Oversupply will continue to vex even if oil prices increase

Justin Smith

IHS Petrodata

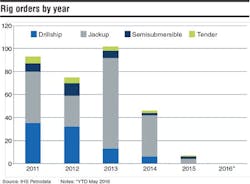

To say that offshore rig construction has entered a lull of late would be something of an understatement, as the bottom has completely fallen out of the market. Due to lower oil prices and significant oversupply ofrigs, drilling contractors have not placed any orders so far this year, and only ordered seven last year, none of which were drillships. It is not likely that many orders will be placed over the remainder of 2016.

At the moment, a total of 177 rigs are at various stages of construction. Jackups make up the vast majority of this set, with 118 units currently under construction. This is almost exactly double the combined number of drillships, semis, and tenders currently being built, of which there are 33, 18, and 8 under construction, respectively. Out of all of these rigs, only 37 were ordered with contracts in hand or by operators themselves. Of the remaining 140 speculative units, a mere four have since locked in charters.

Chinese shipyards lead the way by a significant margin, with a total of 85 rigs under construction, 69 of which are jackups. Meanwhile, 30 of the 36 units being built in Singapore right now are jackups.South Korea continues to be at the forefront of building semis and drillships, which are collectively known as floaters. At the moment, 19 floaters are under construction in the country, and of those, 15 are drillships.

Deferred delivery

Considering the current massive oversupply of rigs, coupled with lower demand the world over, many contractors are seeking to defer the delivery of their newbuild units, or attempting to cancel those construction contracts outright. Thus far, 26 rigs have had their construction ostensibly completed, but not been delivered just yet. Of those 26 units, 17 are jackups, four are drillships, three are semis, and two are tenders.

As with the overall number of rigs being built, a great many of these have been built in China, half to be specific, and are currently on standby awaiting their official delivery at a later date. For example, a CNPC subsidiary is responsible for four of these as-yet undelivered jackups. These 91-m/300-ft IC (independent leg cantilever) units are also some of the oldest rigs that have been pushed back, with three of the four originally scheduled for delivery in 2013, and the fourth in 2014. It is unclear when, or even if, these rigs will be put to use, but both yards previously said they have been nearly fully compensated for these rigs.

Those 26 rigs are only part of the story when it comes to rigs being delivered later than anticipated. While those units are essentially finished, there are many more that are still under construction or on order, but are continually having their expected delivery dates pushed back. Thus far, approximately 100 jackups, 23 drillships, and 13 semis have had their delivery dates extended by at least three months, but most are well over that, with some being pushed out several years. Transocean has delayed five high-specification jackups being built at Keppel FELS until 2020, as well as four newbuild drillships - two from Jurong Shipyard and two from Daewoo Shipbuilding & Marine Engineering (DSME). Speaking of DSME, the yard has agreed to defer the delivery of two drillships each for Atwood and Seadrill. Meanwhile, Seadrill has also delayed the delivery of eight jackups under construction at Dalian Shipbuilding Industry Co. shipyard in China.

Compounding these issues, some contractors have opted to cancel the construction contracts with shipyards that have already started working on or, in some cases, nearly finished building rigs under those contracts, primarily ultra-deepwater floaters. Last August, Vantage canceled its contract with DSME for drillshipCobalt Explorer, while Samsung Heavy Industries is going to arbitration with Pacific Drilling for the latter firm’s decision to rescind the contract on drillship Pacific Zonda. Following Dolphin Drilling’s decision to walk away from semi Bollsta Dolphin, Hyundai Heavy Industries (HHI) is wrapping up the final work on the rig in hopes of selling it. It’s worth noting that that unit actually had a five-year job lined up with Chevron in the UK when it chose to not take delivery of the rig. HHI also had Seadrill cancel its contract for the semi West Mira last year. Furthermore, North Atlantic Drilling reached an agreement with Jurong to attempt to jointly sell the semi West Rigel while still marketing the unit for work in the meantime.

Brazil update

While many of those rigs are having their deliveries pushed back, at least a number of them are likely to finish being built, particularly for the better established contractors, but the same cannot be said for all of the rigs in Sete Brasil’s fleet. In the beginning, the newly formed, presalt-focused contractor was to build 29 ultra-deepwater rigs in total, with 28 of them contracted to Petrobras for terms between 10 and 20 years, and one on spec. Since November 2014, Sete has had trouble paying the five shipyards contracted to build these rigs, and the company has now been enveloped into the widening Petrobras scandals, including testimony from former Sete director Pedro Barusco that his company took bribes from all of the yards.

Following those developments, Sete is now fighting for its very existence. In April, the beleaguered Brazilian rig builder filed for bankruptcy protection. Petrobras, which also owns a share of Sete Brasil, did not vote on the protection measure, but now might be put in position by the courts to have to come to an agreement with the contractor finalizing just how many rigs it will charter and at what rates.

The company has cut steel on 17 units so far, but some have had only a small amount of work done. Last year, the contractor was still pushing the idea of delivering a total of 15 rigs to potential investors, with those rigs primarily being the ones that were supposed to be built at the two most well-established yards in the country, Keppel BrasFELS and Jurong Aracruz, even though construction had not even started yet on all of them. The question arises as to what the contractor will do with the drillships that are well into being built in Asia, but are supposed to be completed at the three Brazilian yards that are in the most trouble. These includeOndina, Cassino, and Copacabana, which are more than half finished; as well as Grumari, Pituba, and Ipanema, each of which is at least a quarter complete. The common consensus now is that the company is more likely to finish closer to 10 units, although the makeup of that fleet is very much up in the air.

With all of this in mind, 2016 is shaping up to be an incredibly slow year in the rig construction market. Despite a plethora of units scheduled for delivery over the remainder of the year, IHS expects there will be additional delays and cancellations. Even if the price of oil were to steadily improve over the next few months, it is unlikely that many contractors will be eager to get back to building, as the oversupply of rigs in the global fleet is still immense.