Peter Howard Wertheim, Dayse Abrantes - Special Correspondents

Last July, Petrobras reported to the National Petroleum Agency (ANP) a light oil discovery offshore Brazil at a subsalt site in Santos basin.

The well, the first to be drilled in block BM-S-11, is 250 km from the southern coast of Rio de Janeiro city and 280 km from the Duque de Caxias refinery. The work was undertaken by Diamond Offshore’s drillshipOcean Clipper.

Petrobras is the operator of the BM-S-11 block, with 65% interest in partnership with BG, 25%, and Petrogal, 10%.

Petrobras’ E&P director Guilherme Estrella says “the 1-RJS-628A well, which is still being drilled, is located in a new exploratory frontier area, at 2,140 m water depth and reached TVD of 6,000 m. It represents a historical landmark for oil exploration in Brazil, since it is the first one to surpass an evaporitic salts sequence that is more than 2,000 m thick.”

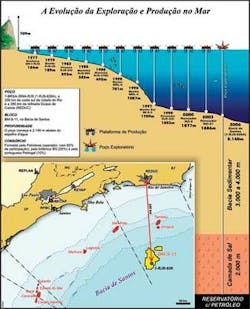

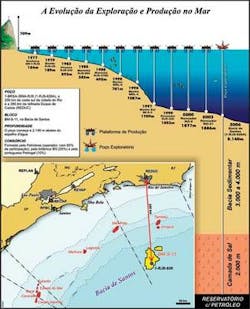

Subsalt discovery well 1-RJS-628A is located in block BM-S-11 in Santos basin. Source: Petroleo Brasileiro SA (Petrobras).

The 1-RJS-628A well will be completed by year-end 2006.

The area of the BM-S-11 block is 2,614 sq km. The well is shown in the accompanying Petrobras map as 1-RJS-628A.

Estrella says the Campos oil was formed by geological clusters underneath a layer of salt. That layer cracked extensively in Campos, allowing the oil to rise to levels closer to the sea bottom, where it is being pumped.

“But, there are areas where the oil remained trapped underneath the salt, and that is a new horizon for us,” Estrella says. “The oil there tends to be lighter.” Some wells in shallow waters and deepwater found light oil under the salt, below the levels with known heavy-crude accumulations.

Some $1.9 billion were spent over 36 years - from 1969 to 2005 - to prospect for oil in Santos. From 2006 to 2010, Petrobras plans to invest $1.4 billion in exploration activities, $250 million of it this year. This total is nearly 28% of the amount earmarked for exploration in 2006.

Over the next four years, 60 exploration wells are scheduled to be drilled in Brazil. By the end of this year, Petrobras plans to call for the drilling of 12 exploratory wells in Santos; four of them will be horizontal to more than 6,000 m deep.

In its new 2007-2011 business plan, Petrobras increases its budget for light oil exploration in an effort to double output.

For Santos, Petrobras will acquire 5,350 sq km of 3D seismic data in 2006 and another 2,500 sq km in 2007.

According to ANP data, on Dec. 31, 2005, Santos basin’s proven reserves totaled 97.03 MMbbl of oil and 52.51 bcm of natural gas.

The portfolio includes 63 exploration areas plus five evaluation plans for BS-4 (1), BS-400 (1), BS-500 (2), and BMS-7 (1), all in Santos basin. It is estimated that on average four drilling rigs will be operating almost exclusively in the area.

Salt drilling challenge

Subsalt drilling requires heavy investment, mainly for coatings. The chemical and physical characteristics of the salt reduce stability, increasing the risk of casing collapse and requiring use of special coatings. According to Estrella, technical problems faced during drilling 1-RTS-628A followed the scenarios analyzed during the planning phase of the project.

Preliminary results are very important but additional investments are required to evaluate these reservoirs’ volume and productivity.

To tackle salt drilling challenges such as mobility, sudden bends that damage the drillbit, corrosion, stuck pipe, etc., studies included experiments and simulations taking into consideration different geological scenarios in laboratories at Cenpes (Petrobras R&D center) and in some Brazilian universities.

“Petrobras already has a ‘casing’ model program for the well. But, since it is a new exploratory frontier, we are just getting to know the sedimentary column. The volumetric analysis will take place after the end of drilling and evaluation of the well, when we will be able to estimate the potential volume of the subsalt reservoir,” says Estrella.

Source of the light hydrocarbon is unknown, but it is thought to be in the subsalt section. Petrobras is also studying the age of the system, the area covered, the age and formation of the reservoir rock, and the trapping and migration processes.

“For a long time drilling in the subsalt was seen as a must, although it is a difficult and expensive task,” says Giuseppe Bacoccoli, who worked as a geologist for 30 years in E&P for Petrobras. He is now a professor coordinating Rio de Janeiro Federal University’s post graduation program for engineering (Coppe).

Bacoccoli says the acceleration of activity in Santos subsalt was due to the gas crisis. The company will be searching for new supplies of natural gas as an alternative in case of an escalation of the stalemate with Bolivia, which currently supplies 26 MMcm/d, equivalent to about half the gas consumed in Brazil.

“In order to find gas it is necessary to drill in ultra deepwaters, where the temperatures are higher. It is possible that Petrobras discovered the light oil because it is also more common where the temperatures are higher,” Bacoccoli says.

He says although Petrobras is recognized for its water depth oil production records (around 2,000 m), its wells average depth does not exceed 2,500 m, and that 1-RJS-628A in Santos is an exception. He estimates that at least another three ultra deep wells must be drilled in the area to verify the block’s potential, dimensions of the reservoir, and flow rates.

Saul Suslick, coordinator of Cepetro, the petroleum study center at Campinas University (Unicamp) in São Paulo, pointed to other operational hurdles in exploring the subsalt reservoir. “Due to sky-high prices of oil, most companies are working to maintain their reserves portfolio, making it difficult to hire drillships or infrastructure for such exploration. Also, due to high pressures, the instability of the salt layer may damage equipment. It is a very thick layer in a very difficult environment, making it a very expensive task.”

Petrobras’ challenge is to develop submersible systems for this kind of exploration,” says Professor Edmar Fagundes de Almeida of Rio de Janeiro Federal University’s Economy Institute. The institute’s energy group developed studies that point to a peak of discoveries during 2006, 2007, and 2008.

Almeida believes the platforms to be used in this block will not differ from those being used in the Campos basin, but warns that well technology is still being developed. “The discovery opens new perspectives for exploration in Brazil,” he adds, saying light oil reservoirs could be found under the salt layer in the Campos basin as well.

Greater Campos basin

In most areas of the shallow to ultra deepwater of the Greater Campos province, composed of the Santos, Campos, and Espírito Santo basins, exploration is far from being complete since deep, Lower Cretaceous pre- and post-Rift coquinas, sandstones and carbonate reservoirs have not been thoroughly explored, says Marcio Rocha Mello, PhD, president, High Resolution Technology & Petroleum in Rio de Janeiro. A former Petrobras geologist and widely published author, Mello is an expert on subsalt formations in Brazil.

“Although almost 100% of all known hydrocarbon reserves (around 15 Bbbl) were sourced by pre-rift lacustrine source rocks, less than 2% of them are found in any of the Lower Cretaceous reservoirs,” he says.

At early exploration stages, the pre-rift reservoirs were targeted, giving satisfactory results allowing the basins to become productive. Later, with the discovery of the super-giant Tertiary turbidities systems, the Lower Cretaceous petroleum system was forgotten.

“Our studies, based in an integrated multidisciplinary approach using technologies ranging from molecular geochemistry to 3D seismic and compositional petroleum system modeling, suggest the occurrence of a super-giant hydrocarbon province in the Lower Cretaceous pre- and post-salt reservoirs of the Greater Campos basin,” says Mello.

Several companies have started to drill deeper, to greater than 6,000 m, in search for Lower Cretaceous petroleum systems in the Greater Campos basin. “Preliminary results indicate that a lesson must be learned in the area: If there is an overcharged, deep-source rock system directly associated with good quality, deep reservoir rocks, giant light oil accumulations almost certainly will be present,” says Mello.

“I estimate that there are 7 Bbbl of recoverable oil in the Greater Campos basin.”

Campos basin’s subsalt

The Campos basin in Brazil is one of the most active offshore oil and gas prospecting regions in the world.

Bacoccoli is also betting on the exploration potential of the marine generator, discovered a few years ago in ultra deepwater in the Campos basin.

“It is incredible that the oil companies have not been interested in more intensively exploring the subsalt layer in the Campos basin up to now, even in shallow water. Beliefs apart, exploration activity in deeper horizons is, in fact, still very timid, especially in Campos, where it is estimated that the number of wells for investigating subsalt layers does not surpass a couple of dozen. Until now, only Petrobras has gone to the trouble to drill below 4,500 m in the region, while unsuccessful in finding commercial deposits despite many traces.”

In the 1980’s, Petrobras drilled about six wells in subsalt formations, some of which were near Garoupa. At that time, the lack of technology led to collapse of the wells caused by the dislocation of salt.

Exploration of these areas is affected directly by the high costs and difficulty of obtaining images of the reservoirs through seismic mapping. The seismic data captured in the pre-salt formations is distorted by irregularities in the salt layer.

A deep horizon well costs three times more to drill than one in conventional deepwater (down to 3,500 m), costing some $30-$50 million. The cost is linked to the fact that the conditions of the reservoir require ultra-modern equipment to withstand high pressures and high temperatures (HP/HT).

The search for hydrocarbons in unexplored horizons could yield an amount of new recoverable oil of up to 6 Bbbl, in relation to the current level of 9 Bbbl. Several geologists say Campos has 22-30 years more exploration activity ahead of it, with a focus now on upper and lower Cretaceous formations.

They point to the fact that just three years ago Petrobras began to explore the upper Cretaceous and discovered Jubarte, Cachalote, and other fields in the Parque das Baleias, north of the Campos basin. These experts say the future looks very good as long as it is aimed at the subsalt, all upper Cretaceous areas in the south and in ultra deepwater in the upper outer region.

Historically, many deep wells have been drilled through thick salt intervals in the Campos basin. Until the 1990’s, the lack of available, reliable methods to predict salt behavior at high temperatures and high differential stresses led to very high drilling costs and even the loss of wells, according to Petrobras geologists A. Maia C., E. Poiate J., J. L. Falcão, and L. F. M. Coelho.

The consensus is that complex salt tectonics, and extreme water and reservoir depths require not only high development costs, but also innovative technology to bring these fields onstream. At the edge of the industry’s experience are salt sections of 2,000-3,000 m thick that overlie targets at depths of 3,000-4,000 m below mudline in water depth of 2,000-2,500 m.