Jeremy Beckman

Editor, Europe

BG Group is looking to replicate its run of exploration successes in newly opened frontier areas.

Since 1998 the company has participated in 15 giant discoveries, said Malcolm Brown, executive VP, Exploration, at a presentation in BG's headquarters west of London. These include the ultra-deepwater Carioca, Iara, Iracema, Lula, and Sapinhoá fields in Brazil's presalt Santos basin, all currently under or close to development.

"Four years ago," Brown added, "we weren't even present in Tanzania. But we have since drilled nine consecutive deepwater gas discoveries there, with ample resources for a new two-train LNG plant. Globally over the past 10 years we have replaced more of our reserves [through exploration] than what we have produced, and in independent research we rank second only to Petrobras in terms of value creation."

Over the years, BG has broadened its geological expertise in exploration and now focuses on four main play types. Carbonates provide over half the company's proven global reserves, offshore Brazil, Tunisia, India and onshore Kazakhstan, Brown said. "We will use this experience to drill a new carbonate inboard oil play offshore Kenya, starting next year." Here the company operates offshore blocks L10A and L10B, where net unrisked resources could be over 1 Bboe. Another prospective carbonate play is offshore Honduras, where BG operates a 35,000-sq km (13,513-sq mi) exploration block. Initial plans call for a review of existing data, followed later by 2D and 3D seismic acquisition.

Another BG specialty is exploration of Tertiary deltas, which have proven prolific in gas offshore Trinidad and Tobago, Egypt, and Thailand, and more recently offshore Tanzania. The third area of expertise is in high-pressure/high-temperature (HP/HT) gas, initially in the UK North Sea and onshore Kazakhstan and now also offshore Norway, China, and Egypt, where recently the company drilled its first HP/HT well in the deepwater Mediterranean sector. The fourth focus is on shale gas plays onshore the US and Australia.

BG employs a total of 6,000 people in 20 countries, including 300 geoscientists. "We try to use the best technology to reduce the exploration risk, with drilling costs so high," Brown said. The Odfjell drillshipDeepsea Metro, which recently drilled the Mzia appraisal well offshore Tanzania, was on a day rate of $1 million, he pointed out, "so we need good seismic to maximize use of this state-of-the-art vessel."

Over the past two years the company has added four new basins to its portfolio, and it has budgeted exploration expenditure of $1.6-$1.8 billion/yr during 2013-15. "Brazil in particular has proved a fantastic success for us," Brown said, "but it has also cost a lot of money to explore."

In May, BG was awarded its first acreage in Brazil's offshore Barreirinhas basin, along the country's northern equatorial margin. The company operates 10 blocks extending over 7,000 sq km (2,703 sq mi). In four of the blocks it is in partnership with Petrobras and Portugal's Galp - the same consortium is developing Iara and Lula in the Santos basin BM-S-11 concession. In the other six blocks, in which BG has a 100% holding, the company will seek to bring in partners via farm-downs or equity swap arrangements.

The Barreirinhas basin is north of the pre-salt areas. "Geologically, we feel it is more analogous to Ghana's Cretaceous fan play," Brown said. Unlike other bidders in the Brazilian licensing round, BG did not apply for the Foz do Amazanos offshore blocks to the north. "There the fans are smaller, and there are significant currents which could add $170 million to well costs," he explained. Over the next three years, BG's program in the Barreinhas basin includes 3D seismic acquisition and processing and subsurface analysis, followed potentially by drilling in 2016.

Tanzania gas trove

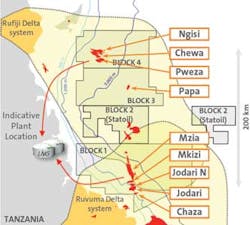

In 2010, BG farmed into 60% of blocks 1, 3, and 4 offshore southern Tanzania, assuming operatorship the following year. London-based Ophir Energy retained the remaining 40%. The blocks cover 20,850 sq km (8,050 sq mi) in the Mafia Deep Offshore basin and the Rovuma basin. To date the partnership has acquired over 13,000 sq km (5,019 sq mi) of 3D seismic and drilled 13 successful wells, including nine discoveries, in water depths ranging from 900-1,600 m (2,953-5,249 ft). Total volumes discovered to date are around 13 tcf, with further exploration upside.

In block 1, the most southerly and most prolific of the three blocks, the Jodari field is a giant and Mzia is probably also in that category. "This is a Tertiary delta play, and we understand how to interpret the seismic over these structures," Brown said. In between blocks 1 and 3, the Statoil/ExxonMobil partnership has gas discoveries in block 2, and plans to drill further exploration and appraisal wells. BG/Ophir are in discussions with the block 2 partners over a shared, two-train LNG plant somewhere on the coast, with produced gas delivered to this complex via long-distance subsea tiebacks from the various fields. All BG/Ophir's fields are within 100 km (62 mi) of the shore.

The rapid pace of the interpretation program is partly due to an in-house developed algorithm, BG Group principal consultant geophysicist Nigel Pike explained. "This has allowed us to scan in three to four days what might previously have taken three to four months, and allows us to bring out all the clouds of anomalies. That gives us the ability to drill and appraise more quickly. We will also apply this algorithm to our acreage in the Pelotas basin offshore Uruguay." The technique works best for gas in soft Tertiary rocks, he added.

Following analysis of well/seismic data, BG commissioned drillstem tests on both Jodari and Mzia. The results confirmed a world-class reservoir in Jodari, the company claims, with a better than expected gas-bearing reservoir in the deeper Cretaceous Mzia structure.