Bruce Beaubouef

Managing Editor

Increasing domestic oil production has been a long-term goal of the Brazilian government, and recent discoveries of large offshore, pre-salt oil deposits could transform Brazil into one of the largest oil producers in the world. It is estimated that Brazil has 12.9 Bbbl of proven oil reserves, the second-largest in South America after Venezuela.

The offshore Campos and Santos basins, located off of the country's southeast coast, hold the majority of Brazil's proven reserves. More than 90% of Brazil's oil production is offshore in very deepwater, and consists of mostly heavy grades. Five fields in the Campos basin (Marlim, Marlim Sul, Marlim Leste, Roncador, and Barracuda) account for more than half of Brazil's oil production. These Petrobras-operated fields each produce between 100,000 and 400,000 b/d.

International oil companies also play a role in Brazilian production. The Shell-operated Parque de Conchas project and the Chevron-operated Frade project are expected to achieve production levels of 100,000 b/d and 68,000 b/d, respectively.

In general, recent exploration efforts offshore Brazil have yielded massive discoveries of pre-salt oil fields, and the prospects for significant development opportunities have already led to a number of new plans, programs, and development activities.

Pre-salt oil

A consortium of Petrobras, BG Group, and Petrogal discovered the Tupi field in 2007. Tupi contains substantial reserves in a pre-salt zone 18,000 ft (5,486 m) below the ocean surface under a thick layer of salt.

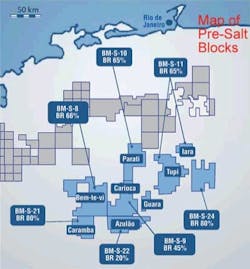

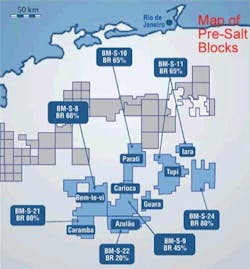

Following Tupi, numerous additional pre-salt finds have dotted the Santos basin. These include Iracema, Carioca, Iara, Libra, Franco, and Guara. Additional pre-salt discoveries also are found in the Campos and Espirito Santo basins. Estimates for the total pre-salt resources vary. Some analysts place total extent of pre-salt recoverable oil and natural gas reserves at more than 50 Bboe.

Last December, Petrobras submitted a declaration of commerciality to Brazil's National Petroleum, Natural Gas and Biofuels Agency (Agência Nacional do Petróleo, Gás Natural e Biocombustíveis, or ANP) for the Tupi and Iracema fields, and renamed the fields Lula and Cernambi, respectively. The total recoverable reserve estimate for these fields is 8.3 Bboe – 6.5 Bboe for Tupi and 1.8 billion for Iracema.

Petrobras plans to develop its major pre-salt assets in three discrete phases: extended well tests; pilot projects; then large-scale production through multiple, duplicate FPSO facilities. The Tupi pilot project began production at 100,000 b/d in 4Q 2010.

In its 2010-2014 business plan, Petrobras plans to invest $33 billion in pre-salt exploration and production activities to achieve an oil production target of close to 4 MMb/d by 2020. More than a quarter of this target is to come from pre-salt oil.

Pre-salt natural gas

Along with their potential to significantly increase Brazil's oil production, the pre-salt areas also are thought to contain sizable natural gas reserves as well. According to Petrobras, Tupi alone could contain 5-7 Tcf of recoverable natural gas, which if proven, could increase Brazil's total natural gas reserves by 50%

Challenges and opportunities

Brazil's pre-salt discoveries have transformed the nature and focus of its oil sector, and the potential impact of these discoveries upon world oil markets is significant. However, considerable challenges still confront those who would develop and produce these reserves. The significant drilling depths and pressures involved represent severe technical hurdles that must be overcome. Further, the scale of the proposed expansion in production will also stretch Petrobras' exploration and production resources, and the nation's infrastructure in general.

Regulatory reforms

In addition to the technical challenges, there are some statutory ones as well, but Brazil seems to be making progress on this front, too. The government released a proposed regulatory framework for the pre-salt reserves in August 2009. The framework consists of four pieces of legislation. The first two elements were signed into law in July 2010. The first creates a new agency, Petrosal, to administer new pre-salt production. The second allows the government to capitalize Petrobras by granting the company 5 Bbbl of unlicensed pre-salt oil reserves in exchange for larger ownership share.

On June 3, Petrobras christened the platformP-56, at the BrasFELS Shipyard, in Angra dos Reis (state of Rio de Janeiro). With capacity to process 100,000 b/d and to compress 6 MMcm/d of gas, the P-56will operate in the Marlim Sul field development Module 3, in the Campos basin, Rio de Janeiro. Photo courtesy Petrobras.

The other two bills, establishing a new development fund to manage government revenues from pre-salt oil and laying out a new production sharing agreement (PSA) system for pre-salt reserves, passed the Brazilian congress in December 2010. In contrast to the earlier concession-based framework, Petrobras will be the sole operator of each PSA and would hold a minimum 30% stake in all pre-salt projects. Some analysts fear that the new system's increased level of state involvement and drain on Petrobras' resources could slow the development of these resources.

Debate on the issue of royalty distribution among Brazilian states is expected to continue well into 2011. Once a final agreement is in place, Brazil is expected to hold an 11th auction round for exploration blocks sometime this year.

Development plans

Early efforts are under way to develop the pre-salt, and several operators and contractors (in addition to Petrobras) are making plans and moving forward with projects to bring the oil and gas to market. In May, it was announced that a combination of government and private investors had formed a new company to build offshore rigs for Petrobras. The company, Sete Brasil SA, will build seven rigs according to Petrobras, with the first scheduled to be available in 2015. The new company will partner with Estaleiro Atlantico Sul shipyard to build the rigs. These will be the first ever fabricated in Brazil.

Sete is owned by Brazilian banking groups Santander, Bradesco, BTG Pactual, and Caixa Economica Federal as well as Brazilian pension funds Previ, Petros, Funcef, Valia, and Lakeshore Financial Partners, Petrobras said. Petrobras will own less than 10% of Sete.

Also in May, OGX Petróleo e Gás Participações S.A. reported that it has found hydrocarbons in the Albian section of well 1-OGX-30-RJS in block BM-S-58, offshore Brazil. The well is in shallow water over the Santos basin. A drillstem test was performed on the hydrocarbon column in Albian carbonates. OGX says the find is contiguous to the Belém accumulation in the same block. The next step is production testing with equipment designed to match the pressure and temperature of the well as determined in the drillstem test. The well is 105 km (65 mi) off the coast of the state of Rio de Janeiro at a water depth of approximately 150 m (492 ft). Diamond Offshore'sOcean Quest semisubmersible rig initiated drilling activities in this location this past January.

And there is activity on other fronts as well. BP recently announced it received final approval to complete the acquisition of Devon Energy's interests in 10 exploration and production blocks off- and onshore Brazil. Regulatory approvals came through from Brazil's ANP; these were needed to conclude the agreement first announced in March 2010.

BP will gain interests in eight offshore license blocks, in water depths ranging from 330-9,100 ft (100-2,780 m). The Campos basin blocks include the Polvo field, currently producing around 25,000 b/d of oil. BP will become operator of Polvo, and also of Campos basin blocks BM-C-32 (containing the Itaipu discovery), and BM-C-34 (consisting of C-M-471 and C-M-473, and containing the Fragata discovery).

Additionally, it will operate Camamu-Almada basin block BM-CAL-13, and receive non-operating interests in Campos basin blocks BM-C-30 (containing the Wahoo discovery), BM-C-35, and the Xerelete discovery (formerly the BC-2 block). Most of Devon's employees in Brazil are expected to transfer to BP.

In April, Petrobras announced an oil discovery in the Campos basin pre-salt at well 6-AB-119D-RJS drilled in the Albacora field, 107 km (66.5 mi) off the coast and only 3.2 km (2 mi) from the FPSOP-31. The discovery was made by the semisubmersible Ocean Concord.

Preliminary estimates indicate an economically recoverable potential of 350 MMbbl of light oil. Drilled at a water depth of 380 m (1,247 ft) it reached TD of 4,835 m (15,863 ft). An oil column of 241 m (791 ft) was found, of which 104 m (342 ft) are from the carbonate reservoirs of the Macabu formation, with porosity around 10%.

Whether to conduct a long-duration test to investigate the production behavior of this new accumulation will be decided after the assessment of the cased-hole drillstem tests program.

Also in April, Petrobras reported that it had started an extended well test (EWT) in the northeastern part of Lula field, in the Santos basin pre-salt reserves, about 300 km (186 mi) off the coast of Rio de Janeiro. The EWT is under way on theBW Cidade de São Vicente FPSO, anchored in 2,120 m (6,955 ft) of water. Estimated output is about 14,000 b/d.

The information gathered during the Lula Nordeste EWT will help in project development for the final production system to be set in Lula field under the name Lula Nordeste Pilot, and run on theCidade de Paraty FPSO. The Lula Nordeste EWT project is owned by a consortium formed by Petrobras (operator, with 65% interest), BG Group (25%), and Galp Energia (10%).

Other technical advances also are being pursued to promote pre-salt development. In May, Petrobras signed an agreement with Japan Oil, Gas, and Metals National Corp. to start a feasibility study on using flexible pipes for pre-salt oil production. The study is scheduled to conclude at the end of 2014. After technical evaluation of the study, the possibility of establishing a production plant in Brazil will be examined. The study will include a consortium of Japanese companies including Furukawa Electric Co. Ltd.

More recently, Petrobras approved the bidding process to award contracts for multiple offshore drilling rigs to be built in Brazil. Each rig will get a leasing contract with the successful bidder and an operation service contract. Companies can bid for one or more rigs up to a total of 21 units. Certification of minimum domestic content is required. Petrobras says this is part of its plan to contract as many as 28 new ultra-deepwater drilling rigs for, among other things, pre-salt field exploration. As mentioned, Sete will build the first seven of these rigs.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com