Contract awards expected to increase in 2017

Christopher M. Barton

Wood Group Mustang

There has been considerable discussion over the past year about the impact of falling oil prices on oil and gas activity around the world. In 2016, global upstream capex is set to fall below $400 billion for the first time since 2009, and is projected to be down 42% from its record high in 2014. Non-sanctioned deepwater projects viable even at $75/bbl have been postponed, recycled for further cost review, or even scrapped as the price hovers in the $40-50 range.

Wood Group Mustang assistedOffshore magazine in compiling its 2016Deepwater Solutions & Records for Concept Selection poster that appeared as an insert in its May 2016 issue. This month, the company helped prepare another poster: the 2016Worldwide Survey of Floating Production, Storage and Offloading (FPSO) Units, which can be found within this issue. Both posters show differences from the 2015 database, although FPSO installations and first production changes have been much more pronounced.

The 2016Deepwater Solutions & Records poster showed very little growth in the number of FPSs reaching first production from the previous year in most categories, including TLPs, semisubmersibles and spars. While the FPSO segment has also been severely impacted, the numbers have been tempered by units previously sanctioned and well into the construction cycle.

The growth and stability of the FPSO market is more robust than other floating facilities for many reasons. They usually require less capex; can be brought on production quicker (even as a full-scale conversion), with attendant cash flow benefits; have the possibility for relocation from one comparable field to another; and can be easier to demobilize and scrap than other deepwater FPS types.

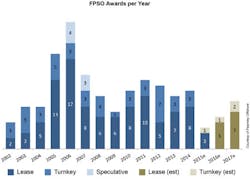

A quick review of the FPSO market indicates that only four out of a probable 15 FPSO projects were awarded in 2015, as orders dried up after 1Q 2015; while seven FPSOs were decommissioned. No more than five FPSO awards are expected in 2016.

Nevertheless, the advantages of FPSOs underscore the rationale for a continuing interest taken by contractors and producers alike.

Conversion and redeployment. Of the various FPS types, the FPSO offers the best opportunity for redeployment or conversion. Design and construction of upgraded hull and topsides facilities for vessel redeployment to a field with similar conditions can vary between seven and 12 months, depending on the extent of modifications needed for operating at its new assignment. Even a full FPSO conversion can be completed in less than 24 months, far less than a newbuild floating system of any other type.

Aging fleet disposition. As the survey indicates, more than 70% of the FPSO fleet operating worldwide today has been converted from its former life as an oil tanker or very large crude carrier. This conversion practice dates back almost 40 years and has provided vessels with extended life as both a producer and a storage vessel. There are currently FPSOs that have been in operation for more than 20 years, many of which started out in another capacity. When poor field economics, outdated vessel performance, or non-renewal of a lease contracts dictate the vessel’s removal, the FPSO can be taken from the field and decommissioned or scrapped. Currently, the database shows three vessels scrapped in 2016 and three becoming idle as contracts expired. Further units are expected to be taken from service during the 2nd half of 2016.

Standardization. Anadarko Petroleum gained considerable attention for the fasttrack engineering and construction of its Lucius and Heidelberg deepwater spar FPSs. The “two-for-one” approach allowed topsides production facilities standardization that dramatically reduced schedule cycle time from project sanction to first production. The duplicate facilities allowed lessons learned to be implemented at critical stages, saving manpower, reducing procurement lead times, lowering fabrication costs and ensuring improved safety to meet current standards. In addition, there is an increasingly complex web of relationships emerging across the supply chain to lower the cost and improve returns in offshore developments.

A similar philosophy has been part of Petrobras’ FPSO approach to producing in complex presalt field developments. UsingSBM Offshore’s G3 design, in late 2014 SBM first inaugurated the Cidade de Ilhabelain 7,000 ft water depth. Subsequently, it used the basic design to follow shortly thereafter with the Cidade de Maricato reach first production in similar water depth in February 2016. A sister vessel, Cidade de Saquarema, with identical capabilities started production in July.

Water depth flexibility. FPSO installations appear to be heading toward deeper waters, especially those destined for Petrobras’ fields offshore Brazil. In addition to the three recently installed SBM Offshore-leased vessels, MODEC’s Cidade de Itaguai andCidade de Caraguatatuba will operate in 7,350 ft and 6,900 ft, respectively.

The most anticipated fleet additions in 2016 is the SBM Offshore-designedTurritella, which will operate for Shell at about 9,500 ft. With innovative disconnect and mooring capabilities, it will be the second installed FPSO in the Gulf of Mexico and the deepest of the world’s FPS fleet. The versatility of FPSOs at much lower water depths can also be demonstrated, as with the recently installed Front Puffin, which is producing at 91 m (<300 ft) offshore Nigeria.

While thedeepwater segment of the oil and gas industry has been constrained due to lower oil prices, the FPSO market is showing some signs of resiliency. Due in part to its economic and operational advantages over other FPS types, lease contract awards are expected to increase in 2016 from the prior years and be even more robust in 2017.