Ed Merrow

Luke Wallace

Independent Project Analysis Inc.

Today’s oil price is low, but only by about $10. The fundamental reality is that the marginal cost of producing an adequate supply of oil for today’s consumption is somewhere in the range of $50 to $60/bbl. That is with Iraq, Iran, Libya, and Venezuela all producing well below their potential. This reality came as a shock to many oil producers in late 2014, whose own valuation of oil was generally on the order of $80 to $110/bbl. Those high expectations drove the industry to do many more projects than were actually justified.

As a result, the industry had too many projects, too many people, and not nearly enough money to make it all work. The OPEC (Saudi) decision not to attempt to defend high prices was not the problem. The problem is that our collective decision to believe in a $100 world resulted in overheated supply markets during a period when the supplier industry was already coming under increasing demographic stress resulting from the long period of contraction in the 1984-2003 timeframe.

In today’s oil price environment, international companies, which generally have access to very little low-cost resources, need project prices to come way down or they will be unable to defend their market share against many national companies with lower-cost-to-produce reserves. When international companies do have access to low-cost resources, it is generally in the context of concessions that provide relatively little upside, such as in Iraq.

The first response to the oil price decline by many owners was to beg or cajole suppliers to share their pain. This process has about run its course with few tangible results. Some markets, especially for offshore drilling rigs, have responded quite dramatically to lower demand in large part because those unfortunate suppliers were in the midst of a large increase in capacity just as the price of oil started to decline. Other segments, however, have stayed stubbornly high, which suggests that they did not have a great deal of cushion to give up in the first place.

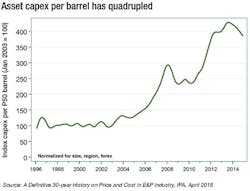

If owners and contractors are going to play a creative role in accelerating declines in project costs, it is essential to understand what contributed to their rapid rise. Although there are a number of causes of increased project cost over the past 12 years, the authors believe the one that offers the most opportunity for correction was the steep increase in project complexity and the manner in which owners responded to that increase. Project complexity increased in at least two dimensions: technology and organization. Technological complexity has increased very rapidly as the industry’s move into challenging reservoirs was accelerated by high prices. Faced with more difficult reservoirs to exploit, the industry opted for highly sophisticated and optimized technology solutions rather than lower technology “fit-for-purpose” alternatives. The result was markedly higher costs as suppliers were asked to customize virtually every project done. The approach also fostered a greatly increased level of specialization on owner project teams, which has made a move to more standardized solutions more difficult.

Project cost readjustment

Costs have decreased and will continue to do so slowly across most elements of the supply chain as supply declines to meet the reduced demand. We are clearly seeing this effect as new projects are moving through to authorization. These reductions alone, however, will not even begin to restore prices to their pre-boom levels because the underlying dual realities of more complex projects and demographically weakened EPC firms. So what can be done?

First, most “company standards” should be dropped completely. These standards are almost always aimed at improving production and especially at moving production forward in time. They are rarely safety-related. Let’s be frank: at $40, a barrel does not command the same economic respect that it did two years ago. That last barrel is not worth as much and bringing it forward in time does not do as much for net present value as in the old days. The company tweaks to standard supplier designs hugely increase costs and do not make sense in the new environment. They probably often did not make sense in the old environment.

Second, the industry needs to reduce the number of specialists working on owner project teams to the absolute minimum. Technical specialists create studies and tweaks. Their value-added at today’s prices has declined substantially.

Third, shift the focus of owner teams to the careful review and quality control of design. This does not mean that owners should be doing contractors’ work. Rather, the owner needs to do a better job of quality control on design because the contractors are struggling with increased design errors. The error rates in design are at unprecedented levels. To the extent that we can use proven designs, we reduce the strain on engineering quality while reducing cost and improving quality.

Fourth, EPC contractors need to rethink how they have changed their approach to design to cope with their loss of experienced personnel throughout the Organization for Economic Cooperation and Development. The error rates clearly suggest that the current approach is not working. The problems, moreover, appear to be concentrated in the home office and in the home office/value interfaces, not in the value centers.

The actions suggested above do not require any cross-industry cooperation; they can all be accomplished by owners and contractors individually. That means that the needed changes can be implemented quickly if owners and contractors have the will necessary to make it happen.