generate strong returns for years to come, even in a low oil price environment.”

And, other field development projects will be moving forward. Shell Offshore Inc. has awarded Jacobs Engineering Group Inc. a contract for its Vito host project in the US Gulf of Mexico. Jacobs will deliver a front-end engineering and design package and detailed engineering for the Vito host platform topsides. Vito is located in more than 4,000 ft (1,219 m) of water in Mississippi Canyon block 984. The Vito host will initially handle production from the Vito subsea field being subsequently developed, with potential for future tiebacks from other fields.

In addition, Murphy E&P has awarded Subsea Integration Alliance with a deepwater integrated subsea engineering, procurement, construction, installation, and commissioning (EPCIC) contract for the Dalmatian field.

The contract calls for the supply and installation of a subsea multi-phase boosting system that includes topsides and subsea controls, as well as a 35-km (22-mi) integrated power and control umbilical.

This is the first EPCIC project award for Subsea Integration Alliance, which was formed in July 2015 between OneSubsea and Subsea 7. The alliance enables a turnkey integrated project from design through supply, installation, and commissioning. Offshore installation activities are scheduled for 2018.

Offshore Mexico

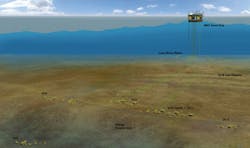

While the US GoM E&P market continues to face challenges, the prospects for development offshore Mexico continue to brighten, spurred on by its ongoing energy reforms and recent deepwater oil auction.

Mexico’s first competitive deepwater oil auction, held in early December, surpassed expectations as eight of 10 blocks were awarded to some of the world’s leading operators and international oil companies. Two of the blocks were not awarded because they received no bids.

The Mexican government has estimated that these exploratory blocks contain as much as 11 Bbbl of oil and natural gas - equivalent to estimates of oil and gas reserves in the South China Sea.

Mexico’s National Hydrocarbons Commission awarded all four blocks in the oil-rich Perdido basin, where the geology is said to mirror the US side of the Gulf of Mexico, to companies including Total SA, CNOOC Ltd., Chevron Corp., and Exxon Mobil Corp. In the Salina basin, in the south, which is less explored and therefore considered riskier, four of six blocks were awarded. Separately, BHP Billiton Ltd. won the right to develop the Trion field in the Gulf along with PEMEX.

The deepwater auction signals the beginning of a new era for Mexico, which ended state-controlled Petroleos Mexicanos’s 75-year monopoly in the energy sector in 2013 by opening the doors to foreign competitors. Mexico is counting on the influx of foreign investment to help reverse 12 years of oil production declines.

The Mexican government reportedly had modest expectations for the sale, with Energy Minister Pedro Joaquin Coldwell indicating prior to the auction that the country would be happy to sell four of the 10 blocks. The blocks in the deepwater auction are estimated to cost $4 billion each to develop, according to the Energy Ministry.

“The participation from across the globe proves [that] the world’s majors are interested in getting into Mexico,” said Jeremy Martin, energy program director of the Institute of the Americas in San Diego. “Mexico, and particularly PEMEX, has to be breathing a huge sigh of relief,” Martin was quoted to say in a Bloomberg report.

Total won three blocks in the auction, including two in the Salina basin as part of a group with Statoil and BP, as well as one in the Perdido basin with ExxonMobil. These companies, along with others that had winning bids, already have a strong presence in the Gulf of Mexico, and can therefore take advantage of existing service crews and pipelines they use in Gulf waters.

Total will operate block 2 in the Perdido basin with a 50% interest, the remainder held by ExxonMobil. The block covers an area of 2,977 sq km (1,149 sq mi) in water depths ranging from 2,300-3,600 m (7,546-11,811 ft).

In the Salina basin, Total, Statoil, and BP are equal partners (33.4%) in block 1, covering 2,381 sq km (1,093 sq mi), and block 3, covering 3,287 sq km (1,269 sq mi).

The winning bids for both blocks consisted of an additional royalty of 10% (on potential future revenues) and an additional work program equivalent to one biddable well per block. Each block also has a minimum work program as defined by the authorities, including a variety of geological activities but no required wells.

CNOOC Ltd. was awarded two blocks in the Perdido, beating out PEMEX for the first block. The Chinese national company also has a strong presence in Latin America, and could now become a big player in Mexico as well.

Chevron Corp., in a consortium with PEMEX and Japan’s INPEX Corp., also won a block in the Perdido; it can also tap its significant presence in the US Gulf for operations in the recently opened Mexican waters.

INPEX, PEMEX, and Chevron were assigned equal shares in block 3 in the Perdido Fold Belt in northern Mexican sector of Gulf of Mexico, with Chevron designated operator. Block 3 covers 1,687 sq km (651 sq mi) in water depths of 500-1,700 m (1,640-5,577 ft). The concession is in an area where new hydrocarbon discoveries are expected, close to the PEMEX-discovered Trion oil field and other producing fields on the US side.

Sierra Oil & Gas, which has backing from private equity firms Riverstone Holdings and BlackRock Inc., pledged the highest additional royalty rates in the auction as it won two blocks in bid groups that included Malaysia’s Petroliam Nasional Bhd. in both and Murphy Oil Corp. and Ophir Energy Plc in one.

BHP Billiton Ltd. reportedly beat out BP for the Trion joint venture with a cash commitment of $624 million compared with BP’s $604 million. The area, which is located just south of the maritime border with the US, is estimated to contain 485 MMboe.

BHP Billiton will serve as operator in the venture, and will provide a 60% participating interest of blocks AE-0092 and AE-0093, containing the Trion discovery in the deepwater Gulf of Mexico. PEMEX Exploration & Production Mexico will retain a 40% interest in the blocks. PEMEX’s joint venture with BHP will be the first in the Mexican company’s 78-year history.

BHP Billiton’s bid for Trion includes an upfront cash payment of $62.4 million and a commitment to a minimum work program (estimated to be up to a maximum of $320 million). Should BHP Billiton and PEMEX agree to progress the project beyond the minimum work program, BHP Billiton will be required to invest the remainder of the $570 million minimum work contribution (which includes the minimum work program spend) and a $624 million cash contribution (which comprises the upfront cash payment of $62.4 million already paid and the balance of $561.6 million as a future carry for PEMEX). The bid also includes a commitment to an additional royalty of 4%.

Subject to satisfaction of conditions (including obtaining government approvals), the relevant agreements are anticipated to be finalized and signed within 90 days.

Steve Pastor, BHP Billiton President Operations Petroleum, said: “We see attractive potential in Trion and the Perdido trend, and we are pleased to have the opportunity to further appraise and potentially develop this prospective frontier area of the deepwater Gulf of Mexico.”

In addition, Murphy Oil says that a joint venture led by its Mexican subsidiary, Murphy Sur, was the high bidder and expects to be awarded block 5 during Mexico’s fourth phase, round one deepwater auction.

Under the terms of the JV, Murphy will operate with a 30% interest in partnership with Petronas subsidiary PC Carigali Mexico Operations, Ophir Energy, and Sierra Offshore Exploration.

Block 5 is in the deepwater Salinas basin covering around 2,600 sq km (1,004 sq mi) and in water depths of 700-1,100 m (2,300-3,600 ft). The initial exploration period for the license is four years, with a work program commitment that includes one well.

The winning bidders have bet that oil and natural gas prices will eventually rebound enough to make additional exploration and drilling profitable. The sale was validation of Mexico’s decision to open its former government-monopoly energy business to foreign investment and expertise.

“This is a vote of confidence that the energy reform is moving forward and for the geological potential of the Mexican Gulf deep waters,” said Jorge R. Piñon, former president of Amoco Oil Latin America and now an analyst at the University of Texas at Austin. “Everybody paid a premium and that premium indicates the potential of the blocks,” Piñon said, as quoted in a New York Times report.

Perhaps more than anything else, the bidding shows that the industry has confidence it will emerge from the current environment of low prices and cuts in capital spending. The companies are betting that if prices recover, they can profitably produce oil from high-cost, deepwater projects. As further testing and development proceeds, the deepwater Mexican fields will probably not produce a significant amount of oil for at least a decade. But by that time, many energy analysts say oil prices might be $80/bbl or more, compared with the current price of just over $50/bbl.