Bruce Beaubouef

Managing Editor

Economic growth in the Asia/Pacific region is driving demand for oil and gas increasingly offshore, and international operators and national oil and gas companies are taking action on a number of fronts to answer that demand.

According to Infield Systems Ltd., total capex in the region is expected to exceed $90 billion during 2011-2015, a 55% increase from the previous five-year period.

The following highlights some of the more notable proposed and ongoing oil and gas development projects offshore Asia.

China

China National Offshore Oil Co. (CNOOC) is active on several fronts. The Chinese national oil company reports that production has commenced on the Panyu 4-2/5-1 oil field adjustment project and the Liuhua 4-1 oil field, located in the Pearl River Mouth basin of South China Sea.

The Panyu 4-2/5-1 oil field has an average water depth of about 100 m (328 ft). The adjustment project was designed to access existing facilities in order to develop Panyu 4-2/5-1 more effectively. The adjustment project was expected to reach peak production in 2014.

CNOOC holds 75.5% interest and serves as operator of the Panyu 4-2/5-1 oil field. Its partner, Burlington Resources China, holds the remaining 24.5% interest.

The Liuhua 4-1 oil field has an average water depth of about 268 m (879 ft). In view of the features of the field, CNOOC built a new subsea production system that also makes use of surrounding facilities for field development. This project is expected to hit peak production in 2013. Liuhua 4-1 is an independent oil field in which CNOOC holds 100% interest and is the operator.

In addition to these developments, CNOOC also reports that oil has begin to flow on the Weizhou 11-2 and Weizhou 6-9/6-10 fields in the South China Sea's Beibu Gulf. Weizhou 11-2, in 35 m (115 ft) of water, has four producing wells and is expected to peak at 3,960 b/d this year. Weizhou 6-9/6-10, in 32.5 m (107 ft) water depth, has nine producing wells and is expected to peak at 5,870 b/d this year. CNOOC holds 100% interest in both fields.

Elsewhere, CNOOC reports success on two wells at Qinghuangdao 29-2 East in Bohai Bay. The tract is in the north central Bohai Bay in 27 m (89 ft) water depth. The E4 well encountered a total of 218.4 m (717 ft) of oil pay, with 133.7 m (439 ft) in a single zone. It tested at 6,600 b/d of oil and 4.5 MMcf/d of natural gas. No further information was available at press time regarding the second well.

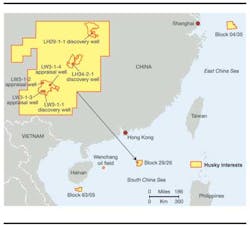

On still another front, Husky Energy says construction of the Liwan gas project in the South China Sea is roughly 75% complete. The central platform jacket has been launched and secured to the seabed in readiness for installation of the topsides next spring.

Vietnam

Significant development activities are taking place offshore Vietnam. PanPacific Petroleum (PPP) recently announced that the Silver Sillago prospect will be drilled as the remaining commitment well in block 07/03 offshore southern Vietnam. Subject to finalization of the rig contract, the well should be drilled in mid-2013. The partners are assessing whether additional appraisal drilling is needed to resolve resource uncertainties over the Cá Rồng Đỏ oil and gas/condensate discovery.

In offshore block 121 (PPP interest 15%, subject to completion of farm-in), a rig will be sought to drill the large Ca Voi prospect in 2Q 2013. Operator Origin Energy has requested an extension to the first exploration phase from PetroVietnam to accommodate the revised spud date.

Elsewhere, production is building at the Te Giac Trang (TGT) field offshore Vietnam, in the Nam Con Son basin. Production is in the range of 50-56,000 b/d, according to SOCO International. The field is operated by the Hoang Long Joint Operating Co., a partnership formed between PetroVietnam (41%), Soco International (28.5%), PTT Exploration and Production (28.5%), and OPECO Vietnam (2%).

Five wells are onstream at the H4-WHP TGT southern platform, which entered service this past summer. The field's daily rate fluctuations reflect well intervention activities. A one-day "high rate" flow test was conducted on the TGT FPSO at 60,789 b/d, SOCO adds. No issues were evident in either reservoir performance or FPSO operability.

At TGT's northern platform, H1-WHP, the PetroVietnam jackupPVD-II has been working on a four-well, infield development drilling program that included two infill wells, an appraisal well, and one development well.

The TGT-15P and TGT-16P infill wells on the H1.1 fault block and the TGT-8X appraisal well on the H2N fault block were batch drilled into the reservoir section. All are now onstream.

Malaysia

In Malaysia, Petronas has reported two major gas discoveries offshore Sarawak. The Kuang North-2 exploration well in block SK316 penetrated a 636-m (2,087-ft) gas column. The well was drilled to a TD of 3,223 m (10,574 ft). Preliminary assessments indicate gas-in-place for the Kuang North field is about 2.3 tcf.

The Tukau Timur Deep-1 well was drilled to a depth of 4,830 m (15,846 ft) and discovered 12 gas-bearing reservoirs with total net gas sand of 183 m (600 ft). This is the first completed high-pressure/high-temperature well in Sarawak and is also the deepest vertical well to be drilled by Petronas.

Preliminary assessments indicate the total gas-in-place for Tukau Timur field is about 2.1 tcf. Petronas Carigali operates block SK307 with 50% interest and Sarawak Shell Berhad holds the remaining 50%.

Petronas has also awarded a production- sharing contract for block SB311 offshore Sabah to the ConocoPhillips Sabah Gas Ltd./Shell Energy Asia Ltd./Petronas Carigali Sdn Bhd partnership.

The partners are committed to drill two wildcats, acquire new 2D seismic, and reprocess existing 3D seismic on the block. The 1,046-sq km (404-sq mi) block is in central Sabah basin and has water depths of 50 to 100 m (164 to 328 ft). ConocoPhillips will be the operator with 40% interest while Petronas and Shell will each hold 30%.

In the North Malay basin, Petronas Carigali Sdn Bhd and Hess Exploration and Production Malaysia B.V. have signed contracts to move forward with the North Malay Basin gas development project. Petronas says $5.2 billion will be invested in the project over the next five years to commercialize 1.7 tcf of gas reserves. Hess will have a 50% working interest and become operator of the project.

First production is forecast to commence in 2013 at a net rate of approximately 40 MMcf/d and increase in 2015 to an estimated 125 MMcf/d.

Meanwhile, Shell and Petronas are teaming up on EOR projects offshore Malaysia. The two companies recently signed two new production-sharing contracts for enhanced oil recovery projects offshore Sarawak and Sabah.

Under the new contracts, Shell Malaysia's upstream companies and partner Petronas will further develop six oil fields in the Baram Delta offshore Sarawak, and three oil fields in the North Sabah development area offshore Sabah.

The deal combines the remaining periods of the earlier PSCs which would have expired in 2018 (Baram Delta Operations) and 2019 (North Sabah) with license extension to 2040, and with the addition of the EOR component for integrated PSCs with new terms.

Thailand

The number of E&P projects is also on the rise offshore Thailand. In the Gulf of Thailand, PTT Exploration and Production plc (PTTEP) has started production from the Greater Bongkot South (GBS) gas and condensate field. Its partners in the development are Total and BG Group.

The GBS field is in blocks B16 and B17, 200 km (124 mi) east of Songkhla. This latest development comprises a new central processing platform, a living quarter platform, and 13 wellhead platforms. According to Total, the processing platform has a capacity of 350 MMcf /d of gas and 15,000 b/d of condensate.

Gas heads via a new spur line to the PTT-operated grid while condensate is exported to the existing FSO vessel at the Greater Bongkot North field, 80 km (49.7 mi) to the north.

In addition to the state-owned PTTEP, several private contractors and E&P firms are looking to develop oil and gas offshore Thailand. Salamander Energy has started oil production through the Bualuang Bravo platform in the Gulf of Thailand. The jackupAtwood Mako drilled and completed the horizontal BB-04H development well from the platform on the Bualuang field. After clean-up operations, the well should produce at its planned rate of 1,500 b/d. The rig is currently drilling the second development well from the platform BB-10H.

The Bualuang field is presently producing more than 8,300 b/d. As the development program progresses, with 15 more wells to be added, next year output is expected to increase to 11,000-14,000 b/d.

Philippines

Off the Philippines, operators and developers are moving to develop several new projects. Total E&P Philippines has agreed to farm into 75% of offshore block SC56 in the Sulu Sea, held by Kuala Lumpur-based Mitra Energy (Philippines SC-56). The block covers an area of roughly 4,300 sq km (1,660 sq mi), in water depths ranging from 200-3,000 m (656-9,842 ft). Mitra will retain a 25% interest in SC56.

The Philippines Department of Energy is also facilitating project requests on the regulatory front. The department has extended for one year an existing permit for exploration Sub-Phase 4 in SC55. Operator BHP Billiton requested the extension in order to secure an appropriate ultra-deepwater rig with specialized well control equipment it wants for safe drilling on the proposed Cinco prospect.

After the extension, Sub-Phase 4 and one committed well will be drilled by Aug. 5, 2013. Sub-Phase 5 calls for another well to be drilled by Aug. 5, 2014. The working interests in Service Contract 55 are Otto Energy through wholly owned subsidiary NorAsian Energy Ltd, 33.18%; BHP Billiton Petroleum (Philippines) Corp., 60%; and Trans-Asia Oil and Energy Development Corp., 6.82%.

The department has also extended by nine months the Otto Energy Ltd. Exploration Sub-Phase 3 on service contract 69. Otto says the extension is to allow sufficient time to complete detailed evaluation and grading of prospects. Further, recent 3D seismic confirms three potential targets in Lampos, Lampos South, and Managua East areas of the service contract. Otto Energy Investments Ltd. holds 79%, Frontier Gasfields Pty Ltd holds 15%, and Trans-Asia Oil and Energy Development Corp. has 6%.

Elsewhere, the Fluor Corp. Offshore Solutions unit has participated in the Malampaya Deepwater Gas-to-Power project contract signing. Joint venture partners in Service Contract 38 are Shell Philippines Exploration, Chevron Malampaya, and Philippine National Oil Co. The venture operates the Malampaya project for the Philippine Department of Energy.

Malampaya is in its third phase and encompasses installation of a depletion compression platform linked by a bridge to the existing shallow water platform. Fluor is responsible for the topsides and substructure. The project is under way with expected completion in late 2015.

The Phase 3 project is led by the Philippine Department of Energy, supported by project operator Shell and its joint venture partners, Chevron Malampaya LLC and the Philippine National Oil Co.-Exploration Corp (PNOC-EC).

Keppel Subic Shipyard has a contract from Shell Philippines Exploration to build a depletion compression platform (DCP) for the Malampaya gas field development.

The DCP will be bridge-linked to the existing shallow-water production platform near Palawan Island, under Phase 3. It will maintain current availability and deliverability of natural gas from the Malampaya field by regulating gas export pressure and flow rates.