Jeremy Beckman

Editor, Europe

Offshore capex across the Middle East and Caspian Sea is set to rise by one-third over the next five years, according to a recent report from Infield Systems Ltd. Much of the growth will come from the Persian Gulf and new projects off Saudia Arabia; but Israel should also become increasingly influential, with its gasfield programs in the eastern Mediterranean incurring expenditure of over $2 billion between now and 2015.

Whether these developments, led by the Noble Energy-operated Tamar, go forward as planned will depend on political as well as commercial considerations. Israel’s parliament (Knesset) has been considering a bill to implement the Sheshinksi Committee’s recommendations on raising taxes on oil and gas production. If ratified in full, it could impact the economics of Tamar and other gas discoveries in the Tamar basin, such as Noble’s Leviathan. Here, though, drilling of the Leviathan 1 well was recently suspended due to the need to procure equipment from outside Israel to deepen the well. TheSedco Express has since transferred to the Tamar field for development drilling.

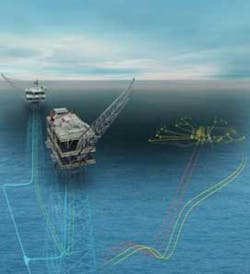

Proposed development configuration for the Tamar gas field in the Levantine basin.

Other companies are moving into the region, among them ATP Oil & Gas, which was recently awarded five deepwater licenses. Toronto-based Adira Energy commissioned two seismic surveys (both acquired by WesternGeco) earlier this year over its Gabriella and Yitzchak offshore permits.

Noble’s drilling success has sparked interest among Israel’s neighbors, with Greek-controlled southern Cyprus considering staging a second offshore licensing round later this year, comprising 12 deepwater blocks – although this might draw objections from the Turkish-controlled north. Noble is reportedly looking to drill southeastern offshore block 12, which is thought to hold 10 tcf of gas.

Syria’s Petroleum and Mineral Resources Ministry recently launched an international offshore bid round, with CGG Veritas providing technical support. And Lebanon’s Ministry of Energy & Water may open the country’s first offshore licensing round in November, which could be promoted by PGS. Lebanon has also voiced concerns that development of Tamar may infringe its rights, if it is proven that the field extends into Israeli waters.

More surprising, according to press reports in Israel, Prime Minister Benjamin Netanyahu has approached the Palestinian Authority for talks on a potential $800 million-plus development of two gas fields offshore Gaza discovered a decade back by BG Group. Gaza Marine 1 and Gaza Marine 2 are thought to hold combined reserves of 1.4 tcf. If the project went ahead, it could alleviate current power generation costs in Gaza.

Offshore Saudi Arabia, development continues of Saudia Aramco’s giant Manifa field in shallow water, 200 km (124 mi) northwest of Dhahran. The company’s drilling team recently set a new record for a long-reach well, drilled from shore to a TD of 32,136 ft (9,795 m) using a Precision Drilling rig. Earlier this year, Aramco awarded Saipem a $2.2 billion-plus EPC contract for offshore development of the Arabiyah and Hasbah fields, 150 km (93 mi) northeast of Jubail industrial city. The program involves building and installing 12 wellhead platforms; one injection and two tie-in platforms; a network of infield flowlines and subsea electric/control cables, and a 260-km (161-mi) export pipeline.

Farther southeast along the Arabian Peninsula, RasGas, the joint venture between Qatar Petroleum and ExxonMobil, awarded Hyundai Heavy Industries a $900-million contract for the Barzan gas project, 80 km (49.7 mi) northeast of Ras Laffan Industrial City. The offshore facilities will include three wellhead platforms and 200 km of subsea pipelines, designed to deliver 1.9 MMcf/d of gas.

Dubai Petroleum Establishment has commissioned an unmanned wellhead platform and associated pipelines from Global Industries for the Al Jalilah project. The newly builtGlobal 1200 vessel was due to participate in the installations. Offshore Oman, the Ras Al Khaimah gas Commission approved RAK Petroleum’s application to re-develop the long shut-in Saleh gas condensate field. The initial program involves deepening an existing well to the Thamam reservoir and rehabilitation of four platforms.

In the Persian Gulf, Pars Oil and Gas Company aims to start production next March from the South Pars Phase 12 development. This is designed to produce 75 MMcm/d of gas and 120,000 b/d of condensate. According to Iran’s Petroleum Minister Dr Seyyed Masoud Mirkazemi, all remaining 19 South Pars phases should come onstream by 2015. Iran is also looking at ways to lift oil production from various offshore fields close to Bushehr province, of which Norouz and Soroush are the main producers.

In the Kazakh sector of the Caspian Sea, progress on the ultra-shallow water Kashagan project remains slow. The government is now thought to be pushing for a simplified design to cut costs of the full field development. Korea National Oil Corp has commissioned DSME to construct a drillship for exploration on Kahazakstan’s Zhambyl oil field, using local shipyards on the Caspian Sea coast and the Mangalia shipyard in Romania.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com