Brazil, East Africa to lead rebound in 2019

Mark Adeosun

Douglas-Westwood

The oil price downturn has dominated the news cycle over the past 18 months and is expected to dictate the fate of manydeepwater developments. Low prices have challenged the economic viability of many deepwater projects, resulting in cancellations and deferred sanctioning. The “lower for longer” oil price environment has initiated a rethink within the industry, resulting in a shift toward standardization and streamlined development processes. Despite these improvements, project execution challenges are expected to continue due to the typical risks associated with local content issues, prompting wide-spread delays.

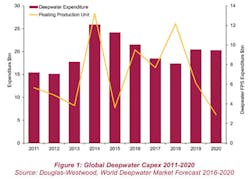

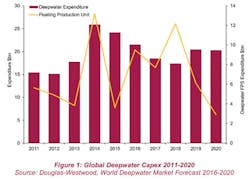

Douglas-Westwood (DW) expects deepwater capex - excluding FPS spend - to plummet from 2014’s record levels and stay low until 2018. A gentle upswing over 2019-2020 will be driven by the development of mega deepwater prospects in Brazil and new projects off East Africa. The FPS market is also expected to see a similar drop in spend; however, this will be most evident in the latter years of the forecast period. Last year (2015) saw the lowest number of deepwater FPS units ordered since 1996. The longer lead times associated with FPS projects has insulated the market to date, since most 2017-2018 installations were ordered in 2013/2014.

Deepwater outlook

Deepwater exploration and production (E&P) activity is driven by a variety of supply and demand-side factors:

- The need to offset declining production from onshore and shallow-water basins

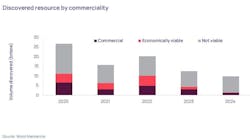

- The potential discovery of large hydrocarbon reserves, with East Africa a clear example

- Economic viability of deepwater developments.

As production from mature basins onshore and in shallow-water declines, development of deepwater reserves has become increasingly vital. Plunging oil prices have increased concerns in the sector; specifically, whether deepwater projects can be viable at current oil prices.

Despite the prolonged low oil prices, there are fasttrack development plans for large deepwater fields such as Eni’s Zohr gas discovery in the Mediterranean Sea off Egypt and ExxonMobil’s Liza discovery off Guyana, which are capital-intensive but provide large potential returns on investment.

Market summary

DW forecasts that deepwater expenditure will decline at -6% CAGR (compound annual growth rate) over the forecast period, with expenditure totaling $137 billion - an increase of 5% compared to the 2011-2015 period.

In the near term, expenditure will be focused on projects that were sanctioned before the oil price downturn in the traditional deepwater regions - Africa and the Americas - accounting for 87% of total capex over the next five years. Mega deepwater projects supporting installation activities in the short term include Total’s Egina (Nigeria) and Kaombo (Angola) projects, Petrobras’ Lula (Brazil) field development, and Chevron’s Big Foot (US) development.

The current low oil price environment has impacted all regions, although this has not been uniform. Latin America will have the highest capex with 38% of total spend, driven by the number of FPS units expected to be installed over the forecast period, which were virtually all ordered before the downturn. Petrobras’ recent problems are likely to result in substantially constrained future expenditure on new units. In 2010, Petrobras awarded contracts to Engevix for the fabrication of eight replica FPSO hulls, but none of the units have entered production. This delay highlights continued inefficiencies within the country which have led to higher field development costs. DW expects six of these units to be operational by the end of the forecast period.

Beyond the oil price, a recent build cycle has led to increased supply of offshore rigs. Rig contractors are now facing plummeting day rates due to a combination of oversupply and reduced demand. Day rate suppression has triggered delays and cancellations for new rigs and widespread stacking of deepwater rigs.

Latin America

Latin America continues to be the largest deepwater region by total capex over the forecast period. However, it will be adversely impacted by a number of issues, including significantly reduced cash flow for Petrobras. The oil company has struggled to address distressed finances by selling assets and slashing capex. Yet there is some potential upside: the NOC recently received a Chinese loan of up to $10 billion that could help pay part of its maturing obligations in 2016.

Mexico showed much promise after reform of its energy sector to allow foreign upstream participants. Phase 4 of the round 1 licensing covers the country’s deepwater assets; this includes vast areas of unexplored acreage which may yield deepwater finds. However, recent interest in this round has been tempered by the prolonged suppression of oil prices. Widespread exploration activity is unlikely in the near term.

East Africa

East Africa is expected to be the next key deepwater hub. Offshore installation activities in Tanzania and Mozambique are expected to commence in the latter years of the forecast period. Development in these gas basins is highly likely, as planning for these projects is well developed - Anadarko has awarded onshore LNG contracts that will process gas reserves in Mozambique. Furthermore, the potential recovery of oil prices may spark a revival in LNG-spot prices.

Other regions

Beyond Africa and the Americas, minimal deepwater activity is forecast. The majority of capex is driven by a small number of projects such as Statoil’s Aasta Hansteen and Chevron’s Rosebank. Consequently, cancellations and delays to individual projects within smaller regions can have a substantial impact on the market outlook. For example, expenditure within the UK is highly dependent on Rosebank, but there have been numerous changes to contractual terms associated with the project and this has led to a degree of uncertainty regarding development timelines. Further delays to the project timeline will dramatically impact deepwater spend, therefore, this represents a large potential downside to total UK capex.

Over the forecast period, the fastest growth in capex is expected in Australasia (37% CAGR), although it will remain a comparatively small deepwater market.

North America is forecast to account for 18% of total capex over the forecast period. Spend in the region will decline by 24% compared to the preceding five years - the outlook is gloomy due to prolonged delays to project FIDs and cancellations. Notable projects affected include BP’s Hopkins project and Murphy Oil’s Thunder Bird.

Components

Drilling and completion (D&C) is the largest segment of the deepwater market with expenditure totaling $53 billion to 2020, an incremental increase on the 2011-2015 period. The majority of spend in this category is associated with subsea well completion.

Africa will have the highest number of deepwater subsea well completions - 38% over 2016-2020. Despite the high volume of completions in Africa, Latin America will account for the highest level of capex, accounting for 40% of expenditure due to lengthier D&C times in this region.

FPS accounts for the second-largest segment of deepwater expenditure at 28% of total capex. Expenditure in this sector is led by Brazil which accounts for 52% of total spend. FPSOs dominate FPS expenditure accounting for almost 81% of forecast spend. Some 82% of forecast units to be installed over 2016-2020 have already been sanctioned, and these projects are expected to prevent a total collapse of the FPS market in the near term.

However, the low oil price environment is causing operators to re-evaluate the use of FPS in development plans. A clear example is the Leviathan field, where Noble Energy abandoned a proposed FPS unit for a subsea tieback to a shallow-water fixed platform in a bid to further reduce development cost.

Subsea equipment (subsea production hardware and SURF) jointly account for 27% of global expenditure over the forecast period. Subsea production hardware spend is driven by the number of development wells drilled - Africa is the largest market both in terms of the number of units installed and capex. SURF expenditure will total $17 billion over the next five years.

Pipeline capex will account for 6% of spend over the forecast period, representing a 2% decline from the previous forecast. Pipeline expenditure has been tempered by the conflict of interest between Russia and Turkey over Syria. This political power tussle has led to the cancellation of the Turkish Stream pipeline, which was expected to boost expenditure in this sector over the forecast period. Projects such as the Texas-to-Mexico gas pipeline and the commencement of offshore installation activity of the SAGE pipeline in the Middle East in the latter years of the forecast period will contribute to expenditure.

Conclusion

To 2020, growth in the deepwater market is expected to be constrained as low oil prices increase pressure on project economics. Operators, subsea manufacturers, and rig owners are likely to find the next few years difficult as project delays continue through the forecast period. Further delays to project sanctioning are expected as operators re-evaluate development plans. However, decreasing drilling and equipment costs may provide a limited upside for sanctioning.

In addition to the low oil price environment, the corruption scandal and financial difficulties rocking Petrobras will likely restrict the NOC’s ambitious spending plans for the foreseeable future, impacting deepwater capex growth in the region.

In Africa, the breakup of the Nigerian National Petroleum Corp. (NNPC) highlights continuing efforts to overhaul Nigeria’s oil and gas sector. However, the future of the long awaited PIB (Petroleum Industry Bill) remains unclear. Prolonged uncertainty has led to a lull in the country’s oil sector; further delays to major deepwater projects such as Shell’s Bonga South West-Aparo, and Chevron’s Nsiko development are expected.

The outlook for North America over the 2016-2020 period is largely negative. There have been a number of major delays to prominent deepwater projects due to cancellation or re-engineering. However, in contrast to other regions, North America is well positioned for recovery by the end of the forecast period due to existing infrastructure. This is likely to lead to increased use of subsea well tiebacks for future developments.

Regions such as Asia, the Middle East, and Western Europe with historically low levels of deepwater activity have seen prospective growth tempered by the prolonged suppression of oil prices. Despite recent negativity, the current oil price is likely to be unsustainable. Deepwater will be critical in serving future energy demand and long-term growth is highly likely. In the near term, despite protracted project delays and cancellations, deepwater capex is expected to total $137 billion in the 2016-2020 timeframe.

The author

Mark Adeosun is author of the Douglas-Westwood report “The World Deepwater Market Forecast 2016-2020.” He has authored various industry reports and has conducted high-level research into various oil and gas projects, with a focus on offshore drilling and deepwater activity. He has undertaken market modeling and analysis, focusing on offshore markets and E&P activities. Adeosun has a BSc degree in geology and a master’s degree from the University of South Wales in geographic information systems.