Jeremy Beckman, Editor, Europe

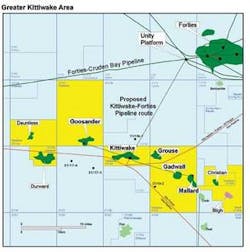

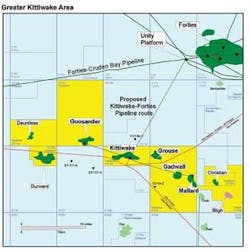

Oil from the Greater Kittiwake Area (GKA) fields in the central North Sea will soon transit through the Forties pipeline system. Operator Venture Production is replacing the tanker loading arrangement, in place since exports started in 1990, with a new 33-km (20.5-mi) pipeline tying in to BP’s Unity riser platform within the Forties pipeline system (FPS).

The £70-million ($144-million) project is the latest of a series of recent measures designed to lift throughput and uptime at the Kittiwake platform complex, which serves four fields in the area. Current output is 30,000 b/d, compared with 4,000 b/d, when Venture took charge in 2003.

Previous incumbent Shell had installed the platform to develop the Kittiwake field, southwest of Forties in UK block 21/18a. During the late 1990s, Shell added production from the Mallard subsea satellite, but by then Kittiwake itself was in decline.

“We first became aware of these assets being on the market in 1999,” says Venture’s chief executive Mike Wagstaff. “They were not core for Shell and its partner ExxonMobil for several reasons: the fields were not tied into their main UK North Sea oil infrastructure, and in gas export terms, they were seen just as an end-stop on the Fulmar pipeline system.

“Shell tried unsuccessfully to sell them in 2000. The breakthrough came in 2001 when Venture secured Total’s interest in Mallard, giving us a foothold in the area. We launched a joint bid with Dana Petroleum, and following long discussions with Shell and ExxonMobil, the deal was concluded in April 2003.”

Both Venture and Dana are Aberdeen-based independents, although Venture is more focused on the North Sea. At the time of the transaction, it had experience operating mature field platforms in the southern gas basin, but Kittiwake was a step up in magnitude. However, Talisman Energy had proven repeatedly that a change of owner can work wonders on large facilities.

“It was clear to us that there was plenty of capacity for more than one company to do this sort of thing,” says Wagstaff. “From our point of view, Kittiwake was interesting, being a self-contained facility, with numerous other tieback opportunities in the surrounding acreage. Also, the platform was fairly small and relatively new and had been designed for removal at the end of field life - unlike many of the big beasts in the UK northern North Sea.”

As for the financial burden of managing this facility, Wagstaff points out that since April 2000, Venture has acquired interests in over 40 UK and Dutch North Sea fields, which last year generated £360 million ($741 million) in production revenue. “Our financing capacity has grown, and in 2002, we also floated the company on the London Stock Exchange, expanding our sources of capital further. And we are operating today in a favorable commodity price environment.

“What we do is different from the traditional model for UK independents, which typically meant holding 25%, non-operating interests in exploration blocks across the North Sea, picking the operators you want to work with. That makes things easier, but what happens if the operator is a major, and the focus changes? You end up leaving unlocked value on the table. For 10 years, the majors have been dis-investors in the UK North Sea, and all the larger fields except Buzzard are in decline.”

Most of the majors lack the budget for smaller projects in the North Sea, he adds, having committed their resources to other projects elsewhere in the world with bigger returns. “We, in contrast, are focused on exactly these types of assets and are driven to get oil and gas out of the ground as soon as possible, then plow the cash from production back into our business as quickly as possible. That requires a set of skills - particularly subsurface - not typically seen in the North Sea, although this is quite common in North America.”

Development factors

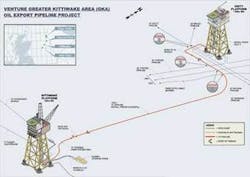

Kittiwake, discovered by Ranger Oil in 1981 in UK block 21/18, is a domed structure in Upper Jurassic Fulmar sandstones. Production started in late 1990, initially under natural depletion, later on with pressure support from four peripheral water injectors.

According to a report at the time by analyst Wood Mackenzie, Shell’s original idea had been a joint development with the Gannet Area fields to the southwest, with a minimal facility installation on Kittiwake exporting production through a pipeline to the Gannet complex. But this plan was jettisoned for cost reasons following the oil price plunge of 1986.

Instead, Shell and Exxon opted for a standalone solution, with a 2-km (1.24-mi), 8-in. (20.3-cm) line taking Kittiwake’s oil from a fixed platform in 85 m (279 ft) of water to a loading buoy mooring system, previously deployed for nine years on the Auk field. The Kittiwake living quarters had also been built for Auk, but never installed, due to late changes in the Auk platform’s refurbishment program. For offloading operations, Shell brought in a shuttle tanker originally designed for use with theBrent spar platform, but only used once in that role.

At the outset, Kittiwake had estimated in-place liquids reserves of 165 MMbbl, including 65 MMbbl of recoverable oil. Three of the four production wells eventually developed integrity problems and were replaced in 2002 with a single new producer well, drilled into the field’s crest. This and another surviving producer currently deliver just under 2,000 b/d combined.

In 1998, Shell added the Mallard subsea satellite, 15 km (9 mi) northwest of the platform. The two-well horizontal producer/water injector configuration swiftly delivered peak oil of 20,000 b/d, but well issues forced new operator Venture to shut in the field for seven months from end-2003. Production restored service following an intervention in July 2004, with perforations added to lift well performance.

The following April, Venture also brought onstream Gadwall, its first GKA subsea satellite development, via a re-completion of Shell’s discovery well in block 21/19, 12 km (7.5 mi) east of the Kittiwake platform. While Gadwall was pumping out 12,000 b/d, Venture took the opportunity to again shut in Mallard, drilling a new water injector in the same fault block as the producer to improve pressure support. Later, the company also sidetracked the original injector to a new bottomhole location to increase recovery from Mallard’s northern extent.

Mallard resumed production in Nov. 2005, and at this point Gadwall was closed down while Venture added a subsea water injector, again to maximize recovery. Production re-started in July 2006, and the field is now capable of delivering 6,000 b/d, alongside 10,000 b/d from Mallard.

A month later, Goosander, the third GKA subsea development, came onstream. Shell had discovered Goosander in 1998, 12 km (7.5 mi) northwest of Kittiwake in block 21/12. The company abandoned evaluation work following a disappointing appraisal well in 2001, but Venture had other plans. These led to re-completion of the suspended subsea discovery well as a producer, the fluids exiting through a reuseable pipeline bundle fabricated in two main sections, 4.9-km (3.04-mi) and 7.4-km (4.6-mi) long, both engineered and installed by Subsea 7.

The bundles each comprise an 8-in. (20.3-cm) production flowline, a 6-in. (15.2-cm) water injection flowline, a 4-in. (10.1-cm) gas lift line, and a chemical injection/control line. “This system has also been designed to allow other fields to flow through the infrastructures,” Wagstaff points out.

Modifications associated with Goosander were more extensive than the previous two tiebacks, with new caissons being installed in two of the platform’s spare conductor slots to house the risers and J-tubes associated with the various lines within the bundle. Goosander’s production riser is tied into the platform’s main production separator. Recently, the Goosander Phase 1 well was producing 30,000 b/d - 22,000 b/d above expectations - making it one of the UK North Sea’s most productive wells, according to Wagstaff. So much so, that the company has postponed drilling a phase two water injector to introduce pressure support.

Transition issues

Petrofac Facilities Management (PFM) has operated the platform on Venture’s behalf since the change of ownership in 2003. The company does similar work for various other independents in the UK North Sea. “This is the most modern installation in our portfolio,” says Robin Watson, PFM’s operations management director.

“Unusually, at the time of the asset sale, the vendor [Shell] wanted to retain as many of the operations staff as possible for redeployment on its other assets. Normally, we encounter a reasonable level of knowledge transfer, with most of the technicians coming over to Petrofac.

“However, we did retain some of the core crew on Kittiwake, and we agreed with Shell that some of their staff would remain for three to six months post-transition in an advisory capacity to ensure our new staff would be wholly trained and fully competent. We also worked closely with Petrofac Training to put together a competency program tailored to this operation.”

According to Wagstaff, the first year under the new regime was a settling-in process - “getting the crew trained, fixing what needed replacing...Even on a small platform like this, there are a lot of interfaces to manage. It’s like an old car - you must tinker with it to understand its foibles.”

The current nameplate processing capacity is around 40,000 b/d of crude, 13.7 MMcf/d of gas, and 70,000 b/d of water, says Watson. Fluids from Mallard and Gadwall pass through a dedicated first-stage processing and metering skid, before being commingled with the Kittiwake and Goosander fluids in a second-stage separator. “We modified the gas compressor to run in medium pressure mode,” he adds. “This allows us to operate Mallard at lower pressure, while still keeping fuel gas running.”

The platform also has facilities to inject up to 38,000 b/d of produced water and 57,000 b/d of seawater. All produced water is re-injected into Kittiwake’s reservoir, while seawater injection is directed to the three satellites for pressure maintenance and enhanced reservoir sweep.

“We improved the existing seawater injection equipment to give us more flexibility in the system,” Watson explains. “We wanted to be able to inject water into the Mallard and Kittiwake reservoirs at different pressures. The solution involved segregation of the pumps through pipework modifications, giving greater flexibility, thus assisting in reservoir management.”

Wagstaff adds: “Environmental standards in the UK North Sea are getting tighter, so in the past year, we have focused more on produced water re-injection, to make sure that we meet restrictions concerning overboard discharge. We have also been doing some work on Kittiwake’s gas compressor to avoid the need for flaring.”

Since the start of production in 1990, all processed oil has been exported via shuttle tankers, which then deliver their cargoes to tankage space in Nigg, northeast Scotland, which Venture/Dana rent from Talisman Energy. An 18,000-bbl subsea storage unit, installed in 1998 on the seabed, close to the platform, allows production to continue temporarily when the weather is too severe for cargo transfers. However, operations have to be fully suspended periodically during high winds and sea states above 2.5 m (8.2 ft). Conditions were particularly disruptive earlier this year.

A review of export arrangements in April 2005 found that availability of the offloading system was typically only 70% with production at 10,000-15,000 b/d. Venture responded in 2005 by replacing the original loading buoy, which had reached the end of its design life, with a more efficient single anchor leg (SAL) offshore loading system, owned by Teekay Shipping.

The SAL had been in service for two years on the recently decommissioned Ardmore field in the central North Sea in a similar water depth and with similar throughput. Thanks to Venture’s new subsea contracting partnership with Subsea 7, the SAL was pulled out and reinstalled on Kittiwake in 16 weeks from start to finish. Engineering from scratch could have taken 18 months, Wagstaff claims.

More changes were in prospect, with the GKA area’s dedicated shuttle tanker, theKitty Knutsen, facing a major structural overhaul. “At that point,” Wagstaff says, “the engineering economics suggested we had to replace it with another tanker, which we did this February, when the Kitty Knutsen came to the end of its effective life.”

At the time of this first review, the partners ruled out the alternative option of a pipeline, due to uncertainty over production performance and pipelay capacity constraints. But changing circumstances caused a re-think early in 2006. “We had not put in the new water injectors,” Wagstaff explains, “but we had still achieved much better reservoir performance.” With various newly acquired fields nearby, he adds, “We also now had the reserves to support a pipeline. And our new North Sea partnership agreement with Subsea 7 gave us access to a pipelay vessel in 2007 in an extremely tight market.”

Contractual arrangements

Prior to making the commitment to the GKA export line, Venture had teamed with a syndicate of investors to form North Sea Gas Partners, a vehicle for developing fields in the UK southern North Sea. Last November, Venture secured finance for the £70-million ($144-million) pipeline construction program through allying with one of these investors, US private equity firm ArcLight Capital.

Under this arrangement, the pipeline would be owned by a new company known as North Sea Infrastructure Partners (NSIP), with Venture managing construction and interface issues on NSIP’s behalf. Dana chose not to be involved in this program.

A nearby export outlet was readily available, as BP had spare capacity in the FPS, which terminates in Grangemouth, Scotland. “The tariff arrangement is quite straightforward,” says Wagstaff, “as the FPS is really geared up for third-party tie-ins. The entry point, however, was more complicated: we looked last year at a ‘hot tap’ at a point 25 km (15.5 mi) north of Kittiwake. That would have been a shorter pipelay, but the tie-in would also have been more complicated - and the costs would have exploded during the evaluation period.

“Instead, we opted for a 33-km (20.5-mi) long, 10-in. (25.4-cm) line connecting to a new riser on the Forties Unity platform.” Wood Group has been handling modifications on Unity since this spring under BP’s supervision. Subsea 7 installed the riser in July.

The GKA pipeline has been engineered for throughput of around 25,00 b/d, at an operating pressure of 110 barg at the Unity tie-in point. But output could be increased if operating pressure in the Forties system itself dropped below 110 barg. Stephen Gillespie Metering Consultants in Grangemouth is supplying new metering equipment for the Kittiwake platform, to ensure that processed GKA crude complies with the FPS requirements.

“Crude quality is a more sensitive issue for BP,” says Wagstaff, “as they wish to maintain the integrity of the FPS for many years to come. Also, our line has to cross five existing pipelines to gain entry to the Unity platform. As 50% of the UK’s oil and 30% of its gas transits through this region, BP are understandably nervous about operating in that environment.”

Petrofac Brownfield in Aberdeen, which worked on all the previous GKA projects with PFM, is managing the latest changes to the Kittiwake topsides. These will include two main oil line (MOL) pumps from Sulzer - one serving as backup - each designed to output up to 28,000 b/d at a Kittiwake export pressure of 175 barg. The existing power generation system is being upgraded to provide the extra 1 MW of power needed to drive the two pumps. Under this program, the turbine exhausts will be re-routed to lower the intake air ambient temperature.

Other new items include a chemical injection skid to safeguard the pipeline against corrosion and to prevent wax deposition. Temporary pig-launch facilities will provide further pipe cleaning services if required. A new pig receiver on Unity will also be available for pipeline cleaning, avoiding the need for subsea intervention.

The new export riser on the Kittiwake platform and Unity’s new import riser have both been designed to withstand the GKA export system’s maximum pressure and flow rate. The GKA line will take the riser slot currently occupied by the seabed storage system. In Unity’s case, BP will release a spare riser slot purposely allocated for third-party imports. On Kittiwake, Petrofac Brownfield is also installing a new cooler for oil export, two emergency shutdown valves, and a new distributed control system, the existing one being obsolete.

Earlier this summer, Subsea 7’sSkandi Navica completed the pipelay within time and budget.

The GKA pipeline subsea system includes a pipeline end template situated at the base of the Kittiwake riser, designed for remote valve operations and diver intervention, with tie-ins for future subsea intelligent pigging equipment. Subsea 7 is managing the interfaces with BP and Petrofac Brownfield for the two platform connections.

Once the pipeline is fully commissioned, PFM and Wood Group plan to shut down production for two weeks in September to work with Subsea 7 on tie-ins to the pipeline and to disconnect the existing export system, including the SAL. This equipment, and the subsea storage system, will then be filled with inhibited seawater.

Despite unusually severe weather this winter, the SAL has lifted average export uptime to 85%. “But there will be no comparison once the pipeline is in,” says Wagstaff. “Nevertheless, we intend to keep the SAL there as a standby option, in case anything happens to the Forties Pipeline System. We are also leaving the seabed storage system in place as a buffer.” The original loading buoy, however, will be decommissioned - detailed engineering is in progress - then likely towed to a fjord in Norway for disposal/recycling. “Good practice suggests you shouldn’t keep these things in place,” he says.

During the September close-down, PFM will also complete various outstanding maintenance programs. “We took the opportunity to bring some of this work forward earlier in the year during an extended, weather-induced shutdown,” says Watson. “We have had to repeatedly fine tune the process plant when the tanker has to come on/off station in order to achieve an extended period of run time. So we are really enthusiastic about the export pipeline, as this will allow us to fine-tune the plant as we would like, with much less interruption to steady delivery.”

The current changes have not added significantly to the platform’s overall weight, and there is room for more process equipment linked to further subsea tiebacks, according to Watson. “No drilling is being carried out on the installation, so we still have space where the derrick, drillfloor, pipe racks, and cement and mud pumps are/have been stationed. We can use this in a different way in terms of square meters, as well as tonnage.

“In terms of dynamic loading on the jacket, again there is no live drilling operation, so we are well within the jacket’s structural capability. If there is an increase in structural weight from extra risers, it should be pretty marginal. The topsides-mounted subsea reception equipment itself is also relatively limited in weight and scale.”

Future performance

Venture believes the associated improvements in production rates and export uptime will also accelerate reserves development and extend the lives of all of the fields produced through the platform by about three years, in turn increasing their ultimate recovery. The company estimates the increase in production and reserves at around 585,000 metric tons (644,852 tons) of oil.

Given the performance of the satellites and water injection to date, the company would like to raise its current threshold to 40-45,000 b/d. The partners are finalizing a technical/cost feasibility study. One of the options involves additional gas compression. “But to produce those extra barrels, we would still have to do this in a phased manner,” says Wagstaff. “Alternatively, we could bring in an FPSO, but that would cost £500,000/day ($1.03 million/day) to operate.”

Theoretically, there is potential out there to go to 50,000 b/d, he adds, by developing new operated prospects nearby, such as Christian and Bligh, and the suspended Durward and Dauntless fields to the west. “Christian will be the first to be developed, but only after we’ve depleted Gadwall and Mallard. Otherwise, we will be bringing in high-pressure production.”

There are also at least five exploration prospects, but others will have to have to follow these up, as Venture is not an exploration company. “Noble Drilling is involved in one of these, but if they want to drill it, there is only one way to develop it in this immediate area - via Kittiwake.”

The company is also examining the potential for exporting new volumes of gas and condensate, all of which are currently routed through Fulmar’s wet gas line system, free to Shell, under the terms of the original transaction. Depending on the performance of the GKA pipeline, a study could be launched within a year of startup to assess the economics of this idea, including the associated topside equipment.