Report finds more than half of offshore cost reductions due to simplification, design

Offshore staff

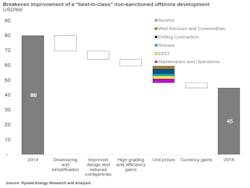

OSLO, Norway–Offshore developments have benefitted significantly from lower breakeven prices over the last two years, with more than half of the cost reductions achieved through downsizing, simplification and design, according to analyst Rystad Energy.

Less in-built flexibility andmore standardized solutions have been instrumental in reducing the breakeven prices, and hence overall project costs. Intentions to optimize design, coupled with the recycling of projects, have stimulated engineering teams to reassess their design approach and in turn has made the project development and budgeting more predictable with reduced cost contingencies.

High grading of rigs, vessels, equipment, and labor has also returned considerable breakeven improvements. Progresses on service prices, especially from rigs and maintenance and operations, have been the result of highly competitive bidding rounds in tenders/re-tenders.

Forfield development in oil-driven currencies, where part of the development or operation is supplied locally, the analyst says significant currency gains can also be attributed to breakeven prices calculated in US dollars.

Audun Martinsen, VP Oilfield Research atRystad Energy, said: “E&P and oilfield service companies have worked intensively on methods to reduce costs. However, these improvements are also a result of a portfolio effect. By focusing on the areas with the highest potential within their portfolios, E&P companies naturally gained the most from these newfound efficiencies by high-grading their undeveloped fields.”

Non-sanctioned offshore developments can expect an improvement of 15-30% in their breakeven prices, the analysis shows.

Martinsen added: “The complete inventory is far from homogenous and represents complex and challenging developments that impact on breakeven price reductions, and cannot compare to the ‘best-in-class’ stories we are presented with at the moment.”

10/27/2016