Craig Hunter

IHS Markit

The past decade has seen many oil companies, particularly smaller ones, come to the decision that the exclusive ownership of data is less important than the interpretation of that data. This notion has accelerated in the last couple of years, with multi-client often now the only affordable way for companies to meet their work program commitments.

The driving force behind this shift has generally not been the oil companies, however, but a seismic industry desperate to find ways to occupy the fleet in the downturn, to avoid the costs involved in laying up vessels and laying off crews. A dramatic drop in contractual day rates has encouraged the notion that even poorly funded multi-client campaigns would eventually be more worthwhile than the alternatives.

The extent to which this is possible is, of course, a reflection on the depth of ones pockets. While Schlumberger subsidiary WesternGeco is now entirely focused on 4D contracts (both streamer and ocean bottom cable) and multi-client acquisition, a smaller company like Polarcus tends toward proprietary work. Having written off a portion of the book value of their data libraries in the past year or so, most seismic companies are starting to insist on a higher level of pre-funding than they would have accepted two years ago.

The opening up of the Mexican offshore to foreign investment provides an interesting insight into the current state of the multi-client business. WesternGeco spent 15 months on a 60,000-sq km (23,166-sq mi) wide-azimuth campaign in the Bay of Campeche, and is now adding a five-month extension to that program. While Petronas has recently licensed “a significant part” of the survey, fully recouping costs is expected to be a longer-term objective.

The flurry of 2D speculative projects in the region ushered in a new era of collaboration in the industry as companies realized the level of duplication, and therefore competition, was not helpful in this virgin territory. Thus, we have a combined program between Spectrum, PGS, and Schlumberger, and a second joint venture between MultiClient Geophysical and Geoex International.

Collaboration between a purely multi-client company like TGS or Spectrum and one more associated with proprietary work is not unusual. It has been less common though, for two of the latter type to come together. This change in tack was reinforced earlier this year when WesternGeco, PGS, and TGS announced plans for a massive joint 2D/3D program offshore Sabah, Malaysia. Elusive funding is still being sought.

Cooperation between seismic companies is not always at their behest. The Statoil-fronted group shoot in 2014 over the Norwegian Barents Sea involved both PGS and WesternGeco being awarded the contract, for example. The UK’s Oil and Gas Authority awarded the same companies a section each of its 2D requirements in the 2016 season.

Governments also often divide multi-client licences to share the spoils, such as in Angola in 2012, which saw TGS, PGS, CGG, and WesternGeco meet the work commitments on various blocks. This is also the case with Mozambique, where CGG, WesternGeco, ION Geophysical, Spectrum, and EMGS were all victorious with their bids. Work on the designated areas is expected to commence in 2017.

The arrangements made with governments in these cases vary hugely. Sometimes the state will fund acquisition to encourage future investment (such as in the UK case mentioned above); on other occasions (such as Mozambique), the state will simply give permission to the company which offers the most comprehensive dataset, with the seismic companies retaining ownership of the data. A responsibility to assist in the promotion of future licensing rounds is also often part of the deal.

In most countries, the traditional model still ensues, whereby seismic companies request a permit to conduct a large survey, usually over multiple blocks and often combining operated with open acreage. Brazil and Australasia are current focal points for this type of activity, while the European season operates almost entirely on this model. The USA is similar, with its small tracts exclusively being covered with wide- or full-azimuth seismic for many years.

Operating in a slightly different market are those companies with a basin-wide approach to 2D mapping. ION Geophysical has long dominated this sub-sector with its global BasinSPAN programs but has potential competition from Geology Without Limits. The new Russian company has a small existing data library but large plans in the Caribbean and Southeast Asia. Nevertheless, a small survey in the Caspian Sea in 2017 is the only likely addition in the next year.

What the resilience of the multi-client model has shown is that it has gone from the dependable fall-back in difficult times to an equal player with proprietary seismic acquisition. Unless their acreage is enormous or in an isolated location, oil companies are as likely to turn to multi-client programs as to put a job out to tender. Major oil companies have indicated that they may never acquire proprietary data again. Why not let the seismic company do the preparatory work for you, especially when the price is right?

For the seismic contractors, however, the price is wrong and unsustainable. While late sales can provide some comfort, working below cost cannot continue endlessly. So while the forthcoming surveys mentioned here will definitely proceed, there are many that will not. After a few poor years, prefunding seems to be taken more seriously before a project will commence, and with competing applications and a low oil price, that is not always easy.

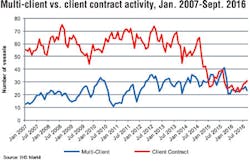

As the graph shows, the number of vessels operating on multi-client projects has not increased dramatically in the past decade, but it has stayed constant when the proprietary market has halved. When the overall market improves, the main increase in proprietary work will come from the 4D sector, not 3D exploration.